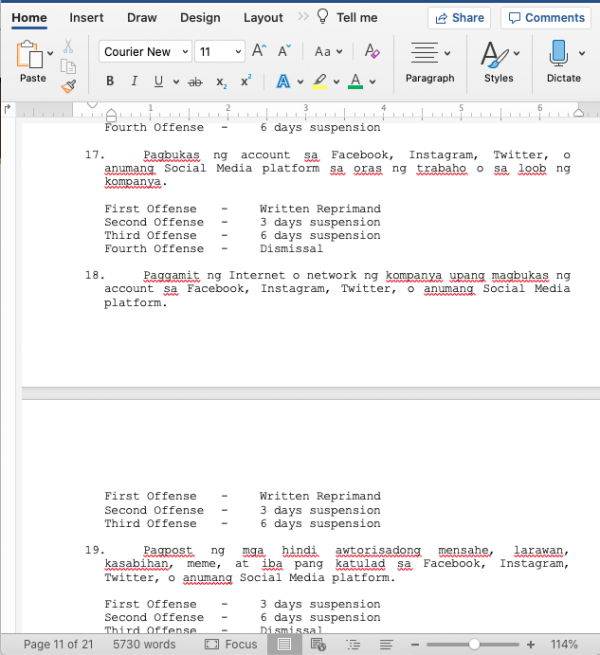

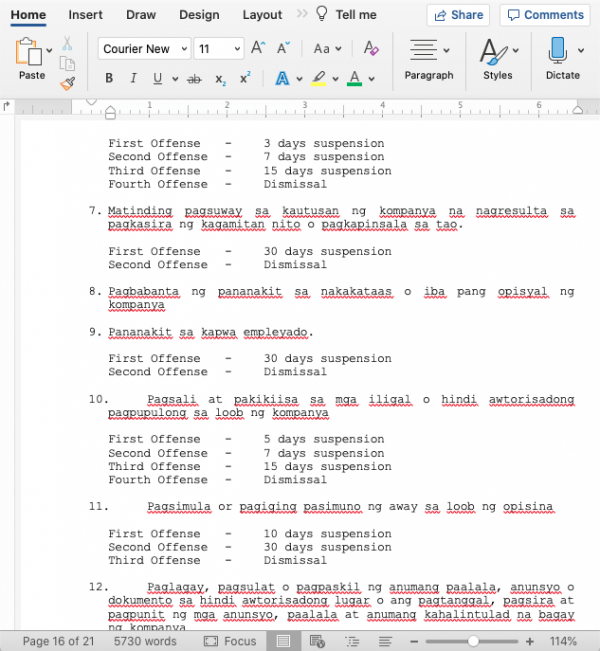

Sample Code of Conduct (in Filipino / Tagalog Version) – Soft Copy Editable Template

₱3,895.00

This product captures the disciplinary process, procedure, and policies that companies usually need in an easy to edit format. The soft copy template is written in Word document making it editable in similar platform in Filipino / Tagalog.

The Code of Conduct template contains 21 pages, in 8.5” x 11” page layout, portrait orientation, using Courier New font, size 11.

It contains statement of disciplinary policy, disciplinary process and standards, Definition of Terms, and the list of offenses and their penalties.

Read more..

The following are the offenses contained in the template:

MGA ALITUNTUNIN AT PATAKARAN SA PAGDIDISIPLINA

I. Mga Kahulugan ng Terminolohiya:

Written Warning

Stern Warning

Reprimand

Suspension

Dismissal

Preventive Suspension

First Offense

Second Offense

Third Offense

Fourth Offense

Opisina o kompanya

II. DISCIPLINARY POLICY (MGA POLISIYA SA DISIPLINA)

III. PAMAMARAAN SA PAGPATAW NG DISIPLINA (DISCIPLINARY PROCEDURE)

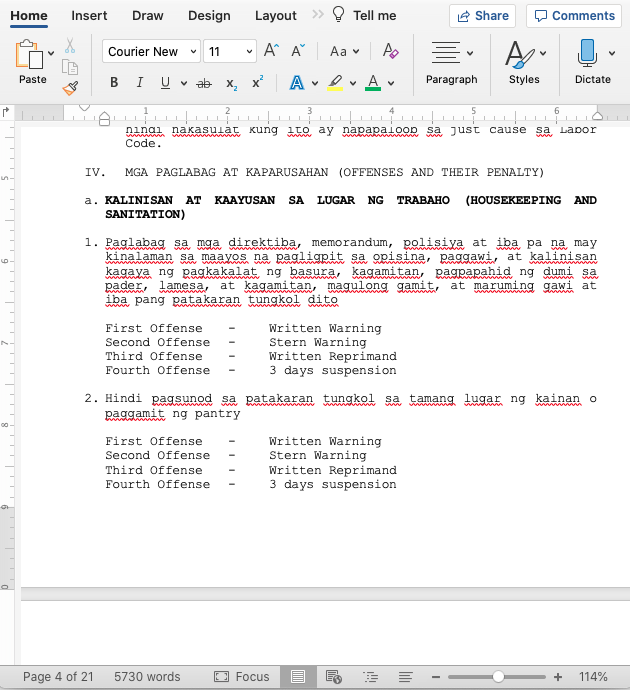

IV. MGA PAGLABAG AT KAPARUSAHAN (OFFENSES AND THEIR PENALTY)

a. KALINISAN AT KAAYUSAN SA LUGAR NG TRABAHO (HOUSEKEEPING AND SANITATION)

b. ORAS NG PAGPASOK SA TRABAHO (ATTENDANCE)

c. MGA HINDI AWTORISADONG PAGLIBAN SA TRABAHO (UNAUTHORIZED ABSENCES)

d. PAGPASOK SA TAMANG ORAS (PUNCTUALITY)

e. PATAKARAN TUNGKOL SA PAGSUOT NG UNIPORME (WEARING OF UNIFORM)

f. MGA PAGLABAG TUNGKOL SA ID O IDENTIFICATION CARD (OFFENSES INVOLVING IDENFICATION CARD)

g. MGA ASAL SA TRABAHO (WORK BEHAVIOR)

h. MGA PINAGBABAWAL NA GAWAIN (PROHIBITED ACTIVITIES)

i. MGA HINDI KANAIS-NAIS NA PAG-UUGALI NA TINUTURING NA SERYOSONG PAGLABAG(SERIOUS MISBEHAVIOR)

j. PAGSASABOTAHE, PANINIKTIK AT PAGLABAG SA MGA SIKRETONG PANG NEGOSYO NG KOMPANYA

k. PAGLABAG SA MGA PATAKARAN UKOL SA SEGURIDAD AT KALIGTASAN

l. HINDI MAGANDANG ASAL AT PAG-UUGALI (DISORDERLY CONDUCT)

m. PAGSIRA NG TIWALA (BETRAYAL OF TRUST)

n. KAPABAYAAN SA TRABAHO O NEGLECT OF DUTY

o. SEXUAL HARASSMENT

p. PAULIT-ULIT NA MGA PAGLABAG NG MGA PATAKARAN (HABITUAL VIOLATIONS)

close

Related Products

-

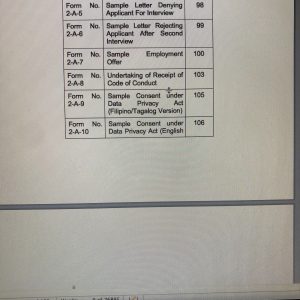

HR Forms, Notices and Contracts 1 Soft Copy Version (150+ Templates in Editable Word)

0 out of 5₱8,495.00Forms, Notices and Contracts

Soft Copy Version (Word File only – Saved as Single File)Alert!: If you were able to purchase any of our soft copy products in the past please double-check that they are not part of these templates. This product is indivisible and individual soft copy templates previously purchased cannot be deducted from the price.

Scroll Down to see the Table of Forms or list of Forms

Read more..

Based on the book Human Resource Forms, Notices & Contracts Volume One

Features:

- Editable in Word file (Saved as one file “HR Forms Volume 1 Soft Copy”)

- Fonts Used: Arial, Book Antiqua, Garamond

- With separate file showing instructions on How to Use and Navigate the HR Forms

- Product will be sent to Buyer’s Email Account from LVS’ gmail account.

- Over 150 Sample Forms such as:

- Employment Contracts (some with Data Privacy Consent Clause)

Regular

Probationary

Casual

Seasonal

Fixed-Term

Part-Time - Consent under Data Privacy Act

- DOLE Mandatory Policies

- Drug-Free Workplace

- HIV/AIDS

- Hepatitis B

- Tuberculosis

- Anti-Sexual Harassment

- Acknowledgment Receipt of Personal Protective Equipment (PPE)

- Authority to Deduct (Debt)

- Notices to Explain

- Notices of Hearing/Conference

- Notice of Suspension

- Preventive Suspension

- Extension of Preventive Suspension

- Termination Notice

- Extension of Preventive Suspension

- Application Form

- Employment checklist, etc.

- Acceptance of Resignation

- Acceptance of Resignation with Pending Case (Graceful Exit)

- Clearance Form

- Release, Waiver and Quitclaim

- Many more!

close

Scroll down for more information (Table of Forms)

- Editable in Word file (Saved as one file “HR Forms Volume 1 Soft Copy”)

-

Ring-Bound: Digest on Critical Supreme Court Decisions on Labor Cases 2016 Cases

0 out of 5₱745.00- Binding: Ring-bound

- Paper size: 8.5” x 13”

- Colored Front Cover with Plastic protection

- Inside: White bond paper with black text

- No. of pages: Approximately 170

- Retail Price: P745.00

ABOUT THE RING-BOUND EDITION

Digest of Critical Supreme Court Decisions on Labor Cases is an ambitious work to provide readers, HR practitioners, lawyers, and law students with crucial information on the Supreme Court decisions in labor cases. The digested cases are handy in tracking the recent rulings which are crucial in policy formulation in labor and employee relations. They are critical in a sense that the changes affect the labor environment and those not in the know may bear the adverse consequences.Read more..

Labor law is like a living organism that changes as time passes by. The employer who is more cognizant of the changes can adapt effectively. The presentation is indexed for easy reference. The book provides a digest of the recent decisions of the Supreme Court in labor such as cases on Retirement, Refusal to retire, Retirement plan vs. Labor Code Redundancy, Redundancy carried out by persons belonging to related companies, Labor claims against related companies, Employment contract, Audited financial statement (AFS) and Judicial notice of losses, Rehiring of some of the retrenched employees, Rehabilitation; and Quitclaim. This Year 2016 Digest covers SC Decisions on Strike; Notice of strike; Illegal strike; Valid dismissal; Employment status deemed lost; Transfer; Promotion; Resignation; force; threat; intimidation; coercion; release; waiver; quitclaim; Res judicata; Conclusiveness of judgment; Certification election; Illegal dismissal; Job contracting; Labor-only contracting; Labor-only contractor; Presumed labor-only contractor; Fixed-term; Fixed-term employment; Independent contractor; Repeated renewal; etc.

close

Scroll down for more information

-

Temporary Flexible Work Arrangement Template – Work from Home – Soft Copy Editable Template

0 out of 5₱500.00TEMPORARY FLEXIBLE WORK AGREEMENT DESCRIPTION

This is a soft copy template saved in Word File and editable in Word Document.

This contains the sample terms, conditions, clauses, and provisions of the contract described.

See the Description below to view the Contents of this soft copy template.

This Agreement establishes the terms and conditions of the Flexible Work Arrangement on account of the COVID-19 outbreak.

It states the WHEREAS clauses providing for the premises providing the voluntary participation in the temporary program. Parties agree to follow the applicable guidelines and policies for the purpose of supporting the government drive on social distancing.

It contains the duration and remote place of work (work-from-home), terms and conditions, duties, obligations, and responsibilities, provisions on business exigencies, data protection, return of company assets, and temporary costs on the company.

This also includes agreement on data privacy and confidentiality, applicability of all other company policies, modification, and termination.

This template is drafted on an 8.5” x 13” Word format, containing four (4) pages, using Arial font 12.

-

Health Checklist & Workplace COVID-19 Protocol – Soft Copy Editable Template

0 out of 5₱500.00On April 30, 2020 the Department Trade and Industry (DTI) and the Department of Labor and Employment (DOLE) issued Interim Guidelines on Workplace Prevention and Control of COVID-19.

The guidelines require employers to implement Health checklists containing declarations of various information and the Workplace Screening Protocol.

Below are sample templates of the health checklist and Screening Protocol which are Editable in Word. Templates are available at only P500.00 to be sent via your email.

-

Guide to Valid Job Contracting & Sub Contracting

4.00 out of 5₱745.00Title: Guide to Valid Job Contracting & Sub Contracting

This work will enlighten contractors, principals and all parties involved in contracting the rules, doctrines and principles behind job contracting. Discussed in this book are rules on labor-only contracting, right to control, supervision, registration, licensing, payment of wages, contracting in construction industry, security service, among others. Laws and rules discussed are D.O. 18-A, Articles 106-109 of the Labor Code, as amended, D.O.19, Series of 1998, RA 5487 on security contracts and its implementing rules.

Employers and Companies will benefit from extensive discussion on various issues on job contracting.

Scroll down for more information

-

Guide To Valid Dismissal Of Employees (The HR Practitioner’s Handbook)

2.86 out of 5Title: Guide To Valid Dismissal Of Employees (The HR Practitioner’s Handbook)

The book by Atty. Elvin B. Villanueva provides a refreshing and analytical insight on the matter with a twist of Human Resource outlook. His works, the HR Guide Series, which includes the “Guide to Valid Dismissal of Employees” and the “Guide on Employee Compensation and Benefits,” provide a compelling lineup of various topics on labor and human resources.

Scroll down for more information

₱400.00₱320.00 -

Human Resource Forms, Notices and Contracts Vol. 1

2.49 out of 5₱499.75Title: Human Resource Forms, Notices & Contracts Made Easy

This book provides 157 samples of employment contracts (probationary, seasonal project and casual), notices to explain covering various offenses, actual notices of dismissal, suspension and warning, among others. All the sample templates are written in English.

The forms used on this book are very important for HR practitioners as they are the ones needed in communicating to employees the terms of employment and due process. They are important evidentiary documents as well in case disputes on dismissal, employment benefits and other matters involving employer-employee relationship reach the labor courts.

These sample forms were designed following the principles laid down in the Labor Code, as amended as well as recent labor jurisprudence. Important principles on just causes of dismissal, five-day notice rule on notice to explain, preventive suspension and the conduct of hearing/conference prior to dismissal are also discussed here.

This book will help HR practitioners in discharging their role as the hub for the maintenance of industrial peace and harmony. Not only that this will help avoid costly mistakes in the event of labor disputes but will also help express the policies and principles of company.

The English forms and templates contained in this book are listed below.

Scroll down for more information

Pages

I………. Introduction ……………………………………………………. 1

II……… Chapter I: Pre-hiring forms ………………………………. 3

A….. Sample Application Form …………………………. 5

B….. Sample Application Letter by Employee ……. 21

C….. Employment Checklist …………………………….. 23

III…….. Chapter II: Contracts at point of hiring …………….. 27

A….. Employment Contracts ……………………………. 27

B….. Contract for Probationary Employment ………. 45

C….. Contract for Regular Employment …………….. 69

D….. Contract for Casual Employment ………………. 75

E….. Contract for Project Employment ……………… 85

F….. Contract for Seasonal Employment …………… 96

G…. Contract for Fixed Term Employment ………. 105

H….. Contract for Part Time Employment ………… 113

I…… Transfer of Employees …………………………… 121

IV…….. Chapter III: Forms Used During Employment ….. 125

A….. Notices to Explain ………………………………… 129

Sample notices to explain (where imposable penalty is a warning) for the following offenses 131

i…… Violation of company policies on …………………… 132

1….. General Cleanliness ……………………………… 132

2….. Littering ………………………………………………. 133

3….. Smudging ……………………………………………. 134

4….. Disorderly Filing ……………………………………. 135

5….. Designated dining areas ………………………… 136

ii….. Attendance …………………………………………………. 138

1….. Unauthorized undertime ………………………… 138

2….. Violation of coffee break schedule ………….. 139

3….. Violation of lunch break schedule …………… 140

4….. Abandoning post ………………………………….. 141

iii…. Unauthorized absences ………………………………… 142

1….. Absence without leave (AWOL) ………………. 142

2….. Failure to give notice for sickness ……………. 144

iv…. Punctuality/Time-keeping …………………………….. 146

1….. Tardiness …………………………………………….. 146

2….. Failure to log-in ……………………………………. 148

3….. Failure to log-out ………………………………….. 149

v….. Knowingly punching timecard or logging in attendance for other employees 150

vi…. Unauthorized alteration made on one’s timecard or attendance sheet 151

vii… Unauthorized alteration made on other’s timecard with consent of such employee 153

viii.. Unauthorized alteration made on other’s timecard without the consent of such employee 154

ix…. Unauthorized removal of one’s timecard or attendance sheet 155

x….. Unauthorized removal of another’s timecard or attendance sheet 157

xi…. Unauthorized concealment of one’s timecard or attendance sheet 158

xii… Unauthorized concealment of another’s timecard or attendance sheet 159

xiii.. Intentional destruction of one’s timecard or attendance sheet 161

xiv… Intentional destruction of another’s timecard or attendance sheet 162

xv…. Dress Code ………………………………………………….. 164

1….. Without uniform ……………………………………. 164

a….. Reporting for work not in prescribed dress code 164

2….. With Uniform ………………………………………… 165

a….. Reporting for work not in prescribed uniform (barong or blouse) 165

b….. Reporting for work not in prescribed uniform (pants or skirt) 167

c….. Reporting for work not in prescribed uniform (blazer) 169

xvi… Identification card ……………………………………….. 171

1….. Failure to wear ID card ………………………….. 172

2….. Refusal to wear ID card ………………………….. 173

3….. Deliberate destruction of ID card …………….. 175

4….. Deliberate mutilation of ID card ……………… 176

5….. Alteration of entries in the ID card …………… 176

6….. Concealment of one’s ID card ………………… 177

7….. Concealment of another’s ID card …………… 179

8….. Unauthorized and improper use of ID card .. 180

xvii.. Loitering …………………………………………………….. 182

1….. Loitering in unrestricted area ………………….. 182

2….. Loitering in restricted area ……………………… 183

xviii. Insubordination ……………………………………………. 184

1….. Refusal to subject oneself to annual physical examinations 184

2….. Refusal to subject oneself to executive checkup 186

3….. Refusal to abide by auditing procedure ……. 187

4….. Refusal to abide by security and safety regulations 188

5….. Refusal to transfer to another assignment …. 190

6….. Refusal to perform one’s task …………………… 191

7….. Refusal to render overtime work ………………. 192

8….. Refusal to report for holiday work …………….. 194

9….. Refusal to issue disciplinary action to subordinate 195

10… Refusal to obey lawful orders of Superior ….. 196

11… Refusal to give information in a company investigation 198

Sample notices to explain (where imposable penalty is suspension) 199

i…… Attendance …………………………………………………. 202

1….. Unauthorized undertime ………………………… 202

2….. Knowingly punching timecard or logging in attendance for other employees 204

ii….. Insubordination ……………………………………………. 205

1….. Refusal to transfer to another assignment …. 205

iii…. Willful breach of trust (with mitigating circumstance) 207

1….. Misappropriation of fund ………………………… 207

Sample notice to explain (where imposable penalty is dismissal) 209

1….. Notice issued for abandonment of work ……. 211

2….. Notice issued for willful breach of trust …….. 214

Sample notice to explain (where imposable penalty is dismissal with preventive suspension) 216

1….. Notice to explain for Serious Misconduct with preventive suspension 211

2….. Notice to explain for offense involving Willful Breach of Trust 214

Sample notice of hearing/conference ………………………. 222

– Instances where hearing is not necessary ………. 224

– Tips in conducting the hearing/conference …… 225

1….. Hearing for offense involving Willful Breach of Trust 228

2….. Hearing for offense involving serious misconduct 229

B….. Notice imposing disciplinary action (warning) ….. 231

i…… Violation of company policies on …………………… 233

1….. General Cleanliness ……………………………… 233

2….. Littering ………………………………………………. 234

3….. Smudging ……………………………………………. 235

4….. Disorderly Filing ……………………………………. 237

5….. Designated dining areas ………………………… 238

ii….. Attendance …………………………………………………. 240

1….. Unauthorized undertime ………………………… 240

2….. Violation of coffee break schedule ………….. 241

3….. Violation of lunch break schedule …………… 243

4….. Abandoning post ………………………………….. 245

iii…. Unauthorized absences ………………………………… 246

1….. Absence without leave (AWOL) ………………. 246

2….. Failure to give notice for sickness ……………. 248

iv…. Punctuality/Time-keeping …………………………….. 251

1….. Tardiness …………………………………………….. 251

2….. Failure to log-in ……………………………………. 253

3….. Failure to log-out ………………………………….. 254

v….. Knowingly punching timecard or logging in attendance for other employees 255

vi…. Unauthorized alteration made on one’s timecard or attendance sheet 257

vii… Unauthorized alteration made on other’s timecard with consent of such employee 258

viii.. Unauthorized alteration made on other’s timecard without the consent of such employee 260

ix…. Unauthorized removal of one’s timecard or attendance sheet 262

x….. Unauthorized removal of another’s timecard or attendance sheet 263

xi…. Unauthorized concealment of one’s timecard or attendance sheet 265

xii… Unauthorized concealment of another’s timecard or attendance sheet 266

xiii.. Intentional destruction of one’s timecard or attendance sheet 268

xiv… Intentional destruction of another’s timecard or attendance sheet 269

xv…. Dress Code ………………………………………………….. 271

1….. Without uniform ……………………………………. 271

a….. Reporting for work not in prescribed dress code 271

2….. With Uniform ………………………………………… 272

a….. Reporting for work not in prescribed uniform (barong or blouse) 272

b….. Reporting for work not in prescribed uniform (pants or skirt) 274

c….. Reporting for work not in prescribed uniform (blazer) 277

xvi… Identification card ……………………………………….. 278

1….. Failure to wear ID card ………………………….. 278

2….. Refusal to wear ID card ………………………….. 280

3….. Deliberate destruction of ID card …………….. 281

4….. Deliberate mutilation of ID card ……………… 283

5….. Alteration of entries in the ID card …………… 285

6….. Concealment of one’s ID card ………………… 287

7….. Concealment of another’s ID card……………. 288

8….. Unauthorized and improper use of ID card .. 290

xvii.. Loitering …………………………………………………….. 293

1….. Loitering in unrestricted area ………………….. 293

2….. Loitering in restricted area ……………………… 294

xviii. Insubordination ……………………………………………. 296

1….. Refusal to subject oneself to annual physical examinations 297

2….. Refusal to subject oneself to executive checkup 298

3….. Refusal to abide by auditing procedure ……. 300

4….. Refusal to abide by security and safety regulations 301

5….. Refusal to transfer to another assignment …. 303

6….. Refusal to perform one’s task …………………… 305

7….. Refusal to render overtime work ………………. 307

8….. Refusal to report for holiday work …………….. 308

9….. Refusal to issue disciplinary action to subordinate 310

10….. Refusal to obey lawful orders of Superior ….. 312

11….. Refusal to give information in a company investigation 313

C….. Notice imposing disciplinary action (suspension). 315

i…… Attendance …………………………………………………. 315

1….. Unauthorized undertime ………………………… 315

2….. Knowingly punching timecard or logging in attendance for other employees 317

ii….. Insubordination ……………………………………………. 318

1….. Refusal to transfer to another assignment …. 318

iii…. Willful breach of trust (with mitigating circumstance) 320

1….. Misappropriation of funds ………………………. 321

D….. Notice of Dismissal ………………………………………. 324

i…… Notice of Dismissal for Abandonment ………. 324

ii….. Dismissal Notice for Serious Misconduct ….. 330

iii…. Dismissal Notice for Willful Breach of Trust.. 341

V….. Note on the next Volume/s of HR Forms, Notices and Contracts Made Easy 346

-

Probationary Employment Evaluation Packet Super 5™ – Soft Copy Editable Template

0 out of 5₱2,795.00How to Evaluate Probationary Employees Using the

Probationary Employment Evaluation Packet Super 5This is a soft copy template saved in Word File and editable in Word Document.

This contains the sample terms, conditions, clauses, and provisions of the contracts described and the forms included.

See the Description below to view the Contents of this soft copy template.

One of the challenging aspects of monitoring the performance of a probationary employee is the establishment of performance ratings, metrics, or measures.

It is a settled rule that a probationary employee who was not apprised of the reasonable standards of performance to become regular employee is deemed regular from day one.

The same effect occurs for employees who have been with the company for at least six months and have not undergone performance evaluation. No matter how low did the probationary employee perform if the employer did not rate him with reasonable standards terminating the worker for failure to qualify is extremely risky.Read more..

Thus, when dealing with probationary employees, the company should have:

- Reasonable standards

- Made known such standards at the time of engagement

- Performance measures

- Periodic evaluation

- Clear rating plan, form, and template

With the right tools, the life of the employer would be bearable and the risk minimized to manageable level.

It is indeed a nerve-wracking exercise to devise the reasonable standards from scratch. However, this is made easy by the new products of LVS Rich Publishing known as the Probationary Employment Evaluation Packet Super 5.

This new soft copy product provides the proposed standards required for probationary to perform to qualify as regular employee. There are metrics with ratings and weights. There is a sample evaluation form where the employee rates himself and his superior then an average of the two ratings is obtained.

The rating system covers Performance, Punctuality/Attendance, Behavior, Teamwork, and Initiative. The total weight is 100%. If the probationary receives an average weight below 75% in one month, it shall be deemed as failure to meet the standards which may be ground for dismissal based on failure to qualify. Of course the buyer of this product can change the weight and rates according to what is considered applicable and necessary.

Performance metrics representing 30% of the total weight is based on Business Knowledge, Output/Production, Resourcefulness, and Teamwork.

Punctuality/attendance is one of the tricky areas to measure. The template though considers this as already 100% of its weight. It is given 20% weight subject to deduction of 3% for every instance of tardiness and 4% for every instance of unauthorized absence.Behavior is another matter of the same level of difficulty. To rate this, it is already pegged at 20% subject to deduction for every citation or violation of company rules, such as:

- Written warning – less 2%

- Stern warning – less 5%

- Written reprimand – less 6%

- 1-day Suspension – less 7%

- Longer suspension – less 10%

As to Performance metrics, sample rating spread can be seen in the Performance Review Template Excel File under the “Performance Weights” Sheet.

The rating system provides the following:

Outstanding Performance (OP) – Highest performance rating Reserved for individuals who continually achieve outstanding results and utilize their abilities in making contributions beyond their primary areas of responsibility.

Commendable Performance (CP) – Performance is above the expected level for the position making contributions beyond expectations in completion of assignments.

Effective Performance (EP) – Performance consistently meets supervisory expectations of the position requirements in making a valuable contribution to the overall objectives of the Group.

Marginal Performance (MP) – Performance does not consistently meet normal expectations and position requirements, improvement is required.

Unacceptable Performance (UP) – Performance fails to meet normal expectations and position requirements. Termination should be considered unless improvement is demonstrated in a short period of time.The buyer can Print Sheet 1 of the Performance Review Template Excel File entitled “Proby Metrics” Sheet as form in Performance Review where ratings shall be filled in. This will be used to tally the evaluation results based on performance metrics.

The Evaluation Packet comes with the Evaluation Guidelines file in Word document that will guide the user on how the evaluate the probationary employee using this product.

To further make this exercise easy, a sample evaluation of probationary employee is provided just to give the user a complete picture of how it will be done.

Upon purchase, the following files will be sent to the buyer’s email account from LVS’ Gmail Account:

- Contract of Probationary Employment for Daily Paid Employee (in Word document file)

- Description of the Contract of Probationary Employment for Daily Paid Employee (in Word document file)

- Evaluation Guidelines – Template (in Word document file)

- Performance Review Template (in Excel File)

- Sample Probationary Evaluation Template (in Word document file)

close

-

Gabay sa mga Karapatan ng Overseas Filipino Worker (OFW)

2.42 out of 5₱395.00Title: Gabay sa mga Karapatan ng Overseas Filipino Worker (OFW)

Author: Atty. Elvin B. Villanueva

Publisher: Central Book Supply, Inc.

ISBN: 978-971-011-130-5

No. Of Pages: 185

Size: 6″x9″

Edition: First Edition, 2010

Size: 6″x9″

Binding: Softbound -

HR Forms, Notices and Contracts 2 Soft Copy Version (170+ Templates in Editable Word)

0 out of 5₱8,495.00HR Forms 2 Soft Copy is now available offering editable templates in Word Document of 170+ disciplinary forms, notices, policies and sample Code of Conduct (with graduated penalties).

Soft Copy Version (Word File only – Saved as Single File)

Alert!: If you were able to purchase any of our soft copy products in the past please double-check that they are not part of these templates. This product is indivisible and individual soft copy templates previously purchased cannot be deducted from the price.

The regular price of P5,495.00 includes free shipping.

Scroll Down to see the Table of Forms or list of Forms

Based on the book Human Resource Forms, Notices & Contracts Volume Two

Features:

- Editable in Word file (Saved as one file “HR Forms Volume 2 Soft Copy”)

- Fonts Used: Courier New, Arial Fonts

- With separate file showing instructions on How to Use and Navigate the HR Forms

- The product will be sent to Buyer’s Email Account given from LVS’ gmail account.

- Over 170 Sample Forms and Templates such as:

- Sample Notice to Explain for offenses falling under Serious Misconduct, Insubordination/Willful Disobedience, Fraud or Willful Breach of Trust, etc.:

Theft, AWOL, Abandonment of Work, Falsification, Fighting, Sexual Intercourse within Office Premises, Fraud, Falsification of Receipts, Non-Wearing of Uniform/ID, Assaulting a Superior, Libel, Use of Prohibited Drugs, Possession of Prohibited Drugs, Accessing Website During Office Hours, Downloading Pornographic Videos, Playing Computer Games, etc. - Sample Notice of Hearing/Conference for offenses falling under Serious Misconduct, Insubordination/Willful Disobedience, Fraud or Willful Breach of Trust, etc.:

Theft, AWOL, Abandonment of Work, Falsification, Fighting, Sexual Intercourse within Office Premises, Fraud, Falsification of Receipts, Non-Wearing of Uniform/ID, Assaulting a Superior, Libel, Use of Prohibited Drugs, Possession of Prohibited Drugs, Accessing Website During Office Hours, Downloading Pornographic Videos, Playing Computer Games, etc.

Read more..

- Sample Notice of Dismissal for offenses falling under Serious Misconduct, Insubordination/Willful Disobedience, Fraud or Willful Breach of Trust, etc.:

Theft, AWOL, Abandonment of Work, Falsification, Fighting, Sexual Intercourse within Office Premises, Fraud, Falsification of Receipts, Non-Wearing of Uniform/ID, Assaulting a Superior, Libel, Use of Prohibited Drugs, Possession of Prohibited Drugs, Accessing Website During Office Hours, Downloading Pornographic Videos, Playing Computer Games, etc. - Sample Notice of Retrenchment

- With Criteria

- Recall of notice

- Sample Notice of Redundancy

- Sample Notice of Termination Due to Installation of Labor Saving Device

- Sample Notice of Termination Due to Disease

- Sample CBA

- Sample Code of Conduct

- Sample Employee Handbook (containing clause on Expanded Maternity Leave)

- Many more!

close

Scroll down for more information (Table of Forms)

- Editable in Word file (Saved as one file “HR Forms Volume 2 Soft Copy”)