Sample Termination of probationary employment

₱1,750.00

The template provided will assist employers / companies in properly and validly executing the termination of probationary employees. (Note: There is a sample Notice of Termination for Failure to Qualify / of Probationary Employee below this guide)

Termination of probationary employment is a technical matter under the Philippine law. There are specific rules applicable only to probationary employees which if confused with all others may cause issues to the employer or the company.

Under Art. 296 of the Labor Code, as amended, a probationary employment shall not exceed six (6) months from the date the employee started working, unless it is covered by an apprenticeship agreement stipulating a longer period. The services of an employee who has been engaged on a probationary basis may be terminated for a just cause or when he fails to qualify as a regular employee in accordance with reasonable standards made known by the employer to the employee at the time of his engagement. An employee who is allowed to work after a probationary period shall be considered a regular employee.

Read more..

Section 6 (d) of the Implementing Rules of Book VI, Rule I of the Labor Code provides that there is probationary employment where the employee, upon his engagement, is made to undergo a trial period during which the employer determines his fitness to qualify for regular employment based on reasonable standards made known to him at the time of engagement.

In the case of Agustin vs. Alphaland Corporation, [G.R. No. 218282, September 09, 2020] the Supreme Court (SC) held that in all cases of probationary employment, the employer shall make known to the employee the standards under which he will qualify as a regular employee at the time of his engagement. Where no standards are made known to the employee at that time, he shall be deemed a regular employee.

Hence, to safely terminate a probationary employee, there has to be a probationary employment contract where it is clearly stated that the employer / company has made known to the employee the standards under which he will qualify as a regular employee at the time of his engagement. Further, that failure on his part to meet such standards, the employment shall be terminated for failure to qualify.

Reasonable standards shall refer to those measures which the employer will use as basis for qualification. These may include standards on performance, behavior, cooperation, punctuality, etc.

Assuming that these standards are present and there are valid stipulations in the Contract for Probationary Employment, the sample Notice of Termination for Failure to Qualify (template) will serve the purpose

close

Related Products

-

Digest of Critical Decisions of the Supreme Court on Labor Cases

0 out of 5₱1,485.00Title: Digest of Critical Decisions of the Supreme on Labor Cases

(YEARS 2015, 2016, 2017 & 2018 Decisions)- Just cause for dismissal: Two steps process on Immorality; Totality of infraction principle;

- Procedural: Reglementary period to appeal; supersedeas bond; computation of backwages; finality of award

- OFW (Permanent disability; 120 day rule; 240 day rule; Krestel Ruling; InterOrient Shipping Doctrine; Lex loci contractus; forum non conveniens)

Scroll down for more information

-

Solutions on Wage Order and Minimum Wage 2nd Ed.

2.79 out of 5₱525.00Title: Solutions and Remedies on Wage Order and Minimum Wage

The book is designed as easy reference for HR Practitioners, Business Owners, Managers, and Expats who deal with Filipino labor.

Philippine law requires compliance by employers with minimum wages and benefits. It is simplistic to see this as mere implementation of labor rules. It is often more complicated than it seems.

This work guides readers on proper perspective, and practical knowledge in the tortuous highway of labor compliance. The discussion is served in no-frills platter as topics are presented in direct fashion and clear explanation.

This edition features Wage Order No. NCR-20 in the NCR. The book provides highlights on regional minimum wage, nature of wage order, wage or special group of workers (handicapped, paid by results, etc.), coverage and exemptions, CTPA, BMBE rules, wage distortion and how to correct it, salaries above minimum (creditable rule), across-the-board increases, and other interesting and important concepts.

This work can be a good tool in understanding the principles and doctrines in wage orders, irrespective of the rates applicable.

Scroll down for more information

-

Digest of SC Decision on Labor 2017 Ring-Bound version

0 out of 5₱845.00This ring-bound edition of the Digest of the Critical Supreme Court (SC) Decisions on Labor Cases Year 2017 is an essential tool for HR/Labor Practitioners, HR Managers, Business Owners, and even law students in achieving a quick grasp of the critical decisions of the SC on certain labor cases.

The product is printed in 8.5” x 13” paper, ring-bound, with plastic front and support paper at the back. Introductory price is only P845.00 which will run for a limited period.

The digested cases are presented showing the facts, the ruling of the labor tribunals (Labor Arbiter [LA], National Labor Relations Commission [NLRC], or other adjudicatory bodies of the DOLE, Court of Appeals [CA], and the Supreme Court [SC]).

Scroll down for more information

-

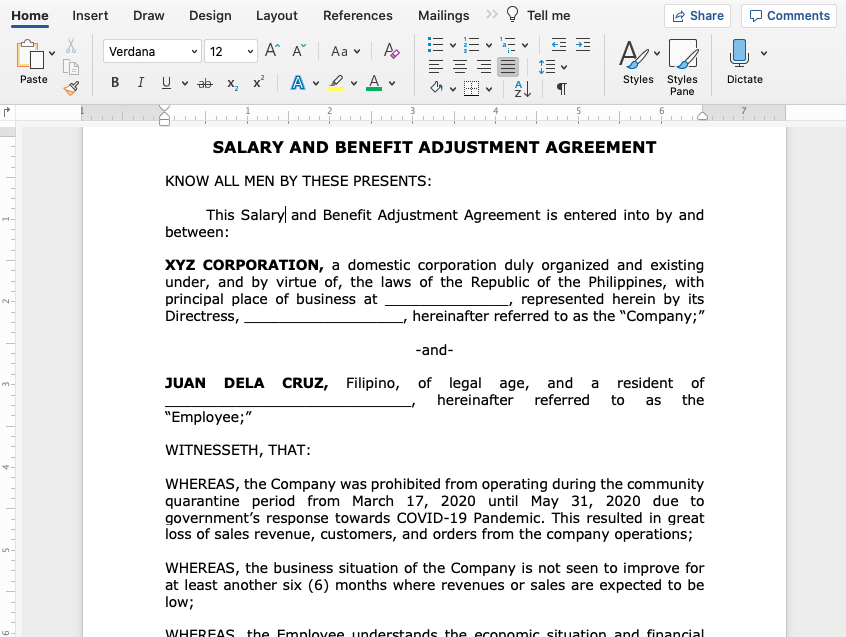

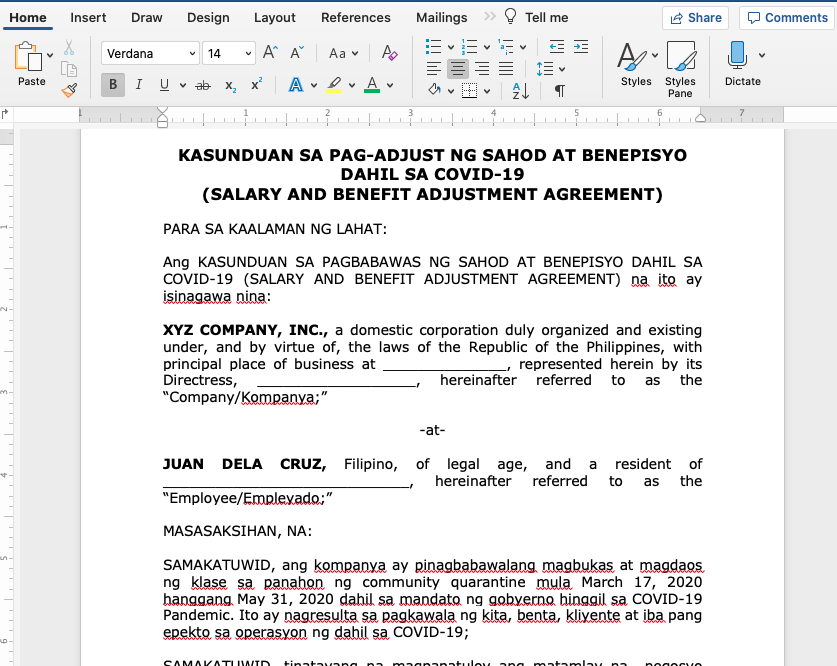

Salary & Benefit Adjustment Agreement (in Filipino / English) – Soft Copy Editable Template

₱750.000 out of 5 -

Guide To Valid Dismissal Of Employees (The HR Practitioner’s Handbook)

2.86 out of 5Title: Guide To Valid Dismissal Of Employees (The HR Practitioner’s Handbook)

The book by Atty. Elvin B. Villanueva provides a refreshing and analytical insight on the matter with a twist of Human Resource outlook. His works, the HR Guide Series, which includes the “Guide to Valid Dismissal of Employees” and the “Guide on Employee Compensation and Benefits,” provide a compelling lineup of various topics on labor and human resources.

Scroll down for more information

₱400.00₱320.00 -

Employee Transfer & Demotion

2.61 out of 5₱347.00Title: Employee Transfer and Demotion

The book provides updated answers to the most pressing questions on employee transfer and demotion. This is must-have for employers who would want to make the right decision and avoid or minimize labor disputes.

This work will guide the practitioners and business owners in navigating the treacherous terrain of transfer and demotion. Questions regarding timing of transfer, acts to avoid, lateral position, location, and rank are concisely discussed in this work. The dos and don’ts in demotion are also clearly and completed explain.

The concepts are easy to understand making this book an important arsenal in every HR practitioner or business owner’s library.

Scroll down for more information

-

Probationary Employment Evaluation Packet Super 5™ – Soft Copy Editable Template

0 out of 5₱2,795.00How to Evaluate Probationary Employees Using the

Probationary Employment Evaluation Packet Super 5This is a soft copy template saved in Word File and editable in Word Document.

This contains the sample terms, conditions, clauses, and provisions of the contracts described and the forms included.

See the Description below to view the Contents of this soft copy template.

One of the challenging aspects of monitoring the performance of a probationary employee is the establishment of performance ratings, metrics, or measures.

It is a settled rule that a probationary employee who was not apprised of the reasonable standards of performance to become regular employee is deemed regular from day one.

The same effect occurs for employees who have been with the company for at least six months and have not undergone performance evaluation. No matter how low did the probationary employee perform if the employer did not rate him with reasonable standards terminating the worker for failure to qualify is extremely risky.Read more..

Thus, when dealing with probationary employees, the company should have:

- Reasonable standards

- Made known such standards at the time of engagement

- Performance measures

- Periodic evaluation

- Clear rating plan, form, and template

With the right tools, the life of the employer would be bearable and the risk minimized to manageable level.

It is indeed a nerve-wracking exercise to devise the reasonable standards from scratch. However, this is made easy by the new products of LVS Rich Publishing known as the Probationary Employment Evaluation Packet Super 5.

This new soft copy product provides the proposed standards required for probationary to perform to qualify as regular employee. There are metrics with ratings and weights. There is a sample evaluation form where the employee rates himself and his superior then an average of the two ratings is obtained.

The rating system covers Performance, Punctuality/Attendance, Behavior, Teamwork, and Initiative. The total weight is 100%. If the probationary receives an average weight below 75% in one month, it shall be deemed as failure to meet the standards which may be ground for dismissal based on failure to qualify. Of course the buyer of this product can change the weight and rates according to what is considered applicable and necessary.

Performance metrics representing 30% of the total weight is based on Business Knowledge, Output/Production, Resourcefulness, and Teamwork.

Punctuality/attendance is one of the tricky areas to measure. The template though considers this as already 100% of its weight. It is given 20% weight subject to deduction of 3% for every instance of tardiness and 4% for every instance of unauthorized absence.Behavior is another matter of the same level of difficulty. To rate this, it is already pegged at 20% subject to deduction for every citation or violation of company rules, such as:

- Written warning – less 2%

- Stern warning – less 5%

- Written reprimand – less 6%

- 1-day Suspension – less 7%

- Longer suspension – less 10%

As to Performance metrics, sample rating spread can be seen in the Performance Review Template Excel File under the “Performance Weights” Sheet.

The rating system provides the following:

Outstanding Performance (OP) – Highest performance rating Reserved for individuals who continually achieve outstanding results and utilize their abilities in making contributions beyond their primary areas of responsibility.

Commendable Performance (CP) – Performance is above the expected level for the position making contributions beyond expectations in completion of assignments.

Effective Performance (EP) – Performance consistently meets supervisory expectations of the position requirements in making a valuable contribution to the overall objectives of the Group.

Marginal Performance (MP) – Performance does not consistently meet normal expectations and position requirements, improvement is required.

Unacceptable Performance (UP) – Performance fails to meet normal expectations and position requirements. Termination should be considered unless improvement is demonstrated in a short period of time.The buyer can Print Sheet 1 of the Performance Review Template Excel File entitled “Proby Metrics” Sheet as form in Performance Review where ratings shall be filled in. This will be used to tally the evaluation results based on performance metrics.

The Evaluation Packet comes with the Evaluation Guidelines file in Word document that will guide the user on how the evaluate the probationary employee using this product.

To further make this exercise easy, a sample evaluation of probationary employee is provided just to give the user a complete picture of how it will be done.

Upon purchase, the following files will be sent to the buyer’s email account from LVS’ Gmail Account:

- Contract of Probationary Employment for Daily Paid Employee (in Word document file)

- Description of the Contract of Probationary Employment for Daily Paid Employee (in Word document file)

- Evaluation Guidelines – Template (in Word document file)

- Performance Review Template (in Excel File)

- Sample Probationary Evaluation Template (in Word document file)

close

-

Temporary Flexible Work Arrangement Template – Work from Home – Soft Copy Editable Template

0 out of 5₱500.00TEMPORARY FLEXIBLE WORK AGREEMENT DESCRIPTION

This is a soft copy template saved in Word File and editable in Word Document.

This contains the sample terms, conditions, clauses, and provisions of the contract described.

See the Description below to view the Contents of this soft copy template.

This Agreement establishes the terms and conditions of the Flexible Work Arrangement on account of the COVID-19 outbreak.

It states the WHEREAS clauses providing for the premises providing the voluntary participation in the temporary program. Parties agree to follow the applicable guidelines and policies for the purpose of supporting the government drive on social distancing.

It contains the duration and remote place of work (work-from-home), terms and conditions, duties, obligations, and responsibilities, provisions on business exigencies, data protection, return of company assets, and temporary costs on the company.

This also includes agreement on data privacy and confidentiality, applicability of all other company policies, modification, and termination.

This template is drafted on an 8.5” x 13” Word format, containing four (4) pages, using Arial font 12.

-

Batas Kasambahay

0 out of 5₱390.00Title: Batas Kasambahay

Batas Kasambahay or Republic Act 10361 is a milestone legislation for Kasambahays all over the country. This by far has offered strong protection and more benefits for covered workers.

Salient provisions discussed in the book are new minimum wage, 5-day service incentive leave benefit, SSS, Philhealth and Pag-ibig coverage, payroll retention of 3 years, communication rules, grounds for termination, rescue, deployment expenses and debt bondage.

The book likewise provides Filipino excerpts on certain concepts for terms that are best expressed in our language. For those who initially read the draft of the book found the contents very useful. In fact, it can serve as handy reference for every household since topics are easy to read, well explained and the format is conducive to easy reading.

Scroll down for more information

-

Tax Solutions on Employee Compensation and Benefits, 2nd Edition 2019

0 out of 5₱998.00Tax Solutions on Employee Compensation and Benefits, 2nd Edition, presents the changes on compensation income tax under R.A. 10963 or the TRAIN Law. The rates and withholding rules have changed after the passage of the law with the new withholding tax tables. The book however, addresses the main challenge for employers which is saving on tax while maximizing the take home of employees.

This work tackles this matter with the presentation of options to minimize tax implications. The revenue regulation, RR 8-2018 implements the TRAIN Law and is discussed in this work in a manner designed for understanding.

RR 11-2018 was also issued by the BIR which primarily deals with the changes on withholding rules. The author provides several sample computations and illustrations

of important concepts like exemption of compensation income of minimum wage earners. Tax on income beyond the non-taxable limit of P20,833 per month. Exclusions from substituted filing rules, among others. The preferential tax treatment of alien employees has been removed.Read more..

The TRAIN Law likewise increases the ceiling for the 13 th month pay and other benefits from the previous P82,000.00 to P90,000.00. This is another useful item to maximize the grant of benefits with minimal tax impact.

De Minimis Benefits are discussed in a comprehensive manner focusing on its availability for tax savings. The list has been updated and some amounts have been increased like that of rice subsidy, medical allowance for dependents, and uniform and clothing allowance.

Fringe benefits are also discussed in combination with all the other benefits granted by the new law and regulations. It is now at 35% which is an increase from the former 32%. The rules on computation of grossed-up monetary value, value of the benefits, and tax accounting rules of the benefits are detailed with examples.

HR and compensation and benefits practitioner as well as managers and business owners will appreciate the exposition of the rules, doctrines and principles under the new tax system.

close

Scroll down for more information