HIV / AIDS Prevention and Control Policy

₱1,249.00

This template is in accordance with the provisions of Republic Act No. 8504, otherwise known as “Philippine AIDS Prevention and Control Act of 1998,” D.O. 102-10 or the rules implementing RA 8504, ILO Code of Practice, and the company hereby adopts the following policy on full protection of human rights and civil liberties of persons suspected or known to be infected with HIV/AIDS.

Reminder!!! Buyer of any of the HR Bundle Products should CHECK if this product is already part of the HR bundle before proceeding to buy. Thank you!

This expresses the company’s aim to provide a safe, respectful and discrimination-free work environment to employees and company stakeholders, to uphold human dignity, human rights and civil liberties. The company is committed to afford full protection to persons suspected or know to be infected with HIV/AIDS.

To this end, the company, through a collaborative efforts with its employees, adopts the policy for HIV/AIDS cases.

The softcopy template is written in Word document using MS Office 365 version, Arial font, 12 font size, containing 4 pages of 8.5”x11” layout.

This expresses the company’s adoption of the policies and programs on the prevention and control of Hepatitis B in the workplace.

The softcopy template is written in Word document using MS Office 365 version, Arial font, 12 font size, containing 4 pages of 8.5”x11” layout.

Read more..

In compliance with the DOLE issuance, this template shows sample provisions on:

- Statement of Legal Compliance

- Declaration of Corporate Policy on Hepatitis B Prevention and Control

- Purpose

- Implementing Structure

- Coverage

- Guidelines

– Preventive Strategies - Recording, Reporting and Setting Up of Database

- Social Policy

– Non-Discriminatory Policy and Practices - Work Accommodation Arrangement

- Roles and Responsibilities of Workers

close

Related Products

-

HR Forms, Notices and Contracts Soft Copy Double Bundle in Word File

0 out of 5This is a time-limited offer involving two best-selling products of LVS Rich Publishing Inc.

These are the soft copies of HR Forms 1 and HR Forms 2 containing a combined total of more than 300 forms and templates ranging from pre-employment to post-employment.

Once purchased, they are sent to your email containing a list of forms and the templates, which are editable in Word file or format.

The forms are updated to the current labor laws, rules and regulations. The buyer will have an easier time to compose the needed document to administer any HR function or resolve important labor situation using the relevant form, notice, or contract.

Below this page, in the Description portion, are the sets of forms list included in the bundle for easy reference:

₱9,990.00₱9,500.00 -

Gabay sa mga Karapatan ng Overseas Filipino Worker (OFW)

2.42 out of 5₱395.00Title: Gabay sa mga Karapatan ng Overseas Filipino Worker (OFW)

Author: Atty. Elvin B. Villanueva

Publisher: Central Book Supply, Inc.

ISBN: 978-971-011-130-5

No. Of Pages: 185

Size: 6″x9″

Edition: First Edition, 2010

Size: 6″x9″

Binding: Softbound -

Guide on Employee Compensation and Benefits Vol. 1

2.54 out of 5₱495.00Title: Guide on Employee Compensation and Benefits Vol. 1

This book provides the guidelines, jurisprudence, and even sample computations on some critical aspects of compensation like overtime, night-shift differential, holiday pay, etc. For example, how to calculate the daily rate if the employee works on a holiday, renders overtime, falling on night differential period and at a time where it is also his rest day? The book shows how.

It shows the solutions to situations in salary administration involving minimum wage and legally mandated benefits. The aim of this work is to promote payment of correct salaries and benefits to the best assets of the company while at the same time preserving the reason for being of any business: that is, derive profits.

Scroll down for more information

-

Employee Transfer & Demotion

2.61 out of 5₱347.00Title: Employee Transfer and Demotion

The book provides updated answers to the most pressing questions on employee transfer and demotion. This is must-have for employers who would want to make the right decision and avoid or minimize labor disputes.

This work will guide the practitioners and business owners in navigating the treacherous terrain of transfer and demotion. Questions regarding timing of transfer, acts to avoid, lateral position, location, and rank are concisely discussed in this work. The dos and don’ts in demotion are also clearly and completed explain.

The concepts are easy to understand making this book an important arsenal in every HR practitioner or business owner’s library.

Scroll down for more information

-

Digest of Critical Decisions of the Supreme Court on Labor Cases

0 out of 5₱1,485.00Title: Digest of Critical Decisions of the Supreme on Labor Cases

(YEARS 2015, 2016, 2017 & 2018 Decisions)- Just cause for dismissal: Two steps process on Immorality; Totality of infraction principle;

- Procedural: Reglementary period to appeal; supersedeas bond; computation of backwages; finality of award

- OFW (Permanent disability; 120 day rule; 240 day rule; Krestel Ruling; InterOrient Shipping Doctrine; Lex loci contractus; forum non conveniens)

Scroll down for more information

-

Tax Solutions on Employee Compensation and Benefits, 2nd Edition 2019

0 out of 5₱998.00Tax Solutions on Employee Compensation and Benefits, 2nd Edition, presents the changes on compensation income tax under R.A. 10963 or the TRAIN Law. The rates and withholding rules have changed after the passage of the law with the new withholding tax tables. The book however, addresses the main challenge for employers which is saving on tax while maximizing the take home of employees.

This work tackles this matter with the presentation of options to minimize tax implications. The revenue regulation, RR 8-2018 implements the TRAIN Law and is discussed in this work in a manner designed for understanding.

RR 11-2018 was also issued by the BIR which primarily deals with the changes on withholding rules. The author provides several sample computations and illustrations

of important concepts like exemption of compensation income of minimum wage earners. Tax on income beyond the non-taxable limit of P20,833 per month. Exclusions from substituted filing rules, among others. The preferential tax treatment of alien employees has been removed.Read more..

The TRAIN Law likewise increases the ceiling for the 13 th month pay and other benefits from the previous P82,000.00 to P90,000.00. This is another useful item to maximize the grant of benefits with minimal tax impact.

De Minimis Benefits are discussed in a comprehensive manner focusing on its availability for tax savings. The list has been updated and some amounts have been increased like that of rice subsidy, medical allowance for dependents, and uniform and clothing allowance.

Fringe benefits are also discussed in combination with all the other benefits granted by the new law and regulations. It is now at 35% which is an increase from the former 32%. The rules on computation of grossed-up monetary value, value of the benefits, and tax accounting rules of the benefits are detailed with examples.

HR and compensation and benefits practitioner as well as managers and business owners will appreciate the exposition of the rules, doctrines and principles under the new tax system.

close

Scroll down for more information

-

Human Resource Forms, Notices and Contracts Vol. 2

2.90 out of 5₱845.00Title: Human Resource Forms, Notices & Contracts Made Easy Vol. 2

Procedures in labor law and social legislation are perilous terrain to navigate most especially to new practitioners in the field of employee relations. Reading and under-standing the provisions of law may not be enough since the actual implementation of the legal requirements will make or break any management decision.

It takes a combination of legal knowledge and experience in the field to safely execute the functions in employee relations. Thus, authors in this work discuss not only the legal principles in labor law but also share useful or practical forms to use in various situations.

By showing the forms to use, the practitioner is enlightened on the purpose and principles behind relevant labor law provisions. The risk involved in executing the management decision may be reduced once the principles and applications are put proper use.

Scroll down for more information

-

Guide on Employee Compensation and Benefits Vol. 2

2.49 out of 5₱475.00Title: Guide on Employee Compensation and Benefits Vol. 2

Just how much should the company give as bonus? Just how many months of bonus should the company give without violating the law? If the company pays Christmas Bonus is it still required to pay 13th month pay? How about 14th and 15th month pay, should the company pay them also?

These are some of the perplexing questions that a typical HR practitioner encounters in his work. Most often, it is resolved in favor of the employees resulting in increased manpower cost on the part of the company.

The rules on 13th month pay and Christmas Bonus are discussed in this book. When to pay them and when not to are explained using the law and jurisprudence. Companies are not required to pay 14th, 15th month pay, and so forth, unless they are stipulated already in the CBA or any contract for that matter. But they are not legally mandated benefits.

How about productivity incentive bonuses, signing bonus, etc.? This book also offers explanation why some should be paid and the rest should not be.

Then comes the issue on leaves. Question like is there such thing as vacation leave in the Labor Code? Why can’t I find it? There is none because the Labor Code only provides for service incentive leave. There are other leave benefits discussed in this work like paternal, paternity and for women who are victims of violence.

This book also deals with issues on

- employee cash bonds, deposits

- authorized deductions

- the rules on employee compensation for disability, sickness, etc.

Scroll down for more information

-

Guide to Valid Job Contracting & Sub Contracting

4.00 out of 5₱745.00Title: Guide to Valid Job Contracting & Sub Contracting

This work will enlighten contractors, principals and all parties involved in contracting the rules, doctrines and principles behind job contracting. Discussed in this book are rules on labor-only contracting, right to control, supervision, registration, licensing, payment of wages, contracting in construction industry, security service, among others. Laws and rules discussed are D.O. 18-A, Articles 106-109 of the Labor Code, as amended, D.O.19, Series of 1998, RA 5487 on security contracts and its implementing rules.

Employers and Companies will benefit from extensive discussion on various issues on job contracting.

Scroll down for more information

-

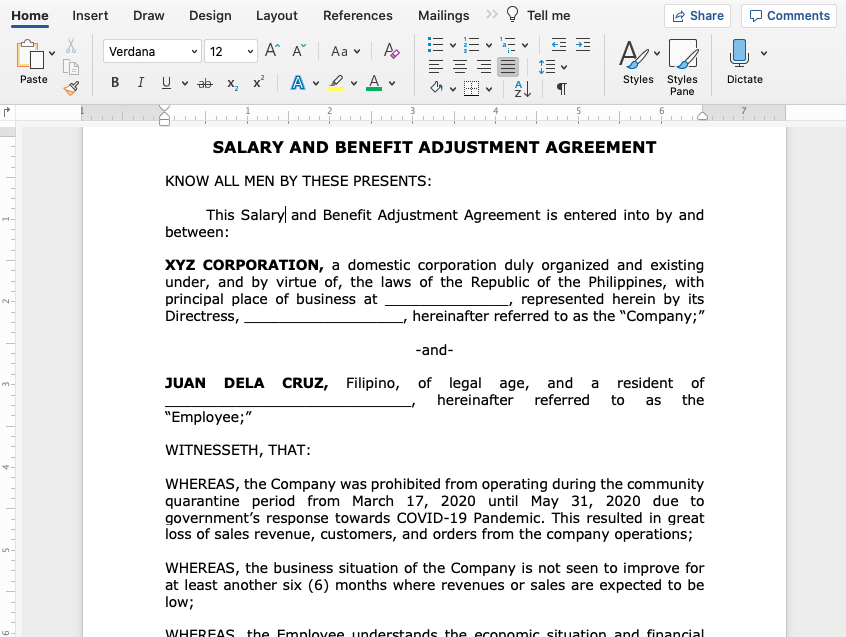

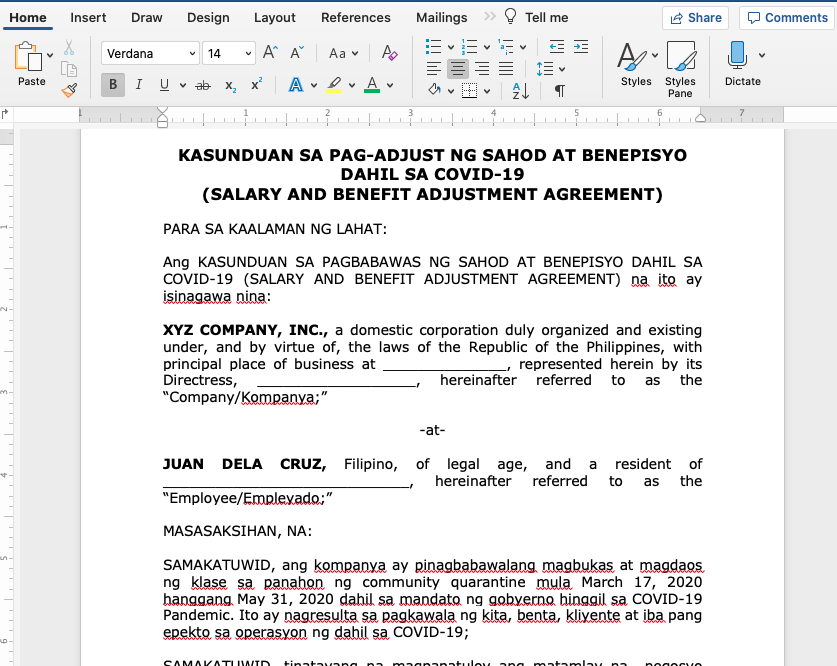

Salary & Benefit Adjustment Agreement (in Filipino / English) – Soft Copy Editable Template

₱750.000 out of 5