Withholding Tax Computation Under the TRAIN Law

Withholding tax computation has been provided by the BIR in the RMC that it issued earlier this year.

Recently, the BIR issued RR 8-2018 as regards computation of withholding on compensation income, among others.

Grab a copy of the newly released title Tax Solutions on Employee Compensation and Benefits (under TRAIN Law), 2nd Edition 2019 by Atty. Villanueva

Grab a copy of the newly released title Tax Solutions on Employee Compensation and Benefits (under TRAIN Law), 2nd Edition 2019 by Atty. Villanueva

The post below is based on the article posted in EBV Law Office.

Under the TRAIN law the compensation range that is not subject to tax has been increased to P20,833.00 for monthly paid employees. How should employers withhold the tax in this case?

The BIR issued Revenue Memorandum Circular (RMC) pursuant to the amendment to the National Internal Revenue Code introduce under the Republic Act No. 10963, which took effect January 1, 2018. The objectives for this RMC are:

- To supplement RMC 105-2017 dated December 28, 2017 by providing the steps on how to use the revised withholding Tax Table on Compensation; and

- To advise on the change in the creditable Withholding Tax and rate on Income Payment to Self- employed Individuals or Professionals.

Related topic: De Minimis Benefits Remain Exempt from Tax Under the TRAIN Law

Steps in the Use of Tax Table

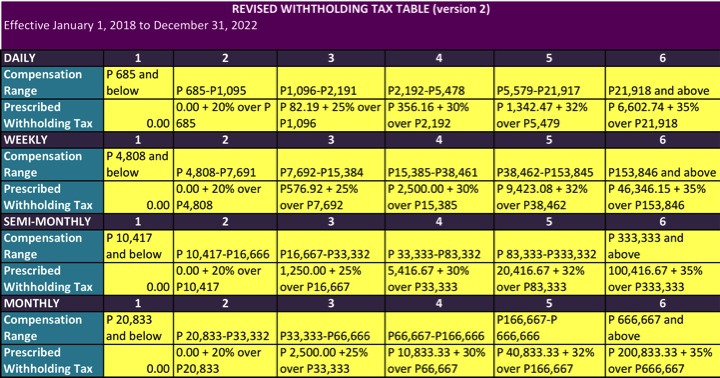

In general, every employer paying compensation to its employee/s shall deduct and withhold from such compensation a tax determined in accordance with the prescribe Revised Withholding Tax Tables, version 2.

Step 1. Determine the total amount of monetary and non-monetary compensation paid to an employee for the payroll period: monthly semi-monthly, weekly or daily, as the case may be, segregating non-taxable benefits and mandatory contribution.

Step 2. Use the appropriate table for the applicable payroll period.

Step 3. Determine the compensation range the employee and apply the applicable tax rates prescribed thereon.

Step 4. Compute the withholding tax due by adding the tax predetermined in the compensation range indicate the column used and the tax in the excess of the total compensation over the minimum of the compensation range.

SAMPLE COMPUTATION

X is receiving monthly compensation in the amount of P25,000 with supplemental compensation in the amount of P5,000.00, net of mandatory contributions.

By using the monthly withholding tax table, the withholding tax beginning January 2018 is computed by referring to compensation range under column 2 which shows a predetermined tax of 0.00 on P20,833 plus 20% of the excess of Compensation Range (Minimum) amounting to P9,167 (P25,000 + P5,000 – 20,833) which is P1,833.40.

As such, the withholding tax to be withheld by the employer shall be P1,833.40.

To plot the numbers involved:

Comments (20)

… [Trackback]

[…] Information to that Topic: lvsbooks.com/withholding-tax-computation-train-law/ […]

… [Trackback]

[…] Read More on that Topic: lvsbooks.com/withholding-tax-computation-train-law/ […]

… [Trackback]

[…] Read More Information here to that Topic: lvsbooks.com/withholding-tax-computation-train-law/ […]

… [Trackback]

[…] Here you can find 30290 more Info on that Topic: lvsbooks.com/withholding-tax-computation-train-law/ […]

… [Trackback]

[…] Find More on on that Topic: lvsbooks.com/withholding-tax-computation-train-law/ […]

… [Trackback]

[…] Read More on that Topic: lvsbooks.com/withholding-tax-computation-train-law/ […]

… [Trackback]

[…] Find More Info here on that Topic: lvsbooks.com/withholding-tax-computation-train-law/ […]

… [Trackback]

[…] Read More here to that Topic: lvsbooks.com/withholding-tax-computation-train-law/ […]

… [Trackback]

[…] There you will find 60403 more Information to that Topic: lvsbooks.com/withholding-tax-computation-train-law/ […]

… [Trackback]

[…] Here you will find 7164 more Information to that Topic: lvsbooks.com/withholding-tax-computation-train-law/ […]

… [Trackback]

[…] Here you will find 67553 more Info on that Topic: lvsbooks.com/withholding-tax-computation-train-law/ […]

… [Trackback]

[…] Find More Info here on that Topic: lvsbooks.com/withholding-tax-computation-train-law/ […]

… [Trackback]

[…] There you will find 49624 more Info on that Topic: lvsbooks.com/withholding-tax-computation-train-law/ […]

… [Trackback]

[…] Information to that Topic: lvsbooks.com/withholding-tax-computation-train-law/ […]

… [Trackback]

[…] There you can find 37984 additional Information to that Topic: lvsbooks.com/withholding-tax-computation-train-law/ […]

… [Trackback]

[…] Read More here on that Topic: lvsbooks.com/withholding-tax-computation-train-law/ […]

… [Trackback]

[…] Find More to that Topic: lvsbooks.com/withholding-tax-computation-train-law/ […]

… [Trackback]

[…] Find More on that Topic: lvsbooks.com/withholding-tax-computation-train-law/ […]

… [Trackback]

[…] Read More here on that Topic: lvsbooks.com/withholding-tax-computation-train-law/ […]

… [Trackback]

[…] Find More on that Topic: lvsbooks.com/withholding-tax-computation-train-law/ […]

Comments are closed.