Sample Affidavit of Cohabitation

₱1,200.00

The Affidavit of Cohabitation is required for male employees who would be availing of the paternity leave under R.A. 8187, every married male employee in the private and public sectors shall be entitled to a paternity leave of seven (7) days with full pay for the first four (4) deliveries of the legitimate spouse with whom he is cohabiting.

In the IRR of the law, “Paternity Leave” refers to the leave credits granted to a married male employee to allow him to earn compensation for seven (7) working days without reporting for work, provided that his spouse has delivered a child or had a miscarriage or an abortion for the purpose of lending support to his wife during her period of recovery and/or the nursing of the newly born child.

“Spouse” refers to the lawful wife. For this purpose, lawful wife refers to a woman who is legally married to the male employee concerned. “Cohabiting” refers to the obligation of the husband and wife to live together.

Read more..

Conditions for entitlement of paternity leave benefits are:

- he is employed at the time of delivery of his child;

- he has notified his employer of the pregnancy of his wife and her expected date of delivery subject to the provisions of Section 4 hereof; and

- his wife has given birth, suffers a miscarriage or an abortion.

As soon as the married male employee learns that his spouse is pregnant, he shall inform his employer of such pregnancy and the expected date of delivery within a reasonable period of time.

The employee shall accomplish a Paternity Notification Form to be provided for by the employer and submit the same to the latter, together with a copy of his marriage contract, or where not applicable, any proof of marriage. The notification requirement shall not apply in cases of miscarriage or abortion.

Any employee who has availed of the paternity benefits shall, within a reasonable period of time, submit a copy of the birth certificate of the newly born child, death or medical certificate in case of miscarriage or abortion, duly signed by the attending physician or midwife showing actual date of childbirth, miscarriage or abortion, as the case may be.

The paternity benefits may be enjoyed by the qualified employee before, during or after the delivery by his wife. The total number of days shall not exceed seven (7) working days for each delivery. This benefit shall be availed of not later than sixty (60) days after the date of said delivery.

The best proof of cohabitation is the affidavit. This template for Affidavit uses fictional name for purposes of illustration only. It contains the name, nationality, residence, and basic allegations.

It is important to state the place of cohabitation, the name of spouse, proof of valid marriage (marriage contract), validating proof of place of cohabitation (barangay captain’s certification), declaration of provision of support as spouses, and purpose of the Affidavit.

While it seems obvious, it should be properly signed and notarized.

close

Related Products

-

HR Forms, Notices and Contracts Soft Copy Double Bundle in Word File

0 out of 5This is a time-limited offer involving two best-selling products of LVS Rich Publishing Inc.

These are the soft copies of HR Forms 1 and HR Forms 2 containing a combined total of more than 300 forms and templates ranging from pre-employment to post-employment.

Once purchased, they are sent to your email containing a list of forms and the templates, which are editable in Word file or format.

The forms are updated to the current labor laws, rules and regulations. The buyer will have an easier time to compose the needed document to administer any HR function or resolve important labor situation using the relevant form, notice, or contract.

Below this page, in the Description portion, are the sets of forms list included in the bundle for easy reference:

₱9,990.00₱9,500.00 -

Tax Solutions on Employee Compensation and Benefits, 2nd Edition 2019

0 out of 5₱998.00Tax Solutions on Employee Compensation and Benefits, 2nd Edition, presents the changes on compensation income tax under R.A. 10963 or the TRAIN Law. The rates and withholding rules have changed after the passage of the law with the new withholding tax tables. The book however, addresses the main challenge for employers which is saving on tax while maximizing the take home of employees.

This work tackles this matter with the presentation of options to minimize tax implications. The revenue regulation, RR 8-2018 implements the TRAIN Law and is discussed in this work in a manner designed for understanding.

RR 11-2018 was also issued by the BIR which primarily deals with the changes on withholding rules. The author provides several sample computations and illustrations

of important concepts like exemption of compensation income of minimum wage earners. Tax on income beyond the non-taxable limit of P20,833 per month. Exclusions from substituted filing rules, among others. The preferential tax treatment of alien employees has been removed.Read more..

The TRAIN Law likewise increases the ceiling for the 13 th month pay and other benefits from the previous P82,000.00 to P90,000.00. This is another useful item to maximize the grant of benefits with minimal tax impact.

De Minimis Benefits are discussed in a comprehensive manner focusing on its availability for tax savings. The list has been updated and some amounts have been increased like that of rice subsidy, medical allowance for dependents, and uniform and clothing allowance.

Fringe benefits are also discussed in combination with all the other benefits granted by the new law and regulations. It is now at 35% which is an increase from the former 32%. The rules on computation of grossed-up monetary value, value of the benefits, and tax accounting rules of the benefits are detailed with examples.

HR and compensation and benefits practitioner as well as managers and business owners will appreciate the exposition of the rules, doctrines and principles under the new tax system.

close

Scroll down for more information

-

Guide on Employee Compensation and Benefits Vol. 1

2.54 out of 5₱495.00Title: Guide on Employee Compensation and Benefits Vol. 1

This book provides the guidelines, jurisprudence, and even sample computations on some critical aspects of compensation like overtime, night-shift differential, holiday pay, etc. For example, how to calculate the daily rate if the employee works on a holiday, renders overtime, falling on night differential period and at a time where it is also his rest day? The book shows how.

It shows the solutions to situations in salary administration involving minimum wage and legally mandated benefits. The aim of this work is to promote payment of correct salaries and benefits to the best assets of the company while at the same time preserving the reason for being of any business: that is, derive profits.

Scroll down for more information

-

Batas Kasambahay

0 out of 5₱390.00Title: Batas Kasambahay

Batas Kasambahay or Republic Act 10361 is a milestone legislation for Kasambahays all over the country. This by far has offered strong protection and more benefits for covered workers.

Salient provisions discussed in the book are new minimum wage, 5-day service incentive leave benefit, SSS, Philhealth and Pag-ibig coverage, payroll retention of 3 years, communication rules, grounds for termination, rescue, deployment expenses and debt bondage.

The book likewise provides Filipino excerpts on certain concepts for terms that are best expressed in our language. For those who initially read the draft of the book found the contents very useful. In fact, it can serve as handy reference for every household since topics are easy to read, well explained and the format is conducive to easy reading.

Scroll down for more information

-

Guide on Employee Compensation and Benefits Vol. 2

2.49 out of 5₱475.00Title: Guide on Employee Compensation and Benefits Vol. 2

Just how much should the company give as bonus? Just how many months of bonus should the company give without violating the law? If the company pays Christmas Bonus is it still required to pay 13th month pay? How about 14th and 15th month pay, should the company pay them also?

These are some of the perplexing questions that a typical HR practitioner encounters in his work. Most often, it is resolved in favor of the employees resulting in increased manpower cost on the part of the company.

The rules on 13th month pay and Christmas Bonus are discussed in this book. When to pay them and when not to are explained using the law and jurisprudence. Companies are not required to pay 14th, 15th month pay, and so forth, unless they are stipulated already in the CBA or any contract for that matter. But they are not legally mandated benefits.

How about productivity incentive bonuses, signing bonus, etc.? This book also offers explanation why some should be paid and the rest should not be.

Then comes the issue on leaves. Question like is there such thing as vacation leave in the Labor Code? Why can’t I find it? There is none because the Labor Code only provides for service incentive leave. There are other leave benefits discussed in this work like paternal, paternity and for women who are victims of violence.

This book also deals with issues on

- employee cash bonds, deposits

- authorized deductions

- the rules on employee compensation for disability, sickness, etc.

Scroll down for more information

-

HR Forms, Notices and Contracts 1 Soft Copy Version (150+ Templates in Editable Word)

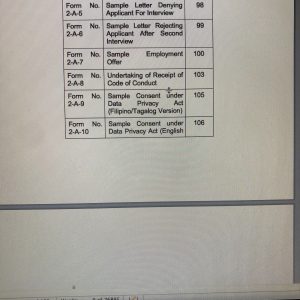

0 out of 5₱8,495.00Forms, Notices and Contracts

Soft Copy Version (Word File only – Saved as Single File)Alert!: If you were able to purchase any of our soft copy products in the past please double-check that they are not part of these templates. This product is indivisible and individual soft copy templates previously purchased cannot be deducted from the price.

Scroll Down to see the Table of Forms or list of Forms

Read more..

Based on the book Human Resource Forms, Notices & Contracts Volume One

Features:

- Editable in Word file (Saved as one file “HR Forms Volume 1 Soft Copy”)

- Fonts Used: Arial, Book Antiqua, Garamond

- With separate file showing instructions on How to Use and Navigate the HR Forms

- Product will be sent to Buyer’s Email Account from LVS’ gmail account.

- Over 150 Sample Forms such as:

- Employment Contracts (some with Data Privacy Consent Clause)

Regular

Probationary

Casual

Seasonal

Fixed-Term

Part-Time - Consent under Data Privacy Act

- DOLE Mandatory Policies

- Drug-Free Workplace

- HIV/AIDS

- Hepatitis B

- Tuberculosis

- Anti-Sexual Harassment

- Acknowledgment Receipt of Personal Protective Equipment (PPE)

- Authority to Deduct (Debt)

- Notices to Explain

- Notices of Hearing/Conference

- Notice of Suspension

- Preventive Suspension

- Extension of Preventive Suspension

- Termination Notice

- Extension of Preventive Suspension

- Application Form

- Employment checklist, etc.

- Acceptance of Resignation

- Acceptance of Resignation with Pending Case (Graceful Exit)

- Clearance Form

- Release, Waiver and Quitclaim

- Many more!

close

Scroll down for more information (Table of Forms)

- Editable in Word file (Saved as one file “HR Forms Volume 1 Soft Copy”)

-

Ring-Bound: Digest on Critical Supreme Court Decisions on Labor Cases 2016 Cases

0 out of 5₱745.00- Binding: Ring-bound

- Paper size: 8.5” x 13”

- Colored Front Cover with Plastic protection

- Inside: White bond paper with black text

- No. of pages: Approximately 170

- Retail Price: P745.00

ABOUT THE RING-BOUND EDITION

Digest of Critical Supreme Court Decisions on Labor Cases is an ambitious work to provide readers, HR practitioners, lawyers, and law students with crucial information on the Supreme Court decisions in labor cases. The digested cases are handy in tracking the recent rulings which are crucial in policy formulation in labor and employee relations. They are critical in a sense that the changes affect the labor environment and those not in the know may bear the adverse consequences.Read more..

Labor law is like a living organism that changes as time passes by. The employer who is more cognizant of the changes can adapt effectively. The presentation is indexed for easy reference. The book provides a digest of the recent decisions of the Supreme Court in labor such as cases on Retirement, Refusal to retire, Retirement plan vs. Labor Code Redundancy, Redundancy carried out by persons belonging to related companies, Labor claims against related companies, Employment contract, Audited financial statement (AFS) and Judicial notice of losses, Rehiring of some of the retrenched employees, Rehabilitation; and Quitclaim. This Year 2016 Digest covers SC Decisions on Strike; Notice of strike; Illegal strike; Valid dismissal; Employment status deemed lost; Transfer; Promotion; Resignation; force; threat; intimidation; coercion; release; waiver; quitclaim; Res judicata; Conclusiveness of judgment; Certification election; Illegal dismissal; Job contracting; Labor-only contracting; Labor-only contractor; Presumed labor-only contractor; Fixed-term; Fixed-term employment; Independent contractor; Repeated renewal; etc.

close

Scroll down for more information

-

Guide to Valid Job Contracting & Sub Contracting

4.00 out of 5₱745.00Title: Guide to Valid Job Contracting & Sub Contracting

This work will enlighten contractors, principals and all parties involved in contracting the rules, doctrines and principles behind job contracting. Discussed in this book are rules on labor-only contracting, right to control, supervision, registration, licensing, payment of wages, contracting in construction industry, security service, among others. Laws and rules discussed are D.O. 18-A, Articles 106-109 of the Labor Code, as amended, D.O.19, Series of 1998, RA 5487 on security contracts and its implementing rules.

Employers and Companies will benefit from extensive discussion on various issues on job contracting.

Scroll down for more information

-

Probationary Employment Evaluation Packet Super 5™ – Soft Copy Editable Template

0 out of 5₱2,795.00How to Evaluate Probationary Employees Using the

Probationary Employment Evaluation Packet Super 5This is a soft copy template saved in Word File and editable in Word Document.

This contains the sample terms, conditions, clauses, and provisions of the contracts described and the forms included.

See the Description below to view the Contents of this soft copy template.

One of the challenging aspects of monitoring the performance of a probationary employee is the establishment of performance ratings, metrics, or measures.

It is a settled rule that a probationary employee who was not apprised of the reasonable standards of performance to become regular employee is deemed regular from day one.

The same effect occurs for employees who have been with the company for at least six months and have not undergone performance evaluation. No matter how low did the probationary employee perform if the employer did not rate him with reasonable standards terminating the worker for failure to qualify is extremely risky.Read more..

Thus, when dealing with probationary employees, the company should have:

- Reasonable standards

- Made known such standards at the time of engagement

- Performance measures

- Periodic evaluation

- Clear rating plan, form, and template

With the right tools, the life of the employer would be bearable and the risk minimized to manageable level.

It is indeed a nerve-wracking exercise to devise the reasonable standards from scratch. However, this is made easy by the new products of LVS Rich Publishing known as the Probationary Employment Evaluation Packet Super 5.

This new soft copy product provides the proposed standards required for probationary to perform to qualify as regular employee. There are metrics with ratings and weights. There is a sample evaluation form where the employee rates himself and his superior then an average of the two ratings is obtained.

The rating system covers Performance, Punctuality/Attendance, Behavior, Teamwork, and Initiative. The total weight is 100%. If the probationary receives an average weight below 75% in one month, it shall be deemed as failure to meet the standards which may be ground for dismissal based on failure to qualify. Of course the buyer of this product can change the weight and rates according to what is considered applicable and necessary.

Performance metrics representing 30% of the total weight is based on Business Knowledge, Output/Production, Resourcefulness, and Teamwork.

Punctuality/attendance is one of the tricky areas to measure. The template though considers this as already 100% of its weight. It is given 20% weight subject to deduction of 3% for every instance of tardiness and 4% for every instance of unauthorized absence.Behavior is another matter of the same level of difficulty. To rate this, it is already pegged at 20% subject to deduction for every citation or violation of company rules, such as:

- Written warning – less 2%

- Stern warning – less 5%

- Written reprimand – less 6%

- 1-day Suspension – less 7%

- Longer suspension – less 10%

As to Performance metrics, sample rating spread can be seen in the Performance Review Template Excel File under the “Performance Weights” Sheet.

The rating system provides the following:

Outstanding Performance (OP) – Highest performance rating Reserved for individuals who continually achieve outstanding results and utilize their abilities in making contributions beyond their primary areas of responsibility.

Commendable Performance (CP) – Performance is above the expected level for the position making contributions beyond expectations in completion of assignments.

Effective Performance (EP) – Performance consistently meets supervisory expectations of the position requirements in making a valuable contribution to the overall objectives of the Group.

Marginal Performance (MP) – Performance does not consistently meet normal expectations and position requirements, improvement is required.

Unacceptable Performance (UP) – Performance fails to meet normal expectations and position requirements. Termination should be considered unless improvement is demonstrated in a short period of time.The buyer can Print Sheet 1 of the Performance Review Template Excel File entitled “Proby Metrics” Sheet as form in Performance Review where ratings shall be filled in. This will be used to tally the evaluation results based on performance metrics.

The Evaluation Packet comes with the Evaluation Guidelines file in Word document that will guide the user on how the evaluate the probationary employee using this product.

To further make this exercise easy, a sample evaluation of probationary employee is provided just to give the user a complete picture of how it will be done.

Upon purchase, the following files will be sent to the buyer’s email account from LVS’ Gmail Account:

- Contract of Probationary Employment for Daily Paid Employee (in Word document file)

- Description of the Contract of Probationary Employment for Daily Paid Employee (in Word document file)

- Evaluation Guidelines – Template (in Word document file)

- Performance Review Template (in Excel File)

- Sample Probationary Evaluation Template (in Word document file)

close

-

Guide on Employee Compensation and Benefits Vol. 1, Second Edition

0 out of 5₱1,198.00This book is the 2nd edition of one of ATTY. ELVIN B. VILLANUEVA’s best selling titles Guide on Employee Compensation and Benefits Volume 1. HR Practitioners, both new and veterans will find this work useful in understanding and keeping up with the latest rules, doctrines and principles on labor standards.

The subject matter of compensation and benefits is among the edgy topics which most HR practitioners, business managers, and even owners find challenging. As always, anything that deals with human psychology on pay, rewards, motivation, and equity requires full attention and creative solution.

Read more..

This work discusses the labor standards most particularly the exceptive rules where most practitioners are often blindsided. The rules and doctrines are tackled with illustrations and sample computations. Presentation of pay computations proceeds from the ordinary day, regular holiday, special day, and rest day or a combination of both holidays and rest days. These affects the daily rate, overtime, and nightshift differential.

There are relevant Supreme Court decisions where the high court interprets crucial areas of compensation. Rules on successive regular holidays are shown with example. Also, illustrative cases for overtime and nightshift differential are shown using different hours worked such as 2-hour, 4-hour, or even 8-hour OT and nightshift with computations when these coincide or concur on the same day.

The author also delineates the impact of benefits when the clock strikes 12:00 midnight such as on overtime, holiday pay, etc. This is particularly crucial for those with call center operations. Also discussed are company-initiated benefits rule, management prerogative to require overtime work, rule on travel time, brownout and other time-related issues.

New laws and rules are correlated with existing ones in the Labor Code such as the lactation period, primer on expanded maternity leave law (with sample salary differential computation), DO 178 and DO 184 on breaks mandated for employees who need to stand or sit for too long at work and the telecommuting act which affects the hours of work depending on the arrangement between the employer and employee.At the end of the day, compensation and benefits is an interesting area of HR/Labor practice. The key to harmony is understanding of the rules and it starts with acquisition of knowledge.

close

Scroll down for more information