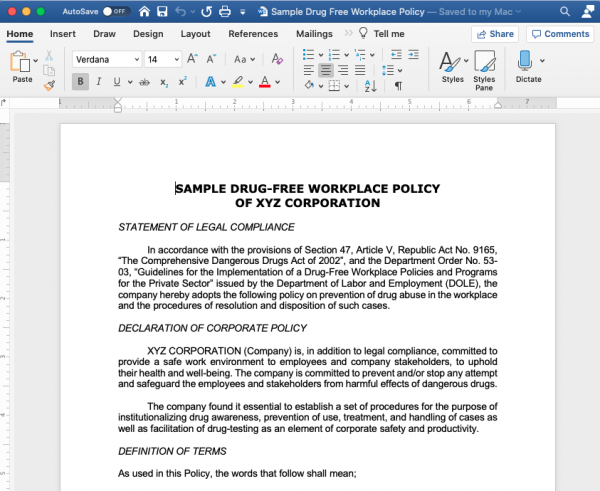

Sample Drug Free Workplace Policy – Soft Copy Editable Template

₱1,395.00

Product Description of Drug-Free Workplace Policy

This is a soft copy template saved in Word File and editable in Word Document.

This contains the sample terms, conditions, clauses, policy statements, and provisions of the policy described.

See the Description below to view the Contents of this soft copy template.

This template is in accordance with the provisions of Section 47, Article V, Republic Act No. 9165, “The Comprehensive Dangerous Drugs Act of 2002”, and the Department Order No. 53-03, “Guidelines for the Implementation of a Drug-Free Workplace Policies and Programs for the Private Sector” issued by the Department of Labor and Employment (DOLE).

This expresses the company’s adoption of the policy on prevention of drug abuse in the workplace and the procedures of resolution and disposition of such cases.

The softcopy template is written in Word document using MS Office 365 version, Arial font, 12 font size, containing 6 pages of 8.5”x13” layout.

Read more..

In compliance with the DOLE issuance, this template provides the following:

1. Statement of Legal Compliance

2. Declaration of Corporate Policy

3. Definition of Terms

a. Employee

b. Assessment Team

c. Screening Test

4. Implementing Guidelines

5. Involvement of Critical Departments in the Implementation

6. Education and Awareness Program

7. Random Drug Testing

8. Implementation and Evaluation

close

Related Products

-

Guide on Employee Compensation and Benefits Vol. 2, 2nd Ed.

2.55 out of 5₱595.00Title: Guide on Employee Compensation and Benefits Vol. 2 Second Edition

Guide on Employee Compensation and Benefits, Second Edition 2015 contains important discussion on 13 th month pay, 14 th month pay, Christmas and other bonuses. It also contains current information on rules on payment of wages, withholding of wages, wage deductions, employment bonds, as well as employee compensation on account of disability, injuries and death, among others. Also incorporated in this edition are recent decisions of the Supreme Court on the 13th month pay, bonuses, allowances and payment of wages. This edition presents newly promulgated rules and regulations on the above topics.

This book will prove helpful to all HR practitioners and professionals on employee or labor relations to achieve industrial harmony and productivity.

Scroll down for more information

-

Tax Solutions

2.49 out of 5₱748.00Title: Tax Solutions on Employee Compensation and Benefits

Tax Solutions on Employee Compensation & Benefits is a revelation for HR practitioners and compensation and benefits practitioners when it comes to taxation on employee pay.

The book shares several practical examples on computation of the benefits, compensation and other pay given to employee. The reader is guided on the intricacies of tax concepts and principles through simple discussion and examples.

Surely, this work can be helpful a tool for HR and comp-ben practitioners in understanding employment tax concepts so employees can clearly understand how taxes impact on their pay.

Scroll down for more information

-

Guide to Valid Dismissal of Employees 2nd Edition

2.57 out of 5₱785.00Title: Guide to Valid Dismissal of Employees 2nd Edition

Guide to Valid Dismissal of Employees 2014 Edition contains updated HR literature on terminal laws, rules and regulations including 2013 cases and other newly establishment doctrines and principles. The best-selling first edition of the book got even better with discussion of relevant provisions on retirement in relation to employee dismissal, rule on separation pay when dismissal is valid, preventive suspension , just causes, authorized causes, termination due to disease, bona fide suspension of operations and other related principles.

This book will prove helpful to all HR practitioners and professionals on employee or labor relations.

Scroll down for more information

-

Gabay sa mga Karapatan ng Overseas Filipino Worker (OFW)

2.42 out of 5₱395.00Title: Gabay sa mga Karapatan ng Overseas Filipino Worker (OFW)

Author: Atty. Elvin B. Villanueva

Publisher: Central Book Supply, Inc.

ISBN: 978-971-011-130-5

No. Of Pages: 185

Size: 6″x9″

Edition: First Edition, 2010

Size: 6″x9″

Binding: Softbound -

Digest of Critical Decisions of the Supreme Court on Labor Cases

0 out of 5₱1,485.00Title: Digest of Critical Decisions of the Supreme on Labor Cases

(YEARS 2015, 2016, 2017 & 2018 Decisions)- Just cause for dismissal: Two steps process on Immorality; Totality of infraction principle;

- Procedural: Reglementary period to appeal; supersedeas bond; computation of backwages; finality of award

- OFW (Permanent disability; 120 day rule; 240 day rule; Krestel Ruling; InterOrient Shipping Doctrine; Lex loci contractus; forum non conveniens)

Scroll down for more information

-

Digest of SC Decision on Labor 2017 Ring-Bound version

0 out of 5₱845.00This ring-bound edition of the Digest of the Critical Supreme Court (SC) Decisions on Labor Cases Year 2017 is an essential tool for HR/Labor Practitioners, HR Managers, Business Owners, and even law students in achieving a quick grasp of the critical decisions of the SC on certain labor cases.

The product is printed in 8.5” x 13” paper, ring-bound, with plastic front and support paper at the back. Introductory price is only P845.00 which will run for a limited period.

The digested cases are presented showing the facts, the ruling of the labor tribunals (Labor Arbiter [LA], National Labor Relations Commission [NLRC], or other adjudicatory bodies of the DOLE, Court of Appeals [CA], and the Supreme Court [SC]).

Scroll down for more information

-

Batas Kasambahay

0 out of 5₱390.00Title: Batas Kasambahay

Batas Kasambahay or Republic Act 10361 is a milestone legislation for Kasambahays all over the country. This by far has offered strong protection and more benefits for covered workers.

Salient provisions discussed in the book are new minimum wage, 5-day service incentive leave benefit, SSS, Philhealth and Pag-ibig coverage, payroll retention of 3 years, communication rules, grounds for termination, rescue, deployment expenses and debt bondage.

The book likewise provides Filipino excerpts on certain concepts for terms that are best expressed in our language. For those who initially read the draft of the book found the contents very useful. In fact, it can serve as handy reference for every household since topics are easy to read, well explained and the format is conducive to easy reading.

Scroll down for more information

-

Guide on Employee Compensation and Benefits Vol. 1

2.54 out of 5₱495.00Title: Guide on Employee Compensation and Benefits Vol. 1

This book provides the guidelines, jurisprudence, and even sample computations on some critical aspects of compensation like overtime, night-shift differential, holiday pay, etc. For example, how to calculate the daily rate if the employee works on a holiday, renders overtime, falling on night differential period and at a time where it is also his rest day? The book shows how.

It shows the solutions to situations in salary administration involving minimum wage and legally mandated benefits. The aim of this work is to promote payment of correct salaries and benefits to the best assets of the company while at the same time preserving the reason for being of any business: that is, derive profits.

Scroll down for more information

-

Tax Solutions on Employee Compensation and Benefits, 2nd Edition 2019

0 out of 5₱998.00Tax Solutions on Employee Compensation and Benefits, 2nd Edition, presents the changes on compensation income tax under R.A. 10963 or the TRAIN Law. The rates and withholding rules have changed after the passage of the law with the new withholding tax tables. The book however, addresses the main challenge for employers which is saving on tax while maximizing the take home of employees.

This work tackles this matter with the presentation of options to minimize tax implications. The revenue regulation, RR 8-2018 implements the TRAIN Law and is discussed in this work in a manner designed for understanding.

RR 11-2018 was also issued by the BIR which primarily deals with the changes on withholding rules. The author provides several sample computations and illustrations

of important concepts like exemption of compensation income of minimum wage earners. Tax on income beyond the non-taxable limit of P20,833 per month. Exclusions from substituted filing rules, among others. The preferential tax treatment of alien employees has been removed.Read more..

The TRAIN Law likewise increases the ceiling for the 13 th month pay and other benefits from the previous P82,000.00 to P90,000.00. This is another useful item to maximize the grant of benefits with minimal tax impact.

De Minimis Benefits are discussed in a comprehensive manner focusing on its availability for tax savings. The list has been updated and some amounts have been increased like that of rice subsidy, medical allowance for dependents, and uniform and clothing allowance.

Fringe benefits are also discussed in combination with all the other benefits granted by the new law and regulations. It is now at 35% which is an increase from the former 32%. The rules on computation of grossed-up monetary value, value of the benefits, and tax accounting rules of the benefits are detailed with examples.

HR and compensation and benefits practitioner as well as managers and business owners will appreciate the exposition of the rules, doctrines and principles under the new tax system.

close

Scroll down for more information

-

Employee Transfer & Demotion

2.61 out of 5₱347.00Title: Employee Transfer and Demotion

The book provides updated answers to the most pressing questions on employee transfer and demotion. This is must-have for employers who would want to make the right decision and avoid or minimize labor disputes.

This work will guide the practitioners and business owners in navigating the treacherous terrain of transfer and demotion. Questions regarding timing of transfer, acts to avoid, lateral position, location, and rank are concisely discussed in this work. The dos and don’ts in demotion are also clearly and completed explain.

The concepts are easy to understand making this book an important arsenal in every HR practitioner or business owner’s library.

Scroll down for more information