Hepatitis B Prevention and Control Policy

₱1,195.00

This template is in accordance with the with the provisions of Department Advisory No. 5, Series of 2010 of the Department of Labor and Employment mandating the institution of policies and programs on the prevention and control of Hepatitis B in the workplace.

Reminder!!! Buyer of any of the HR Bundle Products should CHECK if this product is already part of the HR bundle before proceeding to buy. Thank you!

This expresses the company’s adoption of the policies and programs on the prevention and control of Hepatitis B in the workplace.

The softcopy template is written in Word document using MS Office 365 version, Arial font, 12 font size, containing 4 pages of 8.5”x11” layout.

Read more..

In compliance with the DOLE issuance, this template provides the following:

- Statement of Legal Compliance

- Declaration of Corporate Policy on Hepatitis B Prevention and Control

- Purpose

- Implementing Structure

- Coverage

- Guidelines

– Preventive Strategies - Recording, Reporting and Setting Up of Database

- Social Policy

– Non-Discriminatory Policy and Practices - Work Accommodation Arrangement

- Roles and Responsibilities of Workers

close

Related Products

-

The Labor Code of the Philippines

0 out of 5₱948.00Title: The Labor Code of the Philippines

The Labor Code of the Philippines by Atty. Elvin B. Villanueva

Suggested Retail Price: P948.00

Scroll down for more information

-

Human Resource Forms, Notices and Contracts Vol. 2

2.90 out of 5₱845.00Title: Human Resource Forms, Notices & Contracts Made Easy Vol. 2

Procedures in labor law and social legislation are perilous terrain to navigate most especially to new practitioners in the field of employee relations. Reading and under-standing the provisions of law may not be enough since the actual implementation of the legal requirements will make or break any management decision.

It takes a combination of legal knowledge and experience in the field to safely execute the functions in employee relations. Thus, authors in this work discuss not only the legal principles in labor law but also share useful or practical forms to use in various situations.

By showing the forms to use, the practitioner is enlightened on the purpose and principles behind relevant labor law provisions. The risk involved in executing the management decision may be reduced once the principles and applications are put proper use.

Scroll down for more information

-

Guide on Employee Compensation and Benefits Vol. 1, Second Edition

0 out of 5₱1,198.00This book is the 2nd edition of one of ATTY. ELVIN B. VILLANUEVA’s best selling titles Guide on Employee Compensation and Benefits Volume 1. HR Practitioners, both new and veterans will find this work useful in understanding and keeping up with the latest rules, doctrines and principles on labor standards.

The subject matter of compensation and benefits is among the edgy topics which most HR practitioners, business managers, and even owners find challenging. As always, anything that deals with human psychology on pay, rewards, motivation, and equity requires full attention and creative solution.

Read more..

This work discusses the labor standards most particularly the exceptive rules where most practitioners are often blindsided. The rules and doctrines are tackled with illustrations and sample computations. Presentation of pay computations proceeds from the ordinary day, regular holiday, special day, and rest day or a combination of both holidays and rest days. These affects the daily rate, overtime, and nightshift differential.

There are relevant Supreme Court decisions where the high court interprets crucial areas of compensation. Rules on successive regular holidays are shown with example. Also, illustrative cases for overtime and nightshift differential are shown using different hours worked such as 2-hour, 4-hour, or even 8-hour OT and nightshift with computations when these coincide or concur on the same day.

The author also delineates the impact of benefits when the clock strikes 12:00 midnight such as on overtime, holiday pay, etc. This is particularly crucial for those with call center operations. Also discussed are company-initiated benefits rule, management prerogative to require overtime work, rule on travel time, brownout and other time-related issues.

New laws and rules are correlated with existing ones in the Labor Code such as the lactation period, primer on expanded maternity leave law (with sample salary differential computation), DO 178 and DO 184 on breaks mandated for employees who need to stand or sit for too long at work and the telecommuting act which affects the hours of work depending on the arrangement between the employer and employee.At the end of the day, compensation and benefits is an interesting area of HR/Labor practice. The key to harmony is understanding of the rules and it starts with acquisition of knowledge.

close

Scroll down for more information

-

Guide on Employee Compensation and Benefits Vol. 2

2.49 out of 5₱475.00Title: Guide on Employee Compensation and Benefits Vol. 2

Just how much should the company give as bonus? Just how many months of bonus should the company give without violating the law? If the company pays Christmas Bonus is it still required to pay 13th month pay? How about 14th and 15th month pay, should the company pay them also?

These are some of the perplexing questions that a typical HR practitioner encounters in his work. Most often, it is resolved in favor of the employees resulting in increased manpower cost on the part of the company.

The rules on 13th month pay and Christmas Bonus are discussed in this book. When to pay them and when not to are explained using the law and jurisprudence. Companies are not required to pay 14th, 15th month pay, and so forth, unless they are stipulated already in the CBA or any contract for that matter. But they are not legally mandated benefits.

How about productivity incentive bonuses, signing bonus, etc.? This book also offers explanation why some should be paid and the rest should not be.

Then comes the issue on leaves. Question like is there such thing as vacation leave in the Labor Code? Why can’t I find it? There is none because the Labor Code only provides for service incentive leave. There are other leave benefits discussed in this work like paternal, paternity and for women who are victims of violence.

This book also deals with issues on

- employee cash bonds, deposits

- authorized deductions

- the rules on employee compensation for disability, sickness, etc.

Scroll down for more information

-

Ring-Bound: Digest on Critical Supreme Court Decisions on Labor Cases 2016 Cases

0 out of 5₱745.00- Binding: Ring-bound

- Paper size: 8.5” x 13”

- Colored Front Cover with Plastic protection

- Inside: White bond paper with black text

- No. of pages: Approximately 170

- Retail Price: P745.00

ABOUT THE RING-BOUND EDITION

Digest of Critical Supreme Court Decisions on Labor Cases is an ambitious work to provide readers, HR practitioners, lawyers, and law students with crucial information on the Supreme Court decisions in labor cases. The digested cases are handy in tracking the recent rulings which are crucial in policy formulation in labor and employee relations. They are critical in a sense that the changes affect the labor environment and those not in the know may bear the adverse consequences.Read more..

Labor law is like a living organism that changes as time passes by. The employer who is more cognizant of the changes can adapt effectively. The presentation is indexed for easy reference. The book provides a digest of the recent decisions of the Supreme Court in labor such as cases on Retirement, Refusal to retire, Retirement plan vs. Labor Code Redundancy, Redundancy carried out by persons belonging to related companies, Labor claims against related companies, Employment contract, Audited financial statement (AFS) and Judicial notice of losses, Rehiring of some of the retrenched employees, Rehabilitation; and Quitclaim. This Year 2016 Digest covers SC Decisions on Strike; Notice of strike; Illegal strike; Valid dismissal; Employment status deemed lost; Transfer; Promotion; Resignation; force; threat; intimidation; coercion; release; waiver; quitclaim; Res judicata; Conclusiveness of judgment; Certification election; Illegal dismissal; Job contracting; Labor-only contracting; Labor-only contractor; Presumed labor-only contractor; Fixed-term; Fixed-term employment; Independent contractor; Repeated renewal; etc.

close

Scroll down for more information

-

Batas Kasambahay

0 out of 5₱390.00Title: Batas Kasambahay

Batas Kasambahay or Republic Act 10361 is a milestone legislation for Kasambahays all over the country. This by far has offered strong protection and more benefits for covered workers.

Salient provisions discussed in the book are new minimum wage, 5-day service incentive leave benefit, SSS, Philhealth and Pag-ibig coverage, payroll retention of 3 years, communication rules, grounds for termination, rescue, deployment expenses and debt bondage.

The book likewise provides Filipino excerpts on certain concepts for terms that are best expressed in our language. For those who initially read the draft of the book found the contents very useful. In fact, it can serve as handy reference for every household since topics are easy to read, well explained and the format is conducive to easy reading.

Scroll down for more information

-

Employment Contracts Templates Soft Copy (English and Filipino/Tagalog)

0 out of 5EMPLOYMENT CONTRACTS TEMPLATES DESCRIPTION

Employment contracts in the Philippines should be crafted in accordance with rules to ensure compliance with legal requirements.

This is saved in a single file in Word (Arial Font using sizes 12, 14, and 20). Buyers will receive the file through email from LVS’ gmail account. There will be price increase for this product soon.

Alert!: If you were able to purchase any of our soft copy products in the past please double-check that they are not part of these templates. This product is indivisible and individual soft copy templates previously purchased cannot be deducted from the price.

This product, Employment Contracts Templates (English and Filipino), contains 40+ samples or templates of various employment contracts used in the Philippines such as:

- Probationary

- Regular

- Casual

- Project

- Seasonal

- Fixed-Term or Fixed-Period, and

- Part-Time

Read more..

Some sample templates contain show formats that incorporate provisions on:

- Data Privacy Consent Clause

- Discipline

- Reference to Job Description

- Benefits

- Place of Work

- Shift

- Performance Metrics

- Decorum/Uniform

- Shift, etc.

close

Scroll down for more information

₱3,995.00₱3,900.00 -

Gabay sa mga Karapatan ng Overseas Filipino Worker (OFW)

2.42 out of 5₱395.00Title: Gabay sa mga Karapatan ng Overseas Filipino Worker (OFW)

Author: Atty. Elvin B. Villanueva

Publisher: Central Book Supply, Inc.

ISBN: 978-971-011-130-5

No. Of Pages: 185

Size: 6″x9″

Edition: First Edition, 2010

Size: 6″x9″

Binding: Softbound -

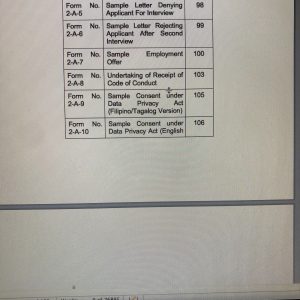

HR Forms, Notices and Contracts 1 Soft Copy Version (150+ Templates in Editable Word)

0 out of 5₱8,495.00Forms, Notices and Contracts

Soft Copy Version (Word File only – Saved as Single File)Alert!: If you were able to purchase any of our soft copy products in the past please double-check that they are not part of these templates. This product is indivisible and individual soft copy templates previously purchased cannot be deducted from the price.

Scroll Down to see the Table of Forms or list of Forms

Read more..

Based on the book Human Resource Forms, Notices & Contracts Volume One

Features:

- Editable in Word file (Saved as one file “HR Forms Volume 1 Soft Copy”)

- Fonts Used: Arial, Book Antiqua, Garamond

- With separate file showing instructions on How to Use and Navigate the HR Forms

- Product will be sent to Buyer’s Email Account from LVS’ gmail account.

- Over 150 Sample Forms such as:

- Employment Contracts (some with Data Privacy Consent Clause)

Regular

Probationary

Casual

Seasonal

Fixed-Term

Part-Time - Consent under Data Privacy Act

- DOLE Mandatory Policies

- Drug-Free Workplace

- HIV/AIDS

- Hepatitis B

- Tuberculosis

- Anti-Sexual Harassment

- Acknowledgment Receipt of Personal Protective Equipment (PPE)

- Authority to Deduct (Debt)

- Notices to Explain

- Notices of Hearing/Conference

- Notice of Suspension

- Preventive Suspension

- Extension of Preventive Suspension

- Termination Notice

- Extension of Preventive Suspension

- Application Form

- Employment checklist, etc.

- Acceptance of Resignation

- Acceptance of Resignation with Pending Case (Graceful Exit)

- Clearance Form

- Release, Waiver and Quitclaim

- Many more!

close

Scroll down for more information (Table of Forms)

- Editable in Word file (Saved as one file “HR Forms Volume 1 Soft Copy”)

-

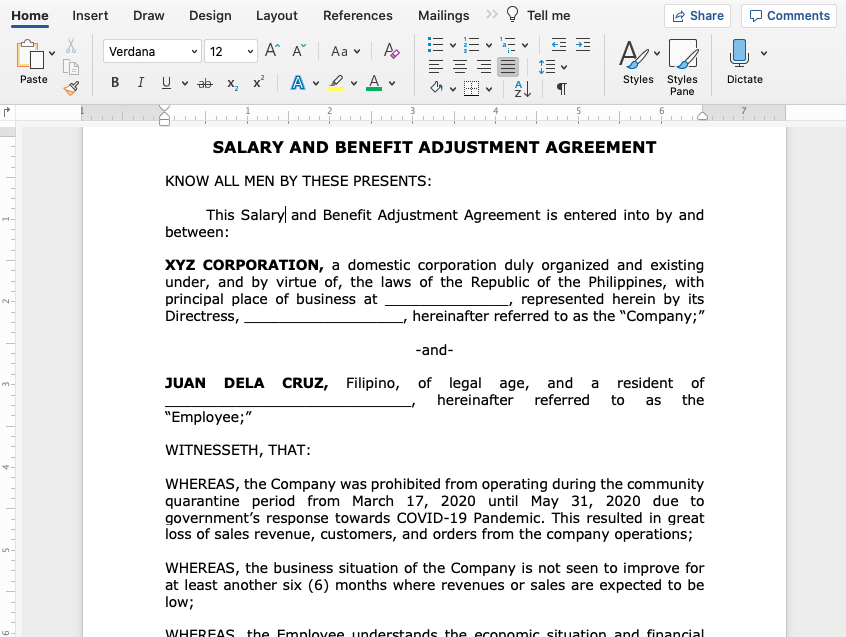

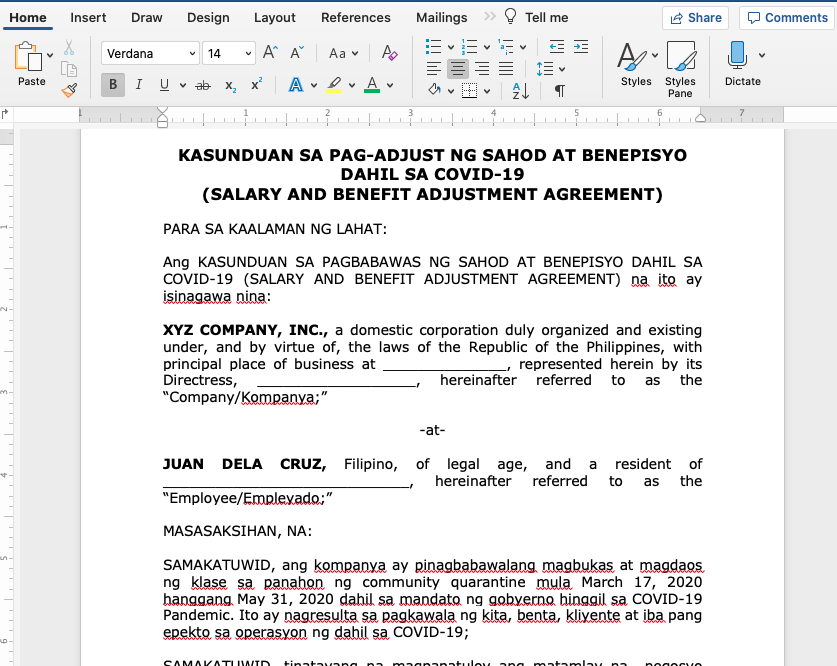

Salary & Benefit Adjustment Agreement (in Filipino / English) – Soft Copy Editable Template

₱750.000 out of 5