Authority to Deduct / Withhold (Filipino)

₱1,250.00

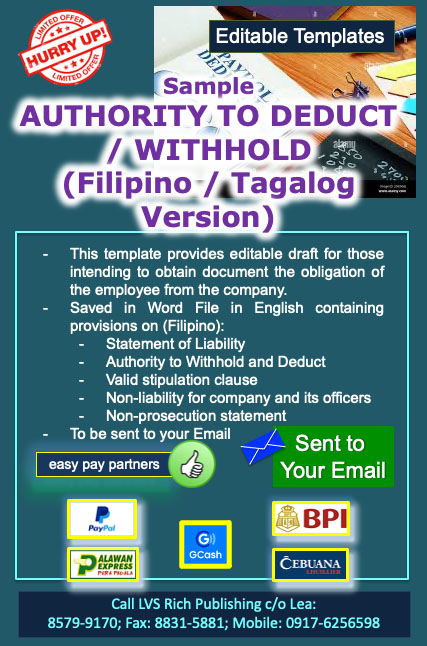

This template is a document intended to facilitate the crafting of an Authority to Withhold and Deduct from the pay or benefits of the employee who has liability from the company crafted in Filipino / Tagalog.

This is written in MS Word document, editable, provided the user’s device and program are compatible in such platform. This will be sent to the buyer via email upon completion of purchase.

This is the best document to use for employees who are not conversant of the English language and who are more familiar with the Filipino / Tagalog.

This document pertains to the admission of employee of his liability which may come from loan, damages, advances, or any unaccounted sum, etc.

The company is guided by the important provisions such as acknowledgment of liability. The user has to fill out the nature of liability (e.g., loan, damages, advances, unaccounted, sum, etc.).

The document may be notarized as well. The lack of notarization will not affect the validity. However, the notarization of this instrument adds weight to the declaration of the employee and admission of liability, in case of dispute in the future.

Hence, whether or not to have the document notarized, is an option of the company depending on its policy governing the weight of the documents executed by employees.

Read more..

This template provides:

- Name of employee

- Personal circumstances (Filipino, age, address, etc.)

- Acknowledgment of liability or indebtedness

- Undertaking to pay at a certain period

- No prior demand clause

- Authority to withhold and subsequently to deduct

- Valid and binding stipulation

- Non-liability clause

- Release of the company and its officers

- Voluntary execution of the document

close

Related Products

-

Guide on Employee Compensation and Benefits Vol. 1, Second Edition

0 out of 5₱1,198.00This book is the 2nd edition of one of ATTY. ELVIN B. VILLANUEVA’s best selling titles Guide on Employee Compensation and Benefits Volume 1. HR Practitioners, both new and veterans will find this work useful in understanding and keeping up with the latest rules, doctrines and principles on labor standards.

The subject matter of compensation and benefits is among the edgy topics which most HR practitioners, business managers, and even owners find challenging. As always, anything that deals with human psychology on pay, rewards, motivation, and equity requires full attention and creative solution.

Read more..

This work discusses the labor standards most particularly the exceptive rules where most practitioners are often blindsided. The rules and doctrines are tackled with illustrations and sample computations. Presentation of pay computations proceeds from the ordinary day, regular holiday, special day, and rest day or a combination of both holidays and rest days. These affects the daily rate, overtime, and nightshift differential.

There are relevant Supreme Court decisions where the high court interprets crucial areas of compensation. Rules on successive regular holidays are shown with example. Also, illustrative cases for overtime and nightshift differential are shown using different hours worked such as 2-hour, 4-hour, or even 8-hour OT and nightshift with computations when these coincide or concur on the same day.

The author also delineates the impact of benefits when the clock strikes 12:00 midnight such as on overtime, holiday pay, etc. This is particularly crucial for those with call center operations. Also discussed are company-initiated benefits rule, management prerogative to require overtime work, rule on travel time, brownout and other time-related issues.

New laws and rules are correlated with existing ones in the Labor Code such as the lactation period, primer on expanded maternity leave law (with sample salary differential computation), DO 178 and DO 184 on breaks mandated for employees who need to stand or sit for too long at work and the telecommuting act which affects the hours of work depending on the arrangement between the employer and employee.At the end of the day, compensation and benefits is an interesting area of HR/Labor practice. The key to harmony is understanding of the rules and it starts with acquisition of knowledge.

close

Scroll down for more information

-

Guide on Wage Order and Minimum Wage

2.43 out of 5₱370.00Title: Guide on Wage Order and Minimum Wage

This work provides a comprehensive discussion on wage orders with regard to the mechanics of issuance, coverage and resolution of certain issues like the wage distortion.

Scroll down for more information

-

Ring-Bound: Digest on Critical Supreme Court Decisions on Labor Cases 2016 Cases

0 out of 5₱745.00- Binding: Ring-bound

- Paper size: 8.5” x 13”

- Colored Front Cover with Plastic protection

- Inside: White bond paper with black text

- No. of pages: Approximately 170

- Retail Price: P745.00

ABOUT THE RING-BOUND EDITION

Digest of Critical Supreme Court Decisions on Labor Cases is an ambitious work to provide readers, HR practitioners, lawyers, and law students with crucial information on the Supreme Court decisions in labor cases. The digested cases are handy in tracking the recent rulings which are crucial in policy formulation in labor and employee relations. They are critical in a sense that the changes affect the labor environment and those not in the know may bear the adverse consequences.Read more..

Labor law is like a living organism that changes as time passes by. The employer who is more cognizant of the changes can adapt effectively. The presentation is indexed for easy reference. The book provides a digest of the recent decisions of the Supreme Court in labor such as cases on Retirement, Refusal to retire, Retirement plan vs. Labor Code Redundancy, Redundancy carried out by persons belonging to related companies, Labor claims against related companies, Employment contract, Audited financial statement (AFS) and Judicial notice of losses, Rehiring of some of the retrenched employees, Rehabilitation; and Quitclaim. This Year 2016 Digest covers SC Decisions on Strike; Notice of strike; Illegal strike; Valid dismissal; Employment status deemed lost; Transfer; Promotion; Resignation; force; threat; intimidation; coercion; release; waiver; quitclaim; Res judicata; Conclusiveness of judgment; Certification election; Illegal dismissal; Job contracting; Labor-only contracting; Labor-only contractor; Presumed labor-only contractor; Fixed-term; Fixed-term employment; Independent contractor; Repeated renewal; etc.

close

Scroll down for more information

-

Guide on Employee Compensation and Benefits Vol. 2

2.49 out of 5₱475.00Title: Guide on Employee Compensation and Benefits Vol. 2

Just how much should the company give as bonus? Just how many months of bonus should the company give without violating the law? If the company pays Christmas Bonus is it still required to pay 13th month pay? How about 14th and 15th month pay, should the company pay them also?

These are some of the perplexing questions that a typical HR practitioner encounters in his work. Most often, it is resolved in favor of the employees resulting in increased manpower cost on the part of the company.

The rules on 13th month pay and Christmas Bonus are discussed in this book. When to pay them and when not to are explained using the law and jurisprudence. Companies are not required to pay 14th, 15th month pay, and so forth, unless they are stipulated already in the CBA or any contract for that matter. But they are not legally mandated benefits.

How about productivity incentive bonuses, signing bonus, etc.? This book also offers explanation why some should be paid and the rest should not be.

Then comes the issue on leaves. Question like is there such thing as vacation leave in the Labor Code? Why can’t I find it? There is none because the Labor Code only provides for service incentive leave. There are other leave benefits discussed in this work like paternal, paternity and for women who are victims of violence.

This book also deals with issues on

- employee cash bonds, deposits

- authorized deductions

- the rules on employee compensation for disability, sickness, etc.

Scroll down for more information

-

Solutions on Wage Order and Minimum Wage 2nd Ed.

2.79 out of 5₱525.00Title: Solutions and Remedies on Wage Order and Minimum Wage

The book is designed as easy reference for HR Practitioners, Business Owners, Managers, and Expats who deal with Filipino labor.

Philippine law requires compliance by employers with minimum wages and benefits. It is simplistic to see this as mere implementation of labor rules. It is often more complicated than it seems.

This work guides readers on proper perspective, and practical knowledge in the tortuous highway of labor compliance. The discussion is served in no-frills platter as topics are presented in direct fashion and clear explanation.

This edition features Wage Order No. NCR-20 in the NCR. The book provides highlights on regional minimum wage, nature of wage order, wage or special group of workers (handicapped, paid by results, etc.), coverage and exemptions, CTPA, BMBE rules, wage distortion and how to correct it, salaries above minimum (creditable rule), across-the-board increases, and other interesting and important concepts.

This work can be a good tool in understanding the principles and doctrines in wage orders, irrespective of the rates applicable.

Scroll down for more information

-

Guide on Employee Compensation and Benefits Vol. 1

2.54 out of 5₱495.00Title: Guide on Employee Compensation and Benefits Vol. 1

This book provides the guidelines, jurisprudence, and even sample computations on some critical aspects of compensation like overtime, night-shift differential, holiday pay, etc. For example, how to calculate the daily rate if the employee works on a holiday, renders overtime, falling on night differential period and at a time where it is also his rest day? The book shows how.

It shows the solutions to situations in salary administration involving minimum wage and legally mandated benefits. The aim of this work is to promote payment of correct salaries and benefits to the best assets of the company while at the same time preserving the reason for being of any business: that is, derive profits.

Scroll down for more information

-

Guide to Valid Dismissal of Employees 2nd Edition

2.57 out of 5₱785.00Title: Guide to Valid Dismissal of Employees 2nd Edition

Guide to Valid Dismissal of Employees 2014 Edition contains updated HR literature on terminal laws, rules and regulations including 2013 cases and other newly establishment doctrines and principles. The best-selling first edition of the book got even better with discussion of relevant provisions on retirement in relation to employee dismissal, rule on separation pay when dismissal is valid, preventive suspension , just causes, authorized causes, termination due to disease, bona fide suspension of operations and other related principles.

This book will prove helpful to all HR practitioners and professionals on employee or labor relations.

Scroll down for more information

-

Tax Solutions on Employee Compensation and Benefits, 2nd Edition 2019

0 out of 5₱998.00Tax Solutions on Employee Compensation and Benefits, 2nd Edition, presents the changes on compensation income tax under R.A. 10963 or the TRAIN Law. The rates and withholding rules have changed after the passage of the law with the new withholding tax tables. The book however, addresses the main challenge for employers which is saving on tax while maximizing the take home of employees.

This work tackles this matter with the presentation of options to minimize tax implications. The revenue regulation, RR 8-2018 implements the TRAIN Law and is discussed in this work in a manner designed for understanding.

RR 11-2018 was also issued by the BIR which primarily deals with the changes on withholding rules. The author provides several sample computations and illustrations

of important concepts like exemption of compensation income of minimum wage earners. Tax on income beyond the non-taxable limit of P20,833 per month. Exclusions from substituted filing rules, among others. The preferential tax treatment of alien employees has been removed.Read more..

The TRAIN Law likewise increases the ceiling for the 13 th month pay and other benefits from the previous P82,000.00 to P90,000.00. This is another useful item to maximize the grant of benefits with minimal tax impact.

De Minimis Benefits are discussed in a comprehensive manner focusing on its availability for tax savings. The list has been updated and some amounts have been increased like that of rice subsidy, medical allowance for dependents, and uniform and clothing allowance.

Fringe benefits are also discussed in combination with all the other benefits granted by the new law and regulations. It is now at 35% which is an increase from the former 32%. The rules on computation of grossed-up monetary value, value of the benefits, and tax accounting rules of the benefits are detailed with examples.

HR and compensation and benefits practitioner as well as managers and business owners will appreciate the exposition of the rules, doctrines and principles under the new tax system.

close

Scroll down for more information

-

Health Checklist & Workplace COVID-19 Protocol – Soft Copy Editable Template

0 out of 5₱500.00On April 30, 2020 the Department Trade and Industry (DTI) and the Department of Labor and Employment (DOLE) issued Interim Guidelines on Workplace Prevention and Control of COVID-19.

The guidelines require employers to implement Health checklists containing declarations of various information and the Workplace Screening Protocol.

Below are sample templates of the health checklist and Screening Protocol which are Editable in Word. Templates are available at only P500.00 to be sent via your email.

-

Digest of Critical Decisions of the Supreme Court on Labor Cases

0 out of 5₱1,485.00Title: Digest of Critical Decisions of the Supreme on Labor Cases

(YEARS 2015, 2016, 2017 & 2018 Decisions)- Just cause for dismissal: Two steps process on Immorality; Totality of infraction principle;

- Procedural: Reglementary period to appeal; supersedeas bond; computation of backwages; finality of award

- OFW (Permanent disability; 120 day rule; 240 day rule; Krestel Ruling; InterOrient Shipping Doctrine; Lex loci contractus; forum non conveniens)

Scroll down for more information