Health Checklist & Workplace COVID-19 Protocol – Soft Copy Editable Template

₱500.00

On April 30, 2020 the Department Trade and Industry (DTI) and the Department of Labor and Employment (DOLE) issued Interim Guidelines on Workplace Prevention and Control of COVID-19.

The guidelines require employers to implement Health checklists containing declarations of various information and the Workplace Screening Protocol.

Below are sample templates of the health checklist and Screening Protocol which are Editable in Word. Templates are available at only P500.00 to be sent via your email.

Related Products

-

Tax Solutions on Employee Compensation and Benefits, 2nd Edition 2019

0 out of 5₱998.00Tax Solutions on Employee Compensation and Benefits, 2nd Edition, presents the changes on compensation income tax under R.A. 10963 or the TRAIN Law. The rates and withholding rules have changed after the passage of the law with the new withholding tax tables. The book however, addresses the main challenge for employers which is saving on tax while maximizing the take home of employees.

This work tackles this matter with the presentation of options to minimize tax implications. The revenue regulation, RR 8-2018 implements the TRAIN Law and is discussed in this work in a manner designed for understanding.

RR 11-2018 was also issued by the BIR which primarily deals with the changes on withholding rules. The author provides several sample computations and illustrations

of important concepts like exemption of compensation income of minimum wage earners. Tax on income beyond the non-taxable limit of P20,833 per month. Exclusions from substituted filing rules, among others. The preferential tax treatment of alien employees has been removed.Read more..

The TRAIN Law likewise increases the ceiling for the 13 th month pay and other benefits from the previous P82,000.00 to P90,000.00. This is another useful item to maximize the grant of benefits with minimal tax impact.

De Minimis Benefits are discussed in a comprehensive manner focusing on its availability for tax savings. The list has been updated and some amounts have been increased like that of rice subsidy, medical allowance for dependents, and uniform and clothing allowance.

Fringe benefits are also discussed in combination with all the other benefits granted by the new law and regulations. It is now at 35% which is an increase from the former 32%. The rules on computation of grossed-up monetary value, value of the benefits, and tax accounting rules of the benefits are detailed with examples.

HR and compensation and benefits practitioner as well as managers and business owners will appreciate the exposition of the rules, doctrines and principles under the new tax system.

close

Scroll down for more information

-

HR Bundle – Print Books

0 out of 5The HR Bundle offers excellent tools for learning about HR/Labor rules, doctrines and principles in various books written by Atty. Elvin B. Villanueva. Each book in the bundle provides unique content dealing with particular labor/HR topic.

HR Bundle comes with a 5% discount. Shipping is free.

Scroll down for more information

₱7,223.00₱6,861.85 -

Guide on Employee Compensation and Benefits Vol. 2, 2nd Ed.

2.55 out of 5₱595.00Title: Guide on Employee Compensation and Benefits Vol. 2 Second Edition

Guide on Employee Compensation and Benefits, Second Edition 2015 contains important discussion on 13 th month pay, 14 th month pay, Christmas and other bonuses. It also contains current information on rules on payment of wages, withholding of wages, wage deductions, employment bonds, as well as employee compensation on account of disability, injuries and death, among others. Also incorporated in this edition are recent decisions of the Supreme Court on the 13th month pay, bonuses, allowances and payment of wages. This edition presents newly promulgated rules and regulations on the above topics.

This book will prove helpful to all HR practitioners and professionals on employee or labor relations to achieve industrial harmony and productivity.

Scroll down for more information

-

Employment Contracts Templates Soft Copy (English and Filipino/Tagalog)

0 out of 5EMPLOYMENT CONTRACTS TEMPLATES DESCRIPTION

Employment contracts in the Philippines should be crafted in accordance with rules to ensure compliance with legal requirements.

This is saved in a single file in Word (Arial Font using sizes 12, 14, and 20). Buyers will receive the file through email from LVS’ gmail account. There will be price increase for this product soon.

Alert!: If you were able to purchase any of our soft copy products in the past please double-check that they are not part of these templates. This product is indivisible and individual soft copy templates previously purchased cannot be deducted from the price.

This product, Employment Contracts Templates (English and Filipino), contains 40+ samples or templates of various employment contracts used in the Philippines such as:

- Probationary

- Regular

- Casual

- Project

- Seasonal

- Fixed-Term or Fixed-Period, and

- Part-Time

Read more..

Some sample templates contain show formats that incorporate provisions on:

- Data Privacy Consent Clause

- Discipline

- Reference to Job Description

- Benefits

- Place of Work

- Shift

- Performance Metrics

- Decorum/Uniform

- Shift, etc.

close

Scroll down for more information

₱3,995.00₱3,900.00 -

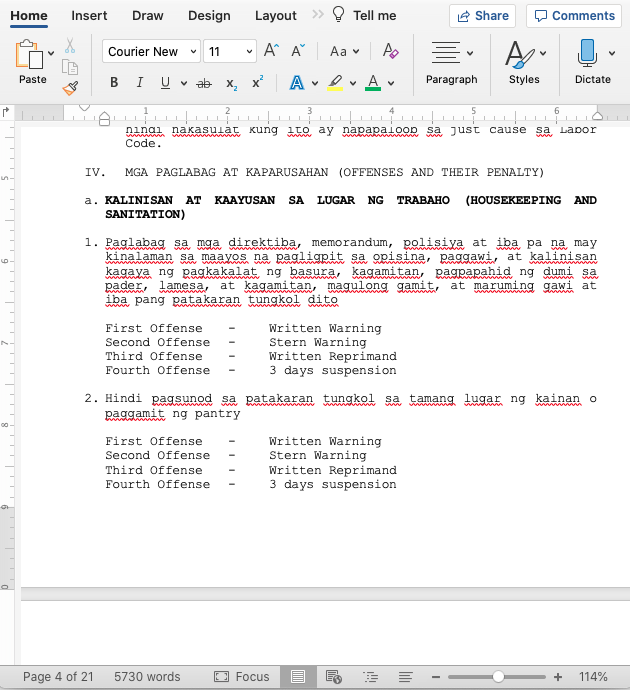

Sample Code of Conduct (in Filipino / Tagalog Version) – Soft Copy Editable Template

0 out of 5₱3,895.00This product captures the disciplinary process, procedure, and policies that companies usually need in an easy to edit format. The soft copy template is written in Word document making it editable in similar platform in Filipino / Tagalog.

The Code of Conduct template contains 21 pages, in 8.5” x 11” page layout, portrait orientation, using Courier New font, size 11.

It contains statement of disciplinary policy, disciplinary process and standards, Definition of Terms, and the list of offenses and their penalties.

Read more..

The following are the offenses contained in the template:MGA ALITUNTUNIN AT PATAKARAN SA PAGDIDISIPLINA

I. Mga Kahulugan ng Terminolohiya:

Written Warning

Stern Warning

Reprimand

Suspension

Dismissal

Preventive Suspension

First Offense

Second Offense

Third Offense

Fourth Offense

Opisina o kompanya

II. DISCIPLINARY POLICY (MGA POLISIYA SA DISIPLINA)

III. PAMAMARAAN SA PAGPATAW NG DISIPLINA (DISCIPLINARY PROCEDURE)

IV. MGA PAGLABAG AT KAPARUSAHAN (OFFENSES AND THEIR PENALTY)

a. KALINISAN AT KAAYUSAN SA LUGAR NG TRABAHO (HOUSEKEEPING AND SANITATION)

b. ORAS NG PAGPASOK SA TRABAHO (ATTENDANCE)

c. MGA HINDI AWTORISADONG PAGLIBAN SA TRABAHO (UNAUTHORIZED ABSENCES)

d. PAGPASOK SA TAMANG ORAS (PUNCTUALITY)

e. PATAKARAN TUNGKOL SA PAGSUOT NG UNIPORME (WEARING OF UNIFORM)

f. MGA PAGLABAG TUNGKOL SA ID O IDENTIFICATION CARD (OFFENSES INVOLVING IDENFICATION CARD)

g. MGA ASAL SA TRABAHO (WORK BEHAVIOR)

h. MGA PINAGBABAWAL NA GAWAIN (PROHIBITED ACTIVITIES)

i. MGA HINDI KANAIS-NAIS NA PAG-UUGALI NA TINUTURING NA SERYOSONG PAGLABAG(SERIOUS MISBEHAVIOR)

j. PAGSASABOTAHE, PANINIKTIK AT PAGLABAG SA MGA SIKRETONG PANG NEGOSYO NG KOMPANYA

k. PAGLABAG SA MGA PATAKARAN UKOL SA SEGURIDAD AT KALIGTASAN

l. HINDI MAGANDANG ASAL AT PAG-UUGALI (DISORDERLY CONDUCT)

m. PAGSIRA NG TIWALA (BETRAYAL OF TRUST)

n. KAPABAYAAN SA TRABAHO O NEGLECT OF DUTY

o. SEXUAL HARASSMENT

p. PAULIT-ULIT NA MGA PAGLABAG NG MGA PATAKARAN (HABITUAL VIOLATIONS)

close

-

Employee Leave Benefits

2.57 out of 5₱99.75Title: Employee Leave Benefits

Relatively new laws have been passed such as the ten (10)-day VAW-C leave for victims of violence and the recently enacted two (2)-month gynecological leave.

The author explain these benefits in interesting fashion and easy-to- read format. Likewise, he discusses important issues on Paternity. Solo Parent’s and Service Incentive Leave Benefits, among others.

Scroll down for more information

-

Tax Solutions

2.49 out of 5₱748.00Title: Tax Solutions on Employee Compensation and Benefits

Tax Solutions on Employee Compensation & Benefits is a revelation for HR practitioners and compensation and benefits practitioners when it comes to taxation on employee pay.

The book shares several practical examples on computation of the benefits, compensation and other pay given to employee. The reader is guided on the intricacies of tax concepts and principles through simple discussion and examples.

Surely, this work can be helpful a tool for HR and comp-ben practitioners in understanding employment tax concepts so employees can clearly understand how taxes impact on their pay.

Scroll down for more information

-

Guide To Valid Dismissal Of Employees (The HR Practitioner’s Handbook)

2.86 out of 5Title: Guide To Valid Dismissal Of Employees (The HR Practitioner’s Handbook)

The book by Atty. Elvin B. Villanueva provides a refreshing and analytical insight on the matter with a twist of Human Resource outlook. His works, the HR Guide Series, which includes the “Guide to Valid Dismissal of Employees” and the “Guide on Employee Compensation and Benefits,” provide a compelling lineup of various topics on labor and human resources.

Scroll down for more information

₱400.00₱320.00 -

The Labor Code of the Philippines

0 out of 5₱948.00Title: The Labor Code of the Philippines

The Labor Code of the Philippines by Atty. Elvin B. Villanueva

Suggested Retail Price: P948.00

Scroll down for more information

-

Guide on Wage Order and Minimum Wage

2.43 out of 5₱370.00Title: Guide on Wage Order and Minimum Wage

This work provides a comprehensive discussion on wage orders with regard to the mechanics of issuance, coverage and resolution of certain issues like the wage distortion.

Scroll down for more information