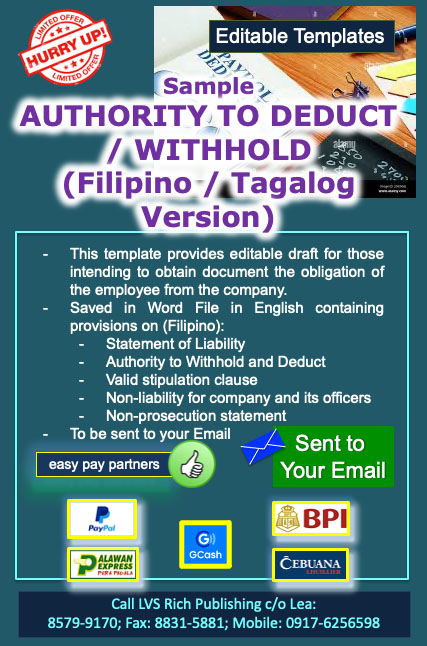

Authority to Deduct / Withhold (Filipino)

₱1,250.00

This template is a document intended to facilitate the crafting of an Authority to Withhold and Deduct from the pay or benefits of the employee who has liability from the company crafted in Filipino / Tagalog.

This is written in MS Word document, editable, provided the user’s device and program are compatible in such platform. This will be sent to the buyer via email upon completion of purchase.

This is the best document to use for employees who are not conversant of the English language and who are more familiar with the Filipino / Tagalog.

This document pertains to the admission of employee of his liability which may come from loan, damages, advances, or any unaccounted sum, etc.

The company is guided by the important provisions such as acknowledgment of liability. The user has to fill out the nature of liability (e.g., loan, damages, advances, unaccounted, sum, etc.).

The document may be notarized as well. The lack of notarization will not affect the validity. However, the notarization of this instrument adds weight to the declaration of the employee and admission of liability, in case of dispute in the future.

Hence, whether or not to have the document notarized, is an option of the company depending on its policy governing the weight of the documents executed by employees.

Read more..

This template provides:

- Name of employee

- Personal circumstances (Filipino, age, address, etc.)

- Acknowledgment of liability or indebtedness

- Undertaking to pay at a certain period

- No prior demand clause

- Authority to withhold and subsequently to deduct

- Valid and binding stipulation

- Non-liability clause

- Release of the company and its officers

- Voluntary execution of the document

close

Related Products

-

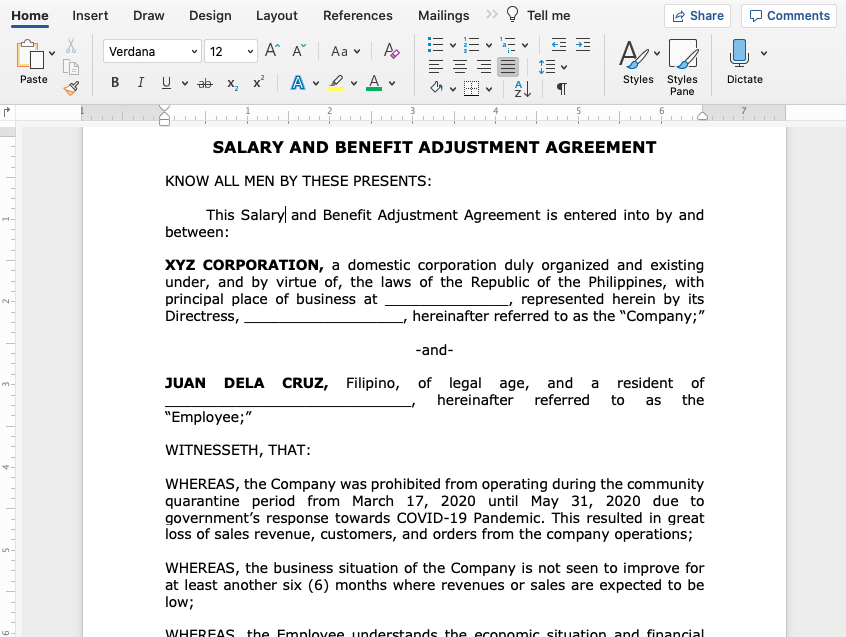

Salary & Benefit Adjustment Agreement (in Filipino / English) – Soft Copy Editable Template

₱750.000 out of 5 -

The Labor Code of the Philippines

0 out of 5₱948.00Title: The Labor Code of the Philippines

The Labor Code of the Philippines by Atty. Elvin B. Villanueva

Suggested Retail Price: P948.00

Scroll down for more information

-

Employment Contracts Templates Soft Copy (English and Filipino/Tagalog)

0 out of 5EMPLOYMENT CONTRACTS TEMPLATES DESCRIPTION

Employment contracts in the Philippines should be crafted in accordance with rules to ensure compliance with legal requirements.

This is saved in a single file in Word (Arial Font using sizes 12, 14, and 20). Buyers will receive the file through email from LVS’ gmail account. There will be price increase for this product soon.

Alert!: If you were able to purchase any of our soft copy products in the past please double-check that they are not part of these templates. This product is indivisible and individual soft copy templates previously purchased cannot be deducted from the price.

This product, Employment Contracts Templates (English and Filipino), contains 40+ samples or templates of various employment contracts used in the Philippines such as:

- Probationary

- Regular

- Casual

- Project

- Seasonal

- Fixed-Term or Fixed-Period, and

- Part-Time

Read more..

Some sample templates contain show formats that incorporate provisions on:

- Data Privacy Consent Clause

- Discipline

- Reference to Job Description

- Benefits

- Place of Work

- Shift

- Performance Metrics

- Decorum/Uniform

- Shift, etc.

close

Scroll down for more information

₱3,995.00₱3,900.00 -

Tax Solutions on Employee Compensation and Benefits, 2nd Edition 2019

0 out of 5₱998.00Tax Solutions on Employee Compensation and Benefits, 2nd Edition, presents the changes on compensation income tax under R.A. 10963 or the TRAIN Law. The rates and withholding rules have changed after the passage of the law with the new withholding tax tables. The book however, addresses the main challenge for employers which is saving on tax while maximizing the take home of employees.

This work tackles this matter with the presentation of options to minimize tax implications. The revenue regulation, RR 8-2018 implements the TRAIN Law and is discussed in this work in a manner designed for understanding.

RR 11-2018 was also issued by the BIR which primarily deals with the changes on withholding rules. The author provides several sample computations and illustrations

of important concepts like exemption of compensation income of minimum wage earners. Tax on income beyond the non-taxable limit of P20,833 per month. Exclusions from substituted filing rules, among others. The preferential tax treatment of alien employees has been removed.Read more..

The TRAIN Law likewise increases the ceiling for the 13 th month pay and other benefits from the previous P82,000.00 to P90,000.00. This is another useful item to maximize the grant of benefits with minimal tax impact.

De Minimis Benefits are discussed in a comprehensive manner focusing on its availability for tax savings. The list has been updated and some amounts have been increased like that of rice subsidy, medical allowance for dependents, and uniform and clothing allowance.

Fringe benefits are also discussed in combination with all the other benefits granted by the new law and regulations. It is now at 35% which is an increase from the former 32%. The rules on computation of grossed-up monetary value, value of the benefits, and tax accounting rules of the benefits are detailed with examples.

HR and compensation and benefits practitioner as well as managers and business owners will appreciate the exposition of the rules, doctrines and principles under the new tax system.

close

Scroll down for more information

-

Batas Kasambahay

0 out of 5₱390.00Title: Batas Kasambahay

Batas Kasambahay or Republic Act 10361 is a milestone legislation for Kasambahays all over the country. This by far has offered strong protection and more benefits for covered workers.

Salient provisions discussed in the book are new minimum wage, 5-day service incentive leave benefit, SSS, Philhealth and Pag-ibig coverage, payroll retention of 3 years, communication rules, grounds for termination, rescue, deployment expenses and debt bondage.

The book likewise provides Filipino excerpts on certain concepts for terms that are best expressed in our language. For those who initially read the draft of the book found the contents very useful. In fact, it can serve as handy reference for every household since topics are easy to read, well explained and the format is conducive to easy reading.

Scroll down for more information

-

Health Checklist & Workplace COVID-19 Protocol – Soft Copy Editable Template

0 out of 5₱500.00On April 30, 2020 the Department Trade and Industry (DTI) and the Department of Labor and Employment (DOLE) issued Interim Guidelines on Workplace Prevention and Control of COVID-19.

The guidelines require employers to implement Health checklists containing declarations of various information and the Workplace Screening Protocol.

Below are sample templates of the health checklist and Screening Protocol which are Editable in Word. Templates are available at only P500.00 to be sent via your email.

-

Guide on Employee Compensation and Benefits Vol. 2, 2nd Ed.

2.55 out of 5₱595.00Title: Guide on Employee Compensation and Benefits Vol. 2 Second Edition

Guide on Employee Compensation and Benefits, Second Edition 2015 contains important discussion on 13 th month pay, 14 th month pay, Christmas and other bonuses. It also contains current information on rules on payment of wages, withholding of wages, wage deductions, employment bonds, as well as employee compensation on account of disability, injuries and death, among others. Also incorporated in this edition are recent decisions of the Supreme Court on the 13th month pay, bonuses, allowances and payment of wages. This edition presents newly promulgated rules and regulations on the above topics.

This book will prove helpful to all HR practitioners and professionals on employee or labor relations to achieve industrial harmony and productivity.

Scroll down for more information

-

Guide on Employee Compensation and Benefits Vol. 1, Second Edition

0 out of 5₱1,198.00This book is the 2nd edition of one of ATTY. ELVIN B. VILLANUEVA’s best selling titles Guide on Employee Compensation and Benefits Volume 1. HR Practitioners, both new and veterans will find this work useful in understanding and keeping up with the latest rules, doctrines and principles on labor standards.

The subject matter of compensation and benefits is among the edgy topics which most HR practitioners, business managers, and even owners find challenging. As always, anything that deals with human psychology on pay, rewards, motivation, and equity requires full attention and creative solution.

Read more..

This work discusses the labor standards most particularly the exceptive rules where most practitioners are often blindsided. The rules and doctrines are tackled with illustrations and sample computations. Presentation of pay computations proceeds from the ordinary day, regular holiday, special day, and rest day or a combination of both holidays and rest days. These affects the daily rate, overtime, and nightshift differential.

There are relevant Supreme Court decisions where the high court interprets crucial areas of compensation. Rules on successive regular holidays are shown with example. Also, illustrative cases for overtime and nightshift differential are shown using different hours worked such as 2-hour, 4-hour, or even 8-hour OT and nightshift with computations when these coincide or concur on the same day.

The author also delineates the impact of benefits when the clock strikes 12:00 midnight such as on overtime, holiday pay, etc. This is particularly crucial for those with call center operations. Also discussed are company-initiated benefits rule, management prerogative to require overtime work, rule on travel time, brownout and other time-related issues.

New laws and rules are correlated with existing ones in the Labor Code such as the lactation period, primer on expanded maternity leave law (with sample salary differential computation), DO 178 and DO 184 on breaks mandated for employees who need to stand or sit for too long at work and the telecommuting act which affects the hours of work depending on the arrangement between the employer and employee.At the end of the day, compensation and benefits is an interesting area of HR/Labor practice. The key to harmony is understanding of the rules and it starts with acquisition of knowledge.

close

Scroll down for more information

-

HR Bundle – Print Books

0 out of 5The HR Bundle offers excellent tools for learning about HR/Labor rules, doctrines and principles in various books written by Atty. Elvin B. Villanueva. Each book in the bundle provides unique content dealing with particular labor/HR topic.

HR Bundle comes with a 5% discount. Shipping is free.

Scroll down for more information

₱7,223.00₱6,861.85 -

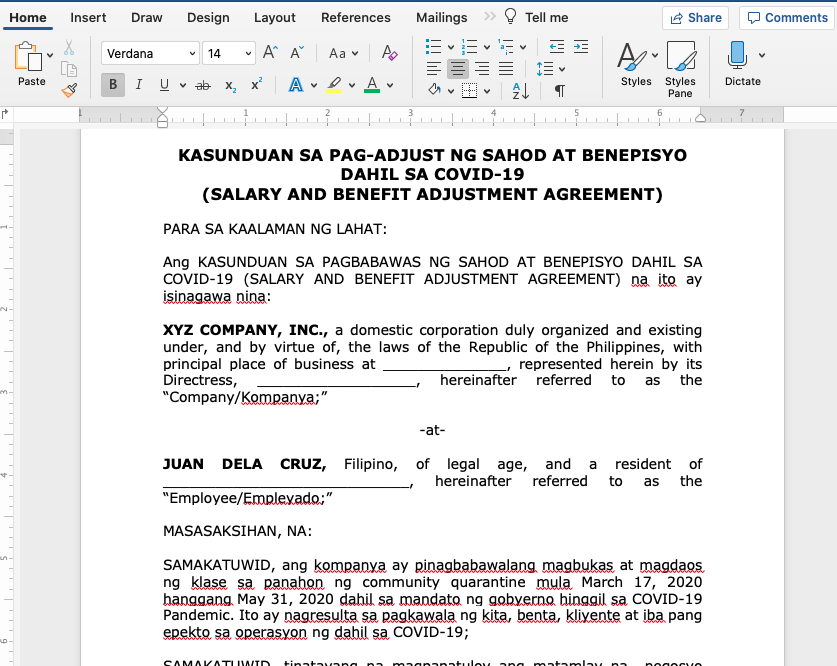

HR Forms, Notices and Contracts 1 Soft Copy Version (150+ Templates in Editable Word)

0 out of 5₱8,495.00Forms, Notices and Contracts

Soft Copy Version (Word File only – Saved as Single File)Alert!: If you were able to purchase any of our soft copy products in the past please double-check that they are not part of these templates. This product is indivisible and individual soft copy templates previously purchased cannot be deducted from the price.

Scroll Down to see the Table of Forms or list of Forms

Read more..

Based on the book Human Resource Forms, Notices & Contracts Volume One

Features:

- Editable in Word file (Saved as one file “HR Forms Volume 1 Soft Copy”)

- Fonts Used: Arial, Book Antiqua, Garamond

- With separate file showing instructions on How to Use and Navigate the HR Forms

- Product will be sent to Buyer’s Email Account from LVS’ gmail account.

- Over 150 Sample Forms such as:

- Employment Contracts (some with Data Privacy Consent Clause)

Regular

Probationary

Casual

Seasonal

Fixed-Term

Part-Time - Consent under Data Privacy Act

- DOLE Mandatory Policies

- Drug-Free Workplace

- HIV/AIDS

- Hepatitis B

- Tuberculosis

- Anti-Sexual Harassment

- Acknowledgment Receipt of Personal Protective Equipment (PPE)

- Authority to Deduct (Debt)

- Notices to Explain

- Notices of Hearing/Conference

- Notice of Suspension

- Preventive Suspension

- Extension of Preventive Suspension

- Termination Notice

- Extension of Preventive Suspension

- Application Form

- Employment checklist, etc.

- Acceptance of Resignation

- Acceptance of Resignation with Pending Case (Graceful Exit)

- Clearance Form

- Release, Waiver and Quitclaim

- Many more!

close

Scroll down for more information (Table of Forms)

- Editable in Word file (Saved as one file “HR Forms Volume 1 Soft Copy”)