Guide to Valid Job Contracting and Subcontracting 2nd Edition

The subject matter of job contracting and subcontracting is a trick territory for businesses their owners. Understanding the technical sides of it are left to the experts and practitioners.

Nonetheless, even experts find the topic challenging. This book is intended to help companies, business owners, managers, expats, and HR practitioners navigate through the “treacherous waters” of job contracting and subcontracting.

While the word “treacherous” used to describe it may be strong the association to it is justified by the fact that engaging in contracting is very technical. A single mistake, regardless of intentions, of the parties will be catastrophic.

Read more..

Imagine, for instance, a big company contracting hundreds of workers with what it thought was a legitimate contract, which due to technical errors the

authorities suddenly found the relationship a labor-only contracting. The said scores of employees of contractor will become regular with the principal. This will surely blow the pay grade of the company out of proportion. The correction and/or adjustments needed will be enormous and costly.

This work provides not just laws, rules, and regulations. It gives perspective, insight, and the bird’s-eye view of the situation to serve as a map to the right direction. It tackles D.O. 174, Series of 2017 which superseded D.O. 18- A. The DOLE Advisory 01, Series of 2017 providing exceptions. Relevant rules such as D.O. 19, D.O. 13, and D.O. 198, among others.

Also, R.A. 11058 and relevant decisions of the Supreme Court on the matter, most especially, on off-detail status in a 2019 case, Bognot vs. Pinic International (Trading) Corporation/CD-R King, et al., (G.R. No. 212471, March 11, 2019). Can individuals with unique skills and talents engage in contracting without registration under D.O. 174? The author discussed the answer in this work.

Salient points of D.O. 174 include the substantial capital of P5 million, shortened validity of the registration, concepts of temporary off-detail, expiration of service agreement, termination for just cause, authorized cause, and not due to expiration of service agreement and their implications.

This book is a compliance guide, first and foremost, to help businesses in their quest to achieve their objectives the legal way and without accidentally falling in the traps of technicalities.

close

Scroll down for more information

- Description

- Additional information

Description

Title: Guide to Valid Job Contracting and Subcontracting 2nd Edition

Author: Atty. Elvin B. Villanueva

Publisher: Central Book Supply, Inc.

ISBN:

No. Of Pages:

Size: 6″x9″

Binding: Softbound

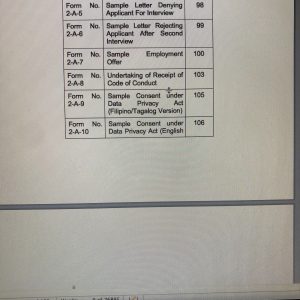

TABLE OF CONTENTS

Pages

CHAPTER I

JOB CONTRACTING AT A GLANCE

CHAPTER II

LAWS, RULES AND JURISPRUDENCE

GOVERNING JOB CONTRACTING

A. Pertinent provisions of the Labor Code on contracting and subcontracting 5

1. Power of the Secretary of Labor, under Ar-ticle 106, to make distinctions between permissible job contracting and labor-only contracting 7

2. Concept of indirect employer under Article 107 of the Labor Code 8

3. The phrase “not an employer” in Article 107 must be read in conjunction with Article 106 8

4. Article 106 deals with labor-only contracting while Article 107 with job contracting 9

5. Article 108 is about the requirement of bond of the contractor or subcontractor 9

6. Article 109 refers to solidary liability 10

7. Other relevant laws, rules and regulations pertaining to contracting and subcontracting 10

Read more..

B. Department Order (DO) No. 174, Series of 2017 provides the present Rules Implementing Articles 106 to 109 of the Labor Code, as amended (Rules) 12

1. Brief historical development of Rules Implementing Articles 106 to 109 of the Labor Code, as amended 12

2. Coverage of DO No. 174, Series of 2017 13

3. Non-applicability of DO 174 to construc-tion and other industries 13

4. Department Circular No. 1, Series of 2017 clarifies non-applicability of DO 174 to Business Process Outsourcing (BPO)/Legal Process Outsourcing (LPO)/ Knowledge Process Outsourcing (KPO) and the Construction Industry 14

5. DO 174 does not contemplate to cover in-formation technology-enabled services in-volving an entire or specific business pro-cess 15

6. D.O. 174 has no application over entire business process 15

7. Non-Applicability of DO 174, Series of 2017 to Construction Industry 16

8. Contractors licensed by PCAB shall not be required by DOLE to register under DO 174, Series of 2017 16

8.1 Violations on labor standards and occupational safety and health shall be coordinated with PCAB for those licensed by it 17

9. Applicability/Non-Applicability of D.O. No. 174, Series of 2017, to Private Security Agencies 17

9.1 Non-Applicability to contracted jobs to a professional

or indi-vidual with unique skills and tal-ents

10. Non-Applicability of D.O. No. 174, Series of 2017, to other Contractual Relationships 20

11. Important definitions under DO 174, Series of 2017

C. Contracting and subcontracting arrangements are expressly allowed by law 21

1. Nature of relationship of the parties in contracting arrangement 22

2. Limitation on the acceptability of job con-tracts 23

3. Practice of contracting and sub-contracting in the construction industry is recognized by law 23

D. Contracting taken as a judicial notice 23

E. Permissible job contracting or subcontracting 24

1. Definition of permissible job contracting or subcontracting 24

2. Requisites of legitimate job contracting or subcontracting 24

2.1 Having substantial capital is not enough 26

2.2 If job contracting is not permissible it is labor-only contracting 26

F. Independent contractor, defined 27

1. Test to determine independent contractorship 27

2. Criteria in determining the existence of an independent and permissible contractorship 28

3. Each independent contracting relationship is determined by its own facts 29

4. Independent contractors carry on business free from control and direction of their principal 29

4.1 Case where principal’s control of the premises tended to disprove independence of the contractor 30

5. Effect if in a contract the contractor is not obligated to perform an identifiable job or service, instead merely to provide specific types of employees 30

6. The contractor need not guarantee to the principal the attendance of the workers assigned to the latter 31

7. Contracts involving directly related jobs are irrelevant in establishing the presence or absence of independent contracting 31

8. Other factors that may be considered to prove independent contractorship 32

9. Difference between subcontractor and Private Recruitment and Placement Agency (PRPA) 33

10. Individuals may engage in legitimate contracting 34

10.1 The right to security of tenure cannot deprive individual to engage in independent contracting as talent 35

10.2 A television program host is an independent contractor 35

10.3 Production Assistants (PA) are neither talents nor independent contractors 41

10.4 The practice of having fixed-term contracts does not always mean compliance with labor laws 43

10.5 Existence of talent contract does not prevent regular employment 43

10.6 Among other elements, there can be no independent contracting where the broadcast station itself provides for the production equipment 44

10.7 Treatment of “program employment” under Policy Instruction No. 40 45

10.8 Engagement of the alleged “program employees” for several years indicate regular employment 46

10.9 Case where the employer alleged that an individual is a talent or program employee and independent contractor; An independent contrac-tor is not an employee 46

10.10 While there is no inflexible rule to determine if one is an independent contractor or an employee, the right to control remains the dominant factor 47

10.11 Rule as to employment of “full-time” nurse in relation to independent contracting 48

11. Cooperatives may engage in contracting 51

11.1. Cases where cooperatives engaged in contracting and were declared as labor-only contractors 52

12. When a worker possesses some attributes of an employee and others of an independent contractor he may be classified as employee 52

13. Joint venture is not governed by the rules on job contracting 52

G. Labor-only contracting 54

1. Definition of labor-only contracting 54

2. Labor dispute including determination as to whether labor-only contacting exists recognizes two possible relations among the parties 54

3. Labor-only contracting distinguished from permissible job contracting 55

3.1 Circumstances in one case that established legitimate job contracting; Cases of Escario and Tabas 56

3.2. Legitimate job contractor provides services while labor-only contractor provides only manpower 58

3.3. Purpose of the distinction is to determine the extent of principal’s liability 58

3.4. The distinction should consider the totality of the facts and the surrounding circumstances 59

4. Criteria for the existence of labor-only contracting 59

5. The presumption is that a contractor is a labor-only contractor 60

6. For failure to adduce evidence of substantial capitalization, the presumption stands 60

7. Employees are not bound to prove negative fact of contracting relationship 60

8. DOLE certification as evidence against claim of labor-only contracting 61

8.1 Rationale behind the presumption of regularity of the DOLE certification 62

8.2 Case declaring DOLE Certification not conclusive evidence of independent contracting status 63

8.3 DOLE certification cannot be taken at its face value where the contractor’s Article of Incorporation allows it to engage in janitorial business but the workers it assigned to the principal performed delivery and distribution of cola products 63

8.4 Effect of belated registration as job contractor 64

8.5 Probative weight of the belated DOLE Secretary’s Opinion allowing the principal to contract out services 64

9. Labor-only contracting is expressly prohibited 65

9.1 Objective of the prohibition 66

9.2 Legal bases of the prohibition 66

9.3 The Secretary of Labor is authorized by law to restrict or prohibit labor-only contracting 67

9.4 The DOLE Regional Director may issue cease and desist order against the labor-only contractor; issuance is pursuant to visitorial power 67

9.5 DOLE findings constitute res judicata before the NLRC 68

10. The principal has the duty to observe the rules and regulations implementing Article 106 to Article 109 of the Labor Code 68

11. Elements of labor-only contracting 69

11.1 Substantial capitalization 70

a. Contractor has the burden to prove substantial capital, investment, tools, etc. 71

b. Employees have no duty to prove that the contractor does not have substantial capital 72

c. Proof of substantial capital must be shown at the time of application for registration of the contractor 72

d. In the case of Neri vs. NLRC, mere having substantial capitalization is enough to be a job contractor 72

e. The Court explains the ruling in Neri case that mere substantial capitalization is sufficient 72

f. The Court further clarifies Neri in Fuji Xerox case 74

g. Showing substantial capitalization or investment in the form of tools, equipment, etc. is not enough to prove that one is an independent contractor 74

h. Case where both substantial capital and investment in tools, equipment, etc. were required by the Court 75

i. Case where the Court went back to Neri interpretation and held that substantial capital is enough 76

j. Effect of principal’s requirement of the contractor to undertake investment in tools etc. on understanding of long-term business relationship 76

k. Certificate of registration issued by the Cooperative Development Authority is not sufficient proof of substantial capitalization 77

11.2 Performance of directly-related jobs 78

a. Provision of clinic and medical supplies by the principal in compliance with Article 157 of the Labor Code does not prove lack of substantial capital by a contractor 78

b. Examples of jobs performed held as directly related to the principal’s business 80

c. Performance of activities di-rectly related to the business of the principal is just one of the indicators of labor-only contracting 82

d. While activities performed may be directly related they do not mean necessity to the principal business 83

e. Case where activities performed are necessary and desirable but not directly related to the principal business 83

f. Performance of activities usu-ally necessary and desirable to the principal gives rise to labor-only contracting and regular employment 84

g. Employee not included in the list assigned to the principal may suggest existence of labor-only contracting 84

h. If there is substantial capitalization, there is no need to refute claim that workers performed directly related jobs 85

i. Rule as to performance of specific special services 86

j. Performance by the contractor’s employees of identical work alongside with the principal’s employees indicates labor-only contracting 87

11.3 Right to control, as an element, is not the only factor to consider 87

a. Right to control, defined 88

b. Power of control is the most important element 88

c. Right of control refers merely to the existence of the power and not to the actual exercise 89

d. In independent contractorship, it is the contractor and not the principal that has discretion to determine the means and manner by which the work is performed 89

e. Monitoring of performance and productivity by principal indicates control 90

f. The principal retains certain degree of control in contracting relationship 91

g. Not all rules imposed by the hiring party indicate employment relationship 91

h. The exclusivity clause in a contract does not indicate control 94

i. Job description issued as mere guidelines to achieve end-result may not indicate control 95

j. Case where the contractor does not exercise control over the workers assigned to principal 95

k. The power to recommend penalties or dismiss workers is the strongest indication of a company’s right of control as direct employer 96

l. Case where right to seek replacement of security guard is not indicative of control; Treatment of adage “The customer is always right” 97

m. Case where the principal exercised control over the workers of the supposed contractor 97

n. Case of Singer Sewing Machine Company vs. Drilon 99

o. Stipulation that the agency cannot pull out any security guard from the principal without its consent does not indicate control 100

p. Conduct of inspection by the principal is not indicative of control 100

q. Control over the personnel supplied by the third-party conduit has legal consequence against the contractor 101

r. Control test can establish existence of independent contracting 102

s. Requirements that ensure the integrity and quality of the products in a distributorship agreement do not amount to control

11.4 Absence of contract with principal may establish labor-only contracting 102

11.5. Allegation that workers are project employees must be proved by the standards used 103

11.6 Even if only one of the elements is present, there can be labor-only contracting 104

11.7 Admission by workers in the complaint that they are “direct employees” of the contractor does not absolve the principal 105

12. Language of the contract between principal and contractor cannot dictate presence of legitimate contracting or absence of labor-only contracting 106

12.1 Effect of stipulation on the absence of employer-employee relationship 107

12.2 Employees cannot be bound by the agreement between the principal and the contractor 107

12.3 Nature of business is not determined by self-serving appellations in the contract 108

12.4 Stipulation that one is an independent contractor is not controlling 108

12.5 “Accreditation Agreement” stipulating that workers were to remain employees of the contractor and shall not become regular employees of the principal cannot govern the relationship 109

13. Effect of labor-only contracting 110

13.1 Finding of labor-only contracting creates employer-employee relationship between the alleged principal and employee of contractor 111

a. The employer-employee relationship for a “comprehensive purpose” 112

b. Employer-employee relationship for a “comprehensive purpose” distinguished from employer-employee relationship for a “limited purpose” 112

c. The finding of labor-only contracting is equivalent to declaring that there is an employer-employee relationship with the principal 113

d. No particular form of proof is required to prove employer-employee relationship 114

e. Documentary evidence alone cannot establish lack of employer-employee relationship 115

13.2 Rationale behind the establishment of employment relationship when there is labor-only contracting 115

13.3 The contractor in labor-only contracting becomes merely an agent of the employer 116

13.4 Direct employer vs. Indirect employer 116

13.5 Employees of contractor cannot form a union within the principal 121

13.6 A finding of labor-only contract-ing does not give the union of the contractor’s employees the legal standing to demand that they be declared as employees of the principal

14. Principal may still be held liable even in the absence of finding that there is labor-only contracting; liability for unpaid wages 123

14.1 Instance when the principal may be held liable for backwages and separation pay of the contractor’s employees 124

14.2 Case where even if there is no labor-only contracting, principal was held liable for money claims 124

14.3 Meaning of joint and several liability 125

14.4 Rationale behind holding principal and contractor jointly and severally liable 126

14.5 The joint and several liability of the principal for unpaid wages shall be to the extent of the work performed only 127

14.6 It does not require contractor’s insolvency to hold the principal solidarily liable for unpaid wages 128

15. Distinction between labor-only contracting and job contracting 128

15.1 The Secretary of Labor is mandated to make appropriate distinctions between labor-only contracting and job contracting 120

H. Bond requirement in job contracting 130

1. Failure to post bond may render principal liable for whatever liabilities of the contractor to its employees 130

2. Principal has the right to seek reimbursement with the contractor the amount it paid for liabilities due to its failure to furnish a bond 131

3. Case where an indirect employer may be held liable for any violation of the Labor Code under Article 109 131

3.1 The “existing laws” mentioned in Article 109 refers to Article 1728 of the Civil Code 132

I. Employer-employee relationship in job contracting 133

1. Issue of employer-employee relationship is a question of fact 133

2. Element of control is crucial in determining employment relationship 134

3. Mere affidavit of principal’s employee that as supervisor he did not exercise supervision is insufficient to disprove element of control 134

4. Necessity to present in the case those who exercised supervision over the worker and other employees assigned to the principal 135

5. Stipulation on the absence of employer-employee relationship has no legal effect 135

6. Concept of economic reality test 136

J. Other Illicit Forms of Employment Arrangements 137

L. Required Contracts Under D.O. 174

M. Payment of wages in relation to job contracting 139

1. Payment of wages as element of employer-employee relationship 139

2. Payment of wages need not be made directly to prove this element 139

3 There is no independent contracting when the contractor merely acted as conduit for the payment of wages 140

4. The court takes judicial notice of the practice of employer of not issuing pay slip to evade liabilities 140

5. Without the pay slip, there is no way for the worker to prove who paid his wages 141

6. Joint and several liability for non-payment of wages 141

6.1 Responsible officers of the corporation may be held liable 142

7. Status in contracting relationship determines parties’ liability for payment of wages 142

8. Right to reimbursement of principal held solidarily liable with the contractor 143

8.1 The solidary liability of the principal does not preclude the right of reimbursement 143

8.2 Article 1217 of the Civil Code as basis for reimbursement claim 144

8.3 If the contractor fails to pay the workers their wage increase he cannot claim adjustment from the principal 144

8.4 The regular court and not the NLRC has the jurisdiction over claims of contractor where there is no employer-employee relationship 145

8.5 Contractor cannot file a cross-claim against the principal where there is no labor dispute involved between them 146

8.6 No reimbursement in favor of the contractor when the principal has already paid in full the unpaid wages and overtime work 147

9. Retaliatory measures consisting of refusal to pay wages, etc. are unlawful 148

10. Rule as to who shall shoulder the wage increase 148

10.1 Service contracts are deemed amended accordingly when there is wage increase 149

10.2 “Shall be borne by the principal” does not mean that the principal shall directly pay the workers of the contractors 150

10.3 Being ultimately liable for increase in wages, the principal cannot seek reimbursement for payment made directly to the workers 150

10.4 Joint and several liability of the principal and contractor in case of failure to pay wage increase 151

10.5 Immediate recourse of the workers for nonpayment of wage increase is against its employer not the principal 151

L. Rules on dismissal from service 152

1. Security of tenure of contractor’s employees 152

2. Procedural due process of dismissal 152

3. Effect of termination of employment 154

3.1 Termination caused by pre-termination of the

service agreement (SA) not due to au-thorized causes

3.2 Termination resulting from expiration of service

agreement (SA); Re-employment within 3 months

3.3 Separation benefit under D.O. 174

3.4 Mere expiration of SA not termination

4. Termination not due to authorized causes 155

5. Pull out from assigned principal due to non-renewal of contract does not consti-tute illegal dismissal

6. Dismissal by contractor of his employee upon the instructions of the principal is dismissal by the latter thereof

7. Case where the contractor cannot dismiss its own worker without getting permission from the principal

8. Absence of signature or initials of receiv-ing officer in the Income Tax Returns prov-ing closure due to business losses engen-ders doubt as to their filing

M. Temporary Off-detail or floating status 159

1. Nature of off-detail or floating status 159

1.1 The right to place the guard on floating status has been declared lawful 160

1.2 Legal effects when the guard is on off-detail status 160

1.3 The employer has the burden to prove that there is no available post for floated guard 161

1.4 Floating status can be applied in other industries 161

M.1.4.1 Off-detailing is not equivalent to dismissal

2. The legal basis for placing an individual on floating status is Article 301 (formerly Art. 286) of the Labor Code, as amended 161

2.1 Floating status, consistent with Article 286, requires dire exigency of bona fide suspension of operations 162

3. Illegal dismissal is premature if off-detail status does not exceed six (6) months 163

4. Effect when off-detail status exceeds six (6) months 163

4.1 Constructive dismissal defined 164

4.2 Pull out does not amount to con-structive dismissal

5. Remedy of the employer when there is surplus security guard is to resort to retrenchment 164

6. Floating status distinguished from preventive suspension 165

CHAPTER III

REGISTRATION RULES

FOR JOB CONTRACTORS

A. Mandatory Registration and Registry of Legitimate Contractors 167

1. Presumption for failure to register 167

2. The Bureau of Working Conditions (BWC) is the central registry of contracting arrangements 167

3. Requirements for registration 168

3.1 Supporting documents 168

3.2 Verified application with certification of attendance to orientation seminar 170

3.3 Where to file the application 170

3.4 Applications with lacking requirements shall not be accepted 170

3.5 Verification inspection of the facilities, tools, equipment and work premises 170

3.6 Approval or denial of the application 171

3.7 Registration fee upon approval of application 171

3.8 File distribution of application documents 171

3.9 Reckoning period of registration 171

4. Validity of the Certificate of Registration 172

4.1 The contractor operating outside the region of registration should furnish authenticated copy to DOLE in such area of operation 172

5. Renewal application shall be made 30 days before the expiration 172

5.1 Fee to be paid for the renewal of registration 172

5.2 Attachments on the renewal application form 173

6. Submission of semi-annual report in triplicate copies 174

6.1 Inclusion in the semi-annual report 174

6.2 File distribution of the semi-annual report 174

7. Cancellation of registration upon a verified complaint 175

7.1 Grounds for cancellation or revocation of registration 175

8. Complaint and due process 176

8.1 Content of the complaint 176

8.2 Filing of verified answer/counter affidavit 177

8.3 Effect of failure to file an answer/counter affidavit when so directed 177

8.4 Motion to dismiss shall not be entertained 177

8.5 Clarificatory hearing 177

9. Appeal to the Secretary of Labor 179

9.1 Appeal from the Order of the Regional Director 179

9.2 Motion for reconsideration filed shall be treated as an appeal 179

9.3 Where to file the appeal 179

9.4 Period to resolve the appeal 179

9.5 Final and executory decision of the Secretary; No motion for reconsideration shall be allowed 180

10. Cancellation of registration 180

10.1 Effects of cancellation of registration 180

10.2 Cancellation Order as ground for denial of application for renewal 180

10.3 Not allowed to operate

10.4 Non-impairment of existing legitimate job contracting entered into prior to cancellation 180

10.5 Effect on principal for contracting with delisted contractor 181

10.6 Retaliatory measures

11. Enforcement of labor standards and work-ing condition 180

12. Duty to produce relevant documents

B. IMPLEMENTATION OF DO 174, SERIES OF 2017 181

1. Tripartite implementation and monitoring of compliance 181

2. Financial relief program for transitioning employees 183

3. Enrollment of contractors and principals in DOLE Kapatiran WISE-TAV Program 184

CHAPTER IV

RULES GOVERNING SECURITY CONTRACTORS

A. Rules and regulations for security service contractors 185

B. Law regulating the organization and operation of private detective, watchmen or security agencies 185

C. Necessity to secure a license prior to operating a security agency 186

D. Coverage of DO No. 150, Series of 2016 186

1. Important definitions under DO No. 150, Series of 2016 187

2. Employment Status of security guards and similar personnel 187

3. Probationary status of security guards or similar personnel 188

3.1 Regular Employment in Security Service 188

4. Service Agreements

5. Status of Employment

6. Contents of Duty Detail Order

7. Rights of Security Guards and Other Pri-vate Security Personnel

8. Requirements for Pre-employment and Continued Employment

9. Obligations of Government Agencies

10. Entitlement to Minimum Wage

11. Transfer of Assigment

12. Statutory Benefits

13. Recommended Compuation of the Esti-mated Equivalent Monthly Rates

14. Deductions from Salary

15. Solidary Liability

16. Mandatory Registration and Registry of Legitimate Security Service Contractors

17. Enforcement of Labor Standards and Working Conditions

18. Keeping of Records

19. Duty to Produce Copy of Service Agreement

20. Right to Security of Tenure and Due Process

21. Report of Dismissal, Termination or Re-tirement

22. Reserved Status

23. Retaliatory Measures

25. Conciliation-Mediation

26. License requirements for security guards to exercise private security profession

E. Basic requirements for private security personnel 189

F. Qualifications of a Private Security Guard 190

1. Exemptions from Basic Pre-Licensing Training 190

G. Qualifications for Security Officer 191

H. Qualifications for Security Consultants 191

I. Qualifications of a private detective 192

J. Standard Operating Procedure (SOP) for the issuance of license for the exercise of security service profession 192

1. Types of License 193

2. License requirements for government security personnel 193

3. Processing of applications for license 194

4. License Fee 194

5. Where to file application for new applicants 194

6. Requirements for application 195

7. Renewal of license 196

8. In-service re-training as requirement for renewal 196

9. Deadline for filing renewal applications 196

10. Effect of failure to file for renewal 197

11. Where to file application for renewal of license 197

11.1 Duty to obtain license is personal obligation of the security guard; No need for express order by the employer 197

12. Disposition of applications for license 198

13. Duty to carry license with proof of payment of license fee 198

14. License is proof of authority 198

15. License is not authority to violate the laws 199

K. Basic wage rate of security guard/personnel 199

1. Applicable wage rate for those recruited through a branch office in another region where the principal also operates 199

2. More beneficial wage rule in case of transfer to another region 199

3. Wage adjustment for transfer within the same region 200

4. Liability of the employer for the compensa-tion and benefits of the security personnel 207

5. Agencies should prepare payrolls of security guards 207

6. Mandatory insurance coverage 207

7. Allowable deductions from salary of security guards/personnel 208

L. Joint and several liability of principal for the failure to pay by the contractor the wages of security guards/personnel 208

1. Wage increases or adjustments shall be borne by the principal; service contract shall be deemed amended accordingly 209

2. Joint and several liability of the contractor for failure of the principal to pay wage increases or adjustments 209

3. Immediate recourse of the security guards for payment of wages before litigation 209

4 Solidary liability of the principal 210

4.1 Solidary liability of the principal to the extent of accrued claims 210

5. Both the principal and the contractor shall be summoned for any finding of violations on wages and other labor standards 211

M. Security service contract required prior to rendering services 211

1. Required stipulations in the service contract 211

2. Tenure of security personnel co-terminus with the service contract 212

N. Grounds for termination of security personnel 213

O. Duty of security service companies to issue DDO to security personnel in certain situations 214

1. What all DDOs must indicate 215

PART II

R.A. 5487 and its Implementing Rules

and Regulations

A. Licensing requirements and procedure for private security agencies 221

1. Important definitions under the Rules and Regulations Implementing RA 5487, as amended 222

2. Basic guidelines in licensing requirements of private security agencies 227

3. Prohibitions 227

4. Entities allowed to operate a private security agency and private detective agency 228

5. Basic requirements for an operator or man-ager of security agency 228

6. Disqualifications and limitations 229

7. Prohibition on “Kabit System” Operators 231

8. Organizational structure of private security agencies/company security 232

9. Required number of security personnel 233

10 Application for License to Operate (LTO) 234

10.1 License shall be issued according to the purpose of the agency 234

10.2 Status and validity of LTO 235

10.3 Processing of applications for Li-cense to Operate 236

10.4 Supporting documents to accompany applications 237

10.5 Renewal of License to Operate 240

10.6 Display of license 241

10.7 Offices authorized to exercise the power to approve, cancel and suspend LTO 241

10.8 Duties of operators of cancelled LTO 242

10.9 Voluntary cessation of operation 242

B. Rules and regulations governing the conduct of security personnel 243

1. Possession of Firearms by Private Security Agency /Private Detective Agency/ Company Security Force/ Government Security Unit 243

2. Restriction to possess high-powered firearms 243

2.1 Conditions allowing possession of high-powered firearms 244

2.2 Limitations in the carrying of firearms 245

3. Justification for the confiscation of firearms 245

3.1 Disposition of confiscated firearms 246

4. Where to file application for firearms license 247

4.1 Documents to submit in support of application for firearms license 247

5. Grounds for revocation of license to possess firearm 248

6. Prohibition on the use of unlicensed firearms or those with duplicated serial numbers 249

7 Limitation on the stocking of ammunition 249

8. Rules on licensing of instructional firearms 249

C. Rules and regulations on uniform, equipment and paraphernalia of security personnel 250

1. Prescribed uniform for male security per-sonnel 250

2. Make of uniform for security personnel 250

3. Prescribed uniform for female security personnel 254

4. Ornaments and patches 255

5. Special set of uniform (white uniform) for security personnel posted at hotels, resorts, cultural and entertainment areas and other sites noted as tourist-heavy areas 256

5.1 One set of uniform shall be provided free of charge by all employ-ers/owners/ operators of private secu-rity agency/

company security force 260

5.2 One set of uniform annually shall be for the account of licensed security guards; exceptions 260

5.3 Responsibility of the heads/operators of the Private Security Agencies, Company Security Force and Government Security Unit for the manufacture and/or tailoring of the prescribed uniform for their respective security 260

D. Rules and regulations on basic equipment 261

E. Rules on other equipment 262

F. Rules on uniform and equipment board 263

1. Modifications, Additions and Exemptions must be made through the initiation of the SAGSD-CSG for approval of the Private Security Personnel Uniform and Equipment Board (Board) 263

2. Composition and representation of the Board 263

G. Staffing pattern and job description of security personnel 263

1. Rules on staffing pattern 264

2. License is required before an individual can fill up the security personnel positions 266

H. Professional conduct and code of ethics for security personnel 267

1. Rules of engagement for security personnel 270

2. Creed of Security Agency Proprietor, Code of Ethics and Code of Conduct for Private Security Force and Government Security Agencies/Company Security Force and Government Security Unit 271

2.1 Those who violate the creeds, ethical standards and codes shall be subject to penalties 274

I. Rules and regulations on private security training 274

1. Private security training policy 274

2. Private security training 275

3. Categories of private security training 275

4. Organization for private security training 276

5. Conduct of private security training 277

6. Procedure in the conduct of training 278

7. Private security training services 279

8. Private security training institutions 279

8.1 Categories of private security training institutions 280

9. Accreditation of training schools or centers 282

10. Accreditation of training personnel 285

10.1 Validity and duration of accreditation 288

10.2 Limitation of Letter Authority 288

10.3 Duration of interim accreditation 288

11. Limitations and prohibitions in the conduct of security training 289

12. General knowledge examination after training of security personnel 291

13. After-training requirements 291

14. Responsibility for the initial processing for the qualification and fitness of all applicants 292

15. Duration of courses 292

16. Basic guarding subjects as part of training 293

17. Fees and charges relative to private security training 293

18. Same schedule of fees for walk-in applicants 294

19. Duty to issue serialized certificates of comple-tion 294

20. Fees to be collected as permit fees from Pri-vate Security Training Institutions 294

21. List of accreditation fees 295

21.1 Fees collected shall accrue to the PNP 295

22. Processing, standards and documentary requirements for private security training shall be prescribed in a Standard Operating Procedure (SOP) 295

23. Private Security Training Board 296

24 Powers of the municipal mayors in case of emergency to muster the help of members of agency in case of disaster 296

25. Supervision of the PNP over security agen-cies and guards 297

J. Duties of security guard and limitations 297

1. Security guard conduction service 298

2. Rules on armored vehicle/guard service 299

3 Guard duties for the prevention of criminal acts 300

4. Utilization of scientifically designed electronic security systems 301

5. Powers and duties of a security guard and limitations 301

6. Instances when a security guard may exercise authority to arrest a suspect 301

6.1 Method of arrest 302

6.2 Duty of security guard making arrest 302

6.3 Rules and procedure on warrantless search incidental to the arrest by the security guard 303

7. General orders to be strictly kept by the security guards 303

8. Duty of the security guard to assist law enforcers 304

9. Reports to be submitted by the security guard 304

10. Records and files to be maintained by agencies 305

11. Periodic and non-period inspections on all security agencies 306

11.1 Officers authorized to conduct inspection 307

11.2 Types of inspection 307

11.3 Inspection procedures 308

11.4 Duties to perform after conducting inspection 313

11.5 Disposition of discovered violations during inspection 314

K. Investigation of cases involving security personnel, agency and security training institutions 316

1. Coverage of rules on security personnel investigation 316

2. Complaint and filing thereof 317

3. Rules of procedure as to the conduct of investigation 318

3.1 Manner of adjudication 319

3.2 Nature of proceedings 321

3.3 Submission of Resolution 321

3.4 Contents of the Resolution 321

3.5 Mode of service of the Resolution 322

3.6 Rule on imposition of penalties 322

3.7 Motion for reconsideration (MR) 322

3.8 Only one MR shall be allowed; period to file 323

3.9 Grounds for appeal 323

3.10 Perfection of appeal 323

3.11 Period to decide 324

3.12 Deemed denial of appeal 324

4 Sanctions for violation 324

4.1 Definition of offenses involving security personnel 325

4.2 Penalties for offenses under Rule XVII 327

4.3 Effect of suspension on security personnel 328

4.4 Cancellation of license for repeated violation 328

5 Sanctions against private agencies; Exercise of authority to impose penalties 328

5.1 Fines to be imposed against private security agency 331

5.2 Meaning of offenses 332

5.3 Penalties for violation by agency 334

5.4 Cancellation of license for repeat offenders 335

L. Rules governing security personnel and agency during strikes and lockouts 335

1. Avoidance of direct contact with strikers 335

2. Duty to stay within the perimeter 335

3. Use of sufficient and reasonable force 336

4. Prohibition against abetting physical clash of forces 336

5. Security personnel cannot enforce Labor Code provisions on strikes or lockouts 336

6. Complete uniform at all times 336

7. Duty of security agencies/companies during strike 336

7.1 Duty to account firearms 337

7.2 Procedure when there is no Detachment Commander or Security Director 337

7.3 Constant contact with management during strike 338

7.4 Rule when the need to talk to strikers is unavoidable 338

7.5 When to request police assistance 338

7.6 Duty to publish emergency telephone numbers 339

8. Nature of relationship between security personnel and members of the PNP 339

9. Liability for prosecution in case of violation 340

M. Use of forms, seal and logo 340

1. Requirement to use letterhead 341

2. Use of logos and company seals/emblems 341

3. Rules in changing logos, seals and forms 342

N. RULES AS TO AWARDS AND DECORATIONS OF SECURITY PERSONNEL 342

1. Description of the awards 343

2. Authority to grant awards 349

3. Wearing of medals by the security personnel 350

4. Special award 350

5. Categories for recognition 351

6. Determination of the awards 351

O. RULES ON PHYSICAL AND MENTAL EXAMINATIONS 351

1. General Policy 351

2. Physical Examination 352

3. Neuro-psychiatric (NP) Examination 352

4. Drug Test 353

CHAPTER V

RULES ON CONTRACTING

IN CONSTRUCTION INDUSTRY

A. Department Order (DO) No. 19-93 is the prevailing rule on contracting in construction industry 354

1. Coverage 354

2. Practice of contracting and sub-contracting in the construction industry is recognized by law 355

3. Workers, where job contracting is permissi-ble, are employees of the contractor 355

4. Classification of employees employed in the construction industry 355

4.1 Definition of project employees 356

4.2 Definition of non-project employees 356

4.3 Types of non-project employees 356

4.4 Definition of probationary employees 356

4.5 Meaning of regular employees 356

4.6 Definition of casual employees 357

5. Indicators of project employment 357

6. Security of tenure of project employees 358

7. Statutory benefits of construction employees 358

7.1 Wage rates shall depend on the skills or level of competence but not lower than the prescribed minimum wage 359

7.2 Basis in determining rates for workers paid by results 359

7.3 Liability of the construction company and general contractors to the workers in their employ 359

7.4 Wage increases shall be borne by the principal and the contract shall be deemed amended accordingly 360

8. Completion of project or phase thereof and its effect on employment status of workers 360

8.1 Bonus upon completion of the project or phase thereof when there is such an undertaking 361

8.2 Basis of computation of completion bonus 361

8.3 Undertaking to pay a completion bo-nus is an indicator of project employ-ment 361

8.4 Effect where there is no undertaking to pay completion bonus 362

9. Project employees, as a rule, are not entitled to separation pay if separation is due to completion of project 362

9.1 Instance when project employees become entitled to separation pay 363

10. Situation when project employees become regular 363

10.1 Meaning of “day” in day certain 363

10.2 If the final completion of a project is determinable and made known to the worker, regularization will not set notwithstanding one-year duration of employment 363

10.3 Reckoning period for the completion of the project 364

10.4 Re-hiring of worker upon completion of the project or phase thereof 364

10.5 Last day of service must be indicated in the employment papers 364

B. Disciplinary Rules in Project Employment 364

1. Duties of project and non-project employees to observe the law and company rules and regulations 365

2. Preventive suspension in project employment 365

2.1 As opposed to other forms of employment, maximum period of preventive suspension is 15 days 366

2.2 Notice of investigation during preventive suspension 366

2.3 Preventive suspension can be extended subject to certain requirements 366

2.4 Final decision after preventive suspension 367

3. Dismissal for just cause 367

4. Rules on payment of separation pay in termination of project employees 367

4.1 No payment of separation pay if termination is due to just causes 367

4.2 Separation pay shall be paid if termination is due to authorized causes 368

4.3 Effect if the employee is terminated prior to completion of project or phase and not due to just or authorized causes 368

4.4 If reinstatement is not possible employer has to pay salaries for the unexpired portion of the agreement 368

4.5 Recognition of employees’ right to form and join a union and collective bargaining in construction industry 369

PART II

OCCUPATIONAL HEALTH AND SAFETY

A. Aims of D.O. 13, Series of 1998 369

1. Legal bases in the promulgation of DOLE guidelines 370

2. Coverage of D.O. 13, Series of 1998 372

3. DOLE has jurisdiction over the preparation of standards and enforcement of occupational safety and health in construction industry 373

3.1 Conditions for delegation of authority 374

4. Important definitions in D.O. 13, Series of 1998 374

5 Agencies involved 379

6. Every construction project must have a Construction Safety and Health Program (CSHP) 382

6.1 Content of CSHP 382

6.2 Verification of the CSHP 383

6.3 Cost of implementation shall be integrated in the construction cost 383

6.4 Minimum requirements for the approval of CSHP 385

7. Personal Protective Equipment (PPE) of workers 399

7.1 Employer to provide the PPE 399

7.2 Provision of safety harnesses and life lines 399

7.3 Special protective equipment 400

7.4 PPE requirement for other persons allowed on site 400

7.5 Required PPE per type of project 400

8. Safety Personnel 401

8.1 Purpose of the requirement 401

8.2 List of requirements for Safety Personnel 402

8.3 All safety personnel employed on full-time basis should be accredited by the DOLE 403

8.4 Standards for the minimum required safety personnel 403

9. Emergency Occupational Health Personnel and Facilities 404

10. Construction Safety Signages and barricading 406

10.1 Purpose of installation of signages 407

10.2 Signage procedure 407

10.3 Posting of safety signages 408

10.4 Barricading procedures 409

10.5 Worksite conditions allowing installation of barricades 410

11. Construction Safety and Health Committee 411

11.1 Composition 411

11.2 Authority and duties of the Construction Safety and Health Committee Chairman 413

11.3 Other duties and responsibilities 414

11.4 Construction safety and health re-ports 415

11.5 Submission of reports 415

12. Safety and health information 416

13. Safety and health information 419

13.1 Workers health and safety informa-tion 419

13.2 Safety instruction and training 419

13.3 Instruction, training and information materials 420

13.4 To whom specialized instruction and training to be provided 421

13.5 Construction workers skills certificate 422

13.6 Provision of welfare facilities 423

13.7 Toilet and bath facilities 424

14. Procedures in the filing and processing of CSHP 425

14.1 Application received by the region 426

14.2 Evaluation of CSHP 426

15. JOINT ADMINISTRATIVE ORDER NO. 1, Series of 2011 431

15.1 Guiding principles of the inter-agency program 431

15.2 Submission of Construction Safety and Health Program (CSHP) of the DOLE prior to issuance of building permit 433

15.3 DILG directive to the LGU on secur-ing of construction license 434

CHAPTER VI

OCCUPATIONAL HEALTH AND SAFETY STANDARDS

PART I

R.A. 11058

(“An Act Strengthening Compliance with Occupational Safety and Health Standards and Penalties for Violations”)

A. Law Strengthening Compliance with Occupational Safety and Health Standards and Penalties for Violations 354

1. Declaration of Policy 354

2. Coverage 355

3. Definition of Terms

4. Duties and Rights of Workers and Other Persons

4.1 Worker’s Right to Know

4.2 Workers’ Right to Refuse Unsafe Work

4.3 Workers’ Right to Report Accidents

4.4 Workers’ Right to Personal Protective Equipment (PPE)

4.5 Safety Signage and Devices

4.6 Safety in the Use of Equipment

4.7 Occupational Safety and Health Information

B. Covered Workplace 354

1. Occupational Safety and Health (OSH) Program 354

2. Occupational Safety and Health (OSH) Committee

3. Safety Officer

4. Occupational Health Personnel and Facilities

5. Safety and Health Training

6. Occupational Safety and Health Reports

7. Workers’ Competency Certification

8. Workers’ Welfare Facilities

9.

9. All Other Occupational Safety and Health Standards

10. Cost of Safety and Health Program

11. Joint and Solidary Liablity of Employer

C. Enforcement of Occupational Safety and Health Standards 354

1. Visitorial and Enforcement Power of the Secretary of Labor and Employment

2. Payment of Workers During Work Stoppage

3. Delegation of Authority

4. Standards Setting Power of the Secretary of Labor and Employment

5. Employee’s Compensation Claim

6. Incentives to Employers and Workers

7. Prohibited Acts and its Corresponding Penalties

PART I

R.A. 11058

Procedural Guidelines in OSH in the Construction Industry

A. Aims of D.O. 13, Series of 1998 354

1. Legal bases in the promulgation of DOLE guidelines

2. Coverage of D.O. 13, Series of 1998

3. DOLE has jurisdiction over the preparation of standards and enforcement of occupational safety and health in construction industry

3.1 Conditions for delegation of authority

4. Important definitions in D.O. 13, Series of 1998

5. Agencies involved

6. Every construction project must have a Construction Safety and Health Program (CSHP)

6.1 Content of CSHP

6.2 Verification of the CSHP

6.3 Cost of implementation shall be integrated in the construction cost

6.4 Minimum requirements for the approval of CSHP

7. Personal Protective Equipment (PPE) of workers

7.1 Employer to provide the PPE

7.2 Provision of safety harnesses and lifelines

7.3 Special protective equipment

7.4 PPE requirement for other persons allowed on site

7.5 Required PPE per type of project

8. Safety Personnel

8.1 Purpose of the requirement

8.3 List of requirements for Safety Personnel

8.4 All safety personnel employed on full-time basis should be accredited by the DOLE

8.5 Standards for the minimum required safety personnel

9. Emergency Occupational Health Personnel and Facilities

10. Construction Safety Signages and barricading

Purpose of installation of signages

10.1 Purpose of installation of signages

10.2 Signage procedure

10.3 Posting of safety signages

10.4 Barricading procedures

10.5 Worksite conditions allowing installation of barricades

11. Construction Safety and Health Committee

11.1 Composition

11.2 Authority and duties of the Construction Safety and Health Committee Chairman

11.3 Other duties and responsibilities

11.4 Construction safety and health reports

11.5 Submission of reports

12. Safety and health information

13. Workers’ Information on safety and health

13.1 Workers health and safety information

13.2 Safety instruction and training

13.3 Instruction, training and information materials

13.4 To whom specialized instruction and training to be provided

13.5 Construction workers skills certificate

13.6 Provision of welfare facilities

13.7 Toilet and bath facilities

14. Procedures in the filing and processing of CSHP

14.1 Application received by the region

14.2 Evaluation of CSHP

15. Joint Administrative Order No. 1, Series of 2011

15.1 Guiding principles of the inter-agency program

15.2 Submission of Construction Safety and Health Program (CSHP) of the DOLE prior to issuance of building permit

15.3 DILG directive to the LGU on securing of construction license

CHAPTER VI

PHILIPPINE CONTRACTORS ACCREDITATION BOARD (PCAB) LICENSING

PART I

PCAB ADMINISTRATION

A. Contractor’s License Law 354

1. Composition of the PCAB Board 354

2. Qualifications of members 355

3. Term of Office

4. Powers and Duties of the Board

5. Definition of Terms

5.1 Non-applicability of R.A. 4566

6. Classification

7. Power to Classify and Limit Operations

7.1 Incidental Work

B. Licensing 354

1. Examinations Required 354

2. Qualifications of Applicants 355

2.1 Notice of Disassociation

2.2 Suspension for Failure to Notify

3. Issuance of Licenses

3.1 Types of License

3.2 Requirements for Licensing

3.3 Regular License Application Documents

3.4 Special License Application Documents

3.5 Sustaining Technical Employee (STE)

3.5.1 Disassociation of STE

3.6 Authorized Managing Officer (AMO)

3.6.1 Change of AMO

3.7 Filing of PCAB Application

3.8 PCAB License Validity

3.9 Terms and Conditions of a Contractor’s PCAB License

3.10 Contracting Classification

3.11 Classification Processing

3.12 Multiple Classification

3.13 Operation by Classification

3.14 Updating of Classification Requirements

3.15 What the License Certificate Confers

3.16 Constructor Categories

3.17 Categorization Criteria

3.18 Category Identification

3.19 Categorization of Special License Constructors

3.20 Survivability in Case of Death

4. Publication of List of Contractors

4.1 Report on Changes

5. Other Matters on Licenses

5.1 Engaging on Construction Without a License is Unlawful

5.2 License in Joint Venture of Separate Licensees

5.3 Renewal

5.4 Renewal Application Filing

5.5 Renewal Application Documents

5.6 Classification Review for Renewal

5.7 Category Review

5.8 Failing in Classification Review

5.9 Provisional License Renewal

5.10 PCAB License Renewal Certificate

5.11 Late License Renewal and License Lapsing

5.12 Category Upgrading

5.13 Classification Revision

5.14 Application for Revision and Upgrading

5.15 Other License Amendments

5.16 Licensing Fees

5.17

C. Accreditation of Constructors 354

1. Accreditation 354

2. Quality of Overall Performance 355

3. Index Rating

4. Performance Factors in Index Rating

5. Eligibility for Accreditation

6. Application for Accreditation

7. Recognized Rating Entities

8. Accreditation Application Processing

9. Accreditation Certification

10. Accreditation Validity

11. Re-Accreditation

12. Index Rating Review

13. Index Rating Upgrade

14. Accreditation or Re-Accreditation Denial

15. Accreditation Fees

15.1 Amount of Fees

15.2 Payment of Fees

16. Change in PCAB Accreditation Performance Factor

17. Change of Address

18. Change of Name

19. Change in Business Organization Style

20. Introduction of Foreign Entity

D. Rights and Duties of PCAB Licensed Constructors 354

1. Regular License Authorization 354

2. Special License Authorization 355

3. Rules on Joint Operation Licensing

E. Disciplinary Action, Proceedings and Decision 354

1. Causes for Disciplinary Action 354

2. Disciplinary Proceedings 355

2.1 Jurisdiction

2.1 Prescription of accusations or charges

3. Complaint

3.1 Withdrawal of Complaint

4. Service and Answer

5. Evidence

6. Memorandum

7. Decision

8. Petition for Reconsideration

F. Lifting of PCAB License Suspension and Restoration 354

1. Lifting of Suspension 354

2. License Restoration

3. Non-Restoration of license

G. Code of Ethics 354

1. Filipino Constructor’s Code of Ethics 354

H. Enforcement of the law 354

1. Application of the Law and Exemptions 354

2. Enforcement by the Board

3. Enforcement by the Officers of the Law

4. Enforcement in Construction Biddings

I. Penalties Imposed by PCAB 354

1. Person or Firm Deemed Guilty of Misdemeanor 354

——o0o——

close

Additional information

| Weight | .91 kg |

|---|