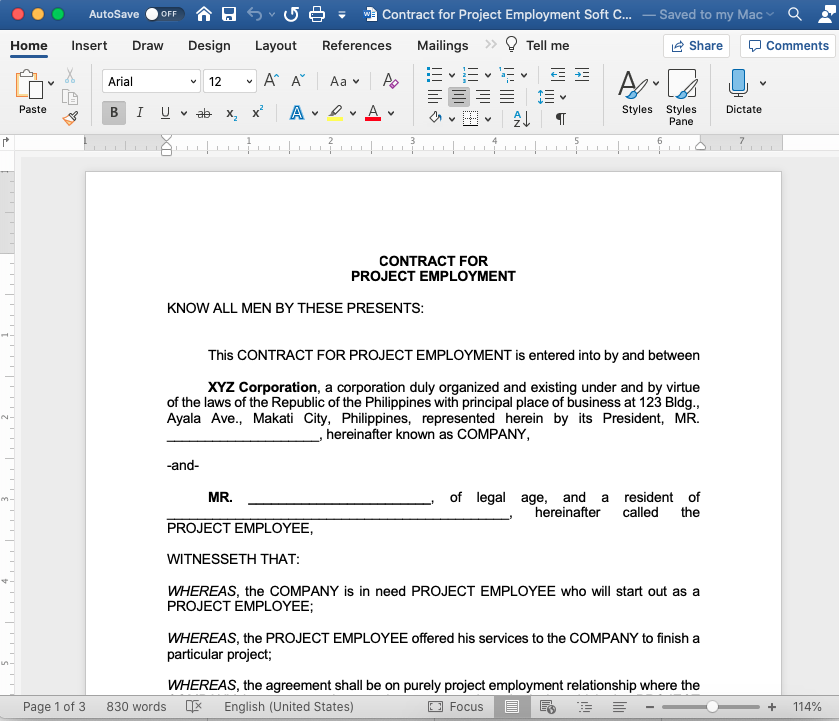

Sample Project Employment Contract (English Version) – Soft Copy Editable Template

₱1,495.00

CONTRACT FOR PROJECT EMPLOYMENT

SOFT COPY DESCRIPTION

This is a soft copy template saved in Word File and editable in Word Document.

This contains the sample terms, conditions, clauses, and provisions of the contract described.

See the Description below to view the Contents of this soft copy template.

Project employment is an exception to the rule on regular employment if all the requisites are complied with.

A project employee under now Article 295 of the Labor Code, as amended, is one whose employment has been fixed for a specific project or undertaking, the completion or termination of which has been determined at the time of the engagement of the employee. (Herma Shipyard, Inc. vs. Oliveros, G.R. No. 208936, April 17, 2017)

Read more..

Thus:

Art, 295. Regular and Casual Employment. –The provisions of written agreement for the contrary notwithstanding and regardless of the oral agreement of the parties, an employment shall be deemed to be regular where the employee has been engaged to perform activities which are usually necessary or desirable in the usual business or trade of the employer, except where the employment has been fixed for a specific

Project or undertaking the completion or termination of which has been determined at the time of the engagement of the employee or where the work or service to be performed is seasonal in nature and the employment is for the duration of the season.

A sample contract will help employers to overcome the technicalities of this form of employment. This template is easy to edit using the Word application. This version is using MS Office 365.

Salient points of this template are:

1. Parties

2. Whereas Clause

3. Commencement of project

4. Scope and duration

5. Duties and responsibilities clause

6. Completion clause (Phase or entire project)

7. Automatic termination upon completion

8. Salary / Wage and benefits

9. Project bonus (not mandatory under the law but is an indicator of project employment)

10. Voluntary signing clause

11. Data privacy consent clause

close

Related Products

-

Employment Contracts Templates Soft Copy (English and Filipino/Tagalog)

0 out of 5EMPLOYMENT CONTRACTS TEMPLATES DESCRIPTION

Employment contracts in the Philippines should be crafted in accordance with rules to ensure compliance with legal requirements.

This is saved in a single file in Word (Arial Font using sizes 12, 14, and 20). Buyers will receive the file through email from LVS’ gmail account. There will be price increase for this product soon.

Alert!: If you were able to purchase any of our soft copy products in the past please double-check that they are not part of these templates. This product is indivisible and individual soft copy templates previously purchased cannot be deducted from the price.

This product, Employment Contracts Templates (English and Filipino), contains 40+ samples or templates of various employment contracts used in the Philippines such as:

- Probationary

- Regular

- Casual

- Project

- Seasonal

- Fixed-Term or Fixed-Period, and

- Part-Time

Read more..

Some sample templates contain show formats that incorporate provisions on:

- Data Privacy Consent Clause

- Discipline

- Reference to Job Description

- Benefits

- Place of Work

- Shift

- Performance Metrics

- Decorum/Uniform

- Shift, etc.

close

Scroll down for more information

₱3,995.00₱3,900.00 -

Employee Leave Benefits

2.57 out of 5₱99.75Title: Employee Leave Benefits

Relatively new laws have been passed such as the ten (10)-day VAW-C leave for victims of violence and the recently enacted two (2)-month gynecological leave.

The author explain these benefits in interesting fashion and easy-to- read format. Likewise, he discusses important issues on Paternity. Solo Parent’s and Service Incentive Leave Benefits, among others.

Scroll down for more information

-

Health Checklist & Workplace COVID-19 Protocol – Soft Copy Editable Template

0 out of 5₱500.00On April 30, 2020 the Department Trade and Industry (DTI) and the Department of Labor and Employment (DOLE) issued Interim Guidelines on Workplace Prevention and Control of COVID-19.

The guidelines require employers to implement Health checklists containing declarations of various information and the Workplace Screening Protocol.

Below are sample templates of the health checklist and Screening Protocol which are Editable in Word. Templates are available at only P500.00 to be sent via your email.

-

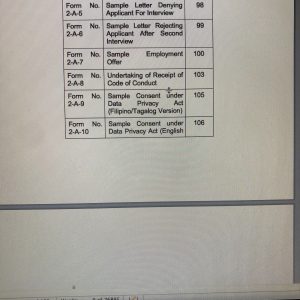

Human Resource Forms, Notices and Contracts Vol. 1

2.49 out of 5₱499.75Title: Human Resource Forms, Notices & Contracts Made Easy

This book provides 157 samples of employment contracts (probationary, seasonal project and casual), notices to explain covering various offenses, actual notices of dismissal, suspension and warning, among others. All the sample templates are written in English.

The forms used on this book are very important for HR practitioners as they are the ones needed in communicating to employees the terms of employment and due process. They are important evidentiary documents as well in case disputes on dismissal, employment benefits and other matters involving employer-employee relationship reach the labor courts.

These sample forms were designed following the principles laid down in the Labor Code, as amended as well as recent labor jurisprudence. Important principles on just causes of dismissal, five-day notice rule on notice to explain, preventive suspension and the conduct of hearing/conference prior to dismissal are also discussed here.

This book will help HR practitioners in discharging their role as the hub for the maintenance of industrial peace and harmony. Not only that this will help avoid costly mistakes in the event of labor disputes but will also help express the policies and principles of company.

The English forms and templates contained in this book are listed below.

Scroll down for more information

Pages

I………. Introduction ……………………………………………………. 1

II……… Chapter I: Pre-hiring forms ………………………………. 3

A….. Sample Application Form …………………………. 5

B….. Sample Application Letter by Employee ……. 21

C….. Employment Checklist …………………………….. 23

III…….. Chapter II: Contracts at point of hiring …………….. 27

A….. Employment Contracts ……………………………. 27

B….. Contract for Probationary Employment ………. 45

C….. Contract for Regular Employment …………….. 69

D….. Contract for Casual Employment ………………. 75

E….. Contract for Project Employment ……………… 85

F….. Contract for Seasonal Employment …………… 96

G…. Contract for Fixed Term Employment ………. 105

H….. Contract for Part Time Employment ………… 113

I…… Transfer of Employees …………………………… 121

IV…….. Chapter III: Forms Used During Employment ….. 125

A….. Notices to Explain ………………………………… 129

Sample notices to explain (where imposable penalty is a warning) for the following offenses 131

i…… Violation of company policies on …………………… 132

1….. General Cleanliness ……………………………… 132

2….. Littering ………………………………………………. 133

3….. Smudging ……………………………………………. 134

4….. Disorderly Filing ……………………………………. 135

5….. Designated dining areas ………………………… 136

ii….. Attendance …………………………………………………. 138

1….. Unauthorized undertime ………………………… 138

2….. Violation of coffee break schedule ………….. 139

3….. Violation of lunch break schedule …………… 140

4….. Abandoning post ………………………………….. 141

iii…. Unauthorized absences ………………………………… 142

1….. Absence without leave (AWOL) ………………. 142

2….. Failure to give notice for sickness ……………. 144

iv…. Punctuality/Time-keeping …………………………….. 146

1….. Tardiness …………………………………………….. 146

2….. Failure to log-in ……………………………………. 148

3….. Failure to log-out ………………………………….. 149

v….. Knowingly punching timecard or logging in attendance for other employees 150

vi…. Unauthorized alteration made on one’s timecard or attendance sheet 151

vii… Unauthorized alteration made on other’s timecard with consent of such employee 153

viii.. Unauthorized alteration made on other’s timecard without the consent of such employee 154

ix…. Unauthorized removal of one’s timecard or attendance sheet 155

x….. Unauthorized removal of another’s timecard or attendance sheet 157

xi…. Unauthorized concealment of one’s timecard or attendance sheet 158

xii… Unauthorized concealment of another’s timecard or attendance sheet 159

xiii.. Intentional destruction of one’s timecard or attendance sheet 161

xiv… Intentional destruction of another’s timecard or attendance sheet 162

xv…. Dress Code ………………………………………………….. 164

1….. Without uniform ……………………………………. 164

a….. Reporting for work not in prescribed dress code 164

2….. With Uniform ………………………………………… 165

a….. Reporting for work not in prescribed uniform (barong or blouse) 165

b….. Reporting for work not in prescribed uniform (pants or skirt) 167

c….. Reporting for work not in prescribed uniform (blazer) 169

xvi… Identification card ……………………………………….. 171

1….. Failure to wear ID card ………………………….. 172

2….. Refusal to wear ID card ………………………….. 173

3….. Deliberate destruction of ID card …………….. 175

4….. Deliberate mutilation of ID card ……………… 176

5….. Alteration of entries in the ID card …………… 176

6….. Concealment of one’s ID card ………………… 177

7….. Concealment of another’s ID card …………… 179

8….. Unauthorized and improper use of ID card .. 180

xvii.. Loitering …………………………………………………….. 182

1….. Loitering in unrestricted area ………………….. 182

2….. Loitering in restricted area ……………………… 183

xviii. Insubordination ……………………………………………. 184

1….. Refusal to subject oneself to annual physical examinations 184

2….. Refusal to subject oneself to executive checkup 186

3….. Refusal to abide by auditing procedure ……. 187

4….. Refusal to abide by security and safety regulations 188

5….. Refusal to transfer to another assignment …. 190

6….. Refusal to perform one’s task …………………… 191

7….. Refusal to render overtime work ………………. 192

8….. Refusal to report for holiday work …………….. 194

9….. Refusal to issue disciplinary action to subordinate 195

10… Refusal to obey lawful orders of Superior ….. 196

11… Refusal to give information in a company investigation 198

Sample notices to explain (where imposable penalty is suspension) 199

i…… Attendance …………………………………………………. 202

1….. Unauthorized undertime ………………………… 202

2….. Knowingly punching timecard or logging in attendance for other employees 204

ii….. Insubordination ……………………………………………. 205

1….. Refusal to transfer to another assignment …. 205

iii…. Willful breach of trust (with mitigating circumstance) 207

1….. Misappropriation of fund ………………………… 207

Sample notice to explain (where imposable penalty is dismissal) 209

1….. Notice issued for abandonment of work ……. 211

2….. Notice issued for willful breach of trust …….. 214

Sample notice to explain (where imposable penalty is dismissal with preventive suspension) 216

1….. Notice to explain for Serious Misconduct with preventive suspension 211

2….. Notice to explain for offense involving Willful Breach of Trust 214

Sample notice of hearing/conference ………………………. 222

– Instances where hearing is not necessary ………. 224

– Tips in conducting the hearing/conference …… 225

1….. Hearing for offense involving Willful Breach of Trust 228

2….. Hearing for offense involving serious misconduct 229

B….. Notice imposing disciplinary action (warning) ….. 231

i…… Violation of company policies on …………………… 233

1….. General Cleanliness ……………………………… 233

2….. Littering ………………………………………………. 234

3….. Smudging ……………………………………………. 235

4….. Disorderly Filing ……………………………………. 237

5….. Designated dining areas ………………………… 238

ii….. Attendance …………………………………………………. 240

1….. Unauthorized undertime ………………………… 240

2….. Violation of coffee break schedule ………….. 241

3….. Violation of lunch break schedule …………… 243

4….. Abandoning post ………………………………….. 245

iii…. Unauthorized absences ………………………………… 246

1….. Absence without leave (AWOL) ………………. 246

2….. Failure to give notice for sickness ……………. 248

iv…. Punctuality/Time-keeping …………………………….. 251

1….. Tardiness …………………………………………….. 251

2….. Failure to log-in ……………………………………. 253

3….. Failure to log-out ………………………………….. 254

v….. Knowingly punching timecard or logging in attendance for other employees 255

vi…. Unauthorized alteration made on one’s timecard or attendance sheet 257

vii… Unauthorized alteration made on other’s timecard with consent of such employee 258

viii.. Unauthorized alteration made on other’s timecard without the consent of such employee 260

ix…. Unauthorized removal of one’s timecard or attendance sheet 262

x….. Unauthorized removal of another’s timecard or attendance sheet 263

xi…. Unauthorized concealment of one’s timecard or attendance sheet 265

xii… Unauthorized concealment of another’s timecard or attendance sheet 266

xiii.. Intentional destruction of one’s timecard or attendance sheet 268

xiv… Intentional destruction of another’s timecard or attendance sheet 269

xv…. Dress Code ………………………………………………….. 271

1….. Without uniform ……………………………………. 271

a….. Reporting for work not in prescribed dress code 271

2….. With Uniform ………………………………………… 272

a….. Reporting for work not in prescribed uniform (barong or blouse) 272

b….. Reporting for work not in prescribed uniform (pants or skirt) 274

c….. Reporting for work not in prescribed uniform (blazer) 277

xvi… Identification card ……………………………………….. 278

1….. Failure to wear ID card ………………………….. 278

2….. Refusal to wear ID card ………………………….. 280

3….. Deliberate destruction of ID card …………….. 281

4….. Deliberate mutilation of ID card ……………… 283

5….. Alteration of entries in the ID card …………… 285

6….. Concealment of one’s ID card ………………… 287

7….. Concealment of another’s ID card……………. 288

8….. Unauthorized and improper use of ID card .. 290

xvii.. Loitering …………………………………………………….. 293

1….. Loitering in unrestricted area ………………….. 293

2….. Loitering in restricted area ……………………… 294

xviii. Insubordination ……………………………………………. 296

1….. Refusal to subject oneself to annual physical examinations 297

2….. Refusal to subject oneself to executive checkup 298

3….. Refusal to abide by auditing procedure ……. 300

4….. Refusal to abide by security and safety regulations 301

5….. Refusal to transfer to another assignment …. 303

6….. Refusal to perform one’s task …………………… 305

7….. Refusal to render overtime work ………………. 307

8….. Refusal to report for holiday work …………….. 308

9….. Refusal to issue disciplinary action to subordinate 310

10….. Refusal to obey lawful orders of Superior ….. 312

11….. Refusal to give information in a company investigation 313

C….. Notice imposing disciplinary action (suspension). 315

i…… Attendance …………………………………………………. 315

1….. Unauthorized undertime ………………………… 315

2….. Knowingly punching timecard or logging in attendance for other employees 317

ii….. Insubordination ……………………………………………. 318

1….. Refusal to transfer to another assignment …. 318

iii…. Willful breach of trust (with mitigating circumstance) 320

1….. Misappropriation of funds ………………………. 321

D….. Notice of Dismissal ………………………………………. 324

i…… Notice of Dismissal for Abandonment ………. 324

ii….. Dismissal Notice for Serious Misconduct ….. 330

iii…. Dismissal Notice for Willful Breach of Trust.. 341

V….. Note on the next Volume/s of HR Forms, Notices and Contracts Made Easy 346

-

HR Bundle – Print Books

0 out of 5The HR Bundle offers excellent tools for learning about HR/Labor rules, doctrines and principles in various books written by Atty. Elvin B. Villanueva. Each book in the bundle provides unique content dealing with particular labor/HR topic.

HR Bundle comes with a 5% discount. Shipping is free.

Scroll down for more information

₱7,223.00₱6,861.85 -

HR Forms, Notices and Contracts 1 Soft Copy Version (150+ Templates in Editable Word)

0 out of 5₱8,495.00Forms, Notices and Contracts

Soft Copy Version (Word File only – Saved as Single File)Alert!: If you were able to purchase any of our soft copy products in the past please double-check that they are not part of these templates. This product is indivisible and individual soft copy templates previously purchased cannot be deducted from the price.

Scroll Down to see the Table of Forms or list of Forms

Read more..

Based on the book Human Resource Forms, Notices & Contracts Volume One

Features:

- Editable in Word file (Saved as one file “HR Forms Volume 1 Soft Copy”)

- Fonts Used: Arial, Book Antiqua, Garamond

- With separate file showing instructions on How to Use and Navigate the HR Forms

- Product will be sent to Buyer’s Email Account from LVS’ gmail account.

- Over 150 Sample Forms such as:

- Employment Contracts (some with Data Privacy Consent Clause)

Regular

Probationary

Casual

Seasonal

Fixed-Term

Part-Time - Consent under Data Privacy Act

- DOLE Mandatory Policies

- Drug-Free Workplace

- HIV/AIDS

- Hepatitis B

- Tuberculosis

- Anti-Sexual Harassment

- Acknowledgment Receipt of Personal Protective Equipment (PPE)

- Authority to Deduct (Debt)

- Notices to Explain

- Notices of Hearing/Conference

- Notice of Suspension

- Preventive Suspension

- Extension of Preventive Suspension

- Termination Notice

- Extension of Preventive Suspension

- Application Form

- Employment checklist, etc.

- Acceptance of Resignation

- Acceptance of Resignation with Pending Case (Graceful Exit)

- Clearance Form

- Release, Waiver and Quitclaim

- Many more!

close

Scroll down for more information (Table of Forms)

- Editable in Word file (Saved as one file “HR Forms Volume 1 Soft Copy”)

-

Tax Solutions

2.49 out of 5₱748.00Title: Tax Solutions on Employee Compensation and Benefits

Tax Solutions on Employee Compensation & Benefits is a revelation for HR practitioners and compensation and benefits practitioners when it comes to taxation on employee pay.

The book shares several practical examples on computation of the benefits, compensation and other pay given to employee. The reader is guided on the intricacies of tax concepts and principles through simple discussion and examples.

Surely, this work can be helpful a tool for HR and comp-ben practitioners in understanding employment tax concepts so employees can clearly understand how taxes impact on their pay.

Scroll down for more information

-

Employee Transfer & Demotion

2.61 out of 5₱347.00Title: Employee Transfer and Demotion

The book provides updated answers to the most pressing questions on employee transfer and demotion. This is must-have for employers who would want to make the right decision and avoid or minimize labor disputes.

This work will guide the practitioners and business owners in navigating the treacherous terrain of transfer and demotion. Questions regarding timing of transfer, acts to avoid, lateral position, location, and rank are concisely discussed in this work. The dos and don’ts in demotion are also clearly and completed explain.

The concepts are easy to understand making this book an important arsenal in every HR practitioner or business owner’s library.

Scroll down for more information

-

Gabay sa mga Karapatan ng Overseas Filipino Worker (OFW)

2.42 out of 5₱395.00Title: Gabay sa mga Karapatan ng Overseas Filipino Worker (OFW)

Author: Atty. Elvin B. Villanueva

Publisher: Central Book Supply, Inc.

ISBN: 978-971-011-130-5

No. Of Pages: 185

Size: 6″x9″

Edition: First Edition, 2010

Size: 6″x9″

Binding: Softbound -

Guide on Employee Compensation and Benefits Vol. 1, Second Edition

0 out of 5₱1,198.00This book is the 2nd edition of one of ATTY. ELVIN B. VILLANUEVA’s best selling titles Guide on Employee Compensation and Benefits Volume 1. HR Practitioners, both new and veterans will find this work useful in understanding and keeping up with the latest rules, doctrines and principles on labor standards.

The subject matter of compensation and benefits is among the edgy topics which most HR practitioners, business managers, and even owners find challenging. As always, anything that deals with human psychology on pay, rewards, motivation, and equity requires full attention and creative solution.

Read more..

This work discusses the labor standards most particularly the exceptive rules where most practitioners are often blindsided. The rules and doctrines are tackled with illustrations and sample computations. Presentation of pay computations proceeds from the ordinary day, regular holiday, special day, and rest day or a combination of both holidays and rest days. These affects the daily rate, overtime, and nightshift differential.

There are relevant Supreme Court decisions where the high court interprets crucial areas of compensation. Rules on successive regular holidays are shown with example. Also, illustrative cases for overtime and nightshift differential are shown using different hours worked such as 2-hour, 4-hour, or even 8-hour OT and nightshift with computations when these coincide or concur on the same day.

The author also delineates the impact of benefits when the clock strikes 12:00 midnight such as on overtime, holiday pay, etc. This is particularly crucial for those with call center operations. Also discussed are company-initiated benefits rule, management prerogative to require overtime work, rule on travel time, brownout and other time-related issues.

New laws and rules are correlated with existing ones in the Labor Code such as the lactation period, primer on expanded maternity leave law (with sample salary differential computation), DO 178 and DO 184 on breaks mandated for employees who need to stand or sit for too long at work and the telecommuting act which affects the hours of work depending on the arrangement between the employer and employee.At the end of the day, compensation and benefits is an interesting area of HR/Labor practice. The key to harmony is understanding of the rules and it starts with acquisition of knowledge.

close

Scroll down for more information