Batas Kasambahay

₱390.00

Title: Batas Kasambahay

Batas Kasambahay or Republic Act 10361 is a milestone legislation for Kasambahays all over the country. This by far has offered strong protection and more benefits for covered workers.

Salient provisions discussed in the book are new minimum wage, 5-day service incentive leave benefit, SSS, Philhealth and Pag-ibig coverage, payroll retention of 3 years, communication rules, grounds for termination, rescue, deployment expenses and debt bondage.

The book likewise provides Filipino excerpts on certain concepts for terms that are best expressed in our language. For those who initially read the draft of the book found the contents very useful. In fact, it can serve as handy reference for every household since topics are easy to read, well explained and the format is conducive to easy reading.

Scroll down for more information

52 in stock

- Description

- Additional information

Description

Title: Batas Kasambahay

Author: Atty. Elvin B. Villanueva

Publisher: Central Book Supply, Inc.

ISBN: 978-971-011-683-6

No. Of Pages: 70

Size: 6″x9″

Binding: Softbound

Additional information

| Weight | .21 kg |

|---|

Related Products

-

Guide to Valid Job Contracting & Sub Contracting

4.00 out of 5₱745.00Title: Guide to Valid Job Contracting & Sub Contracting

This work will enlighten contractors, principals and all parties involved in contracting the rules, doctrines and principles behind job contracting. Discussed in this book are rules on labor-only contracting, right to control, supervision, registration, licensing, payment of wages, contracting in construction industry, security service, among others. Laws and rules discussed are D.O. 18-A, Articles 106-109 of the Labor Code, as amended, D.O.19, Series of 1998, RA 5487 on security contracts and its implementing rules.

Employers and Companies will benefit from extensive discussion on various issues on job contracting.

Scroll down for more information

-

Guide on Employee Compensation and Benefits Vol. 1

2.54 out of 5₱495.00Title: Guide on Employee Compensation and Benefits Vol. 1

This book provides the guidelines, jurisprudence, and even sample computations on some critical aspects of compensation like overtime, night-shift differential, holiday pay, etc. For example, how to calculate the daily rate if the employee works on a holiday, renders overtime, falling on night differential period and at a time where it is also his rest day? The book shows how.

It shows the solutions to situations in salary administration involving minimum wage and legally mandated benefits. The aim of this work is to promote payment of correct salaries and benefits to the best assets of the company while at the same time preserving the reason for being of any business: that is, derive profits.

Scroll down for more information

-

The Labor Code of the Philippines

0 out of 5₱948.00Title: The Labor Code of the Philippines

The Labor Code of the Philippines by Atty. Elvin B. Villanueva

Suggested Retail Price: P948.00

Scroll down for more information

-

Tax Solutions

2.49 out of 5₱748.00Title: Tax Solutions on Employee Compensation and Benefits

Tax Solutions on Employee Compensation & Benefits is a revelation for HR practitioners and compensation and benefits practitioners when it comes to taxation on employee pay.

The book shares several practical examples on computation of the benefits, compensation and other pay given to employee. The reader is guided on the intricacies of tax concepts and principles through simple discussion and examples.

Surely, this work can be helpful a tool for HR and comp-ben practitioners in understanding employment tax concepts so employees can clearly understand how taxes impact on their pay.

Scroll down for more information

-

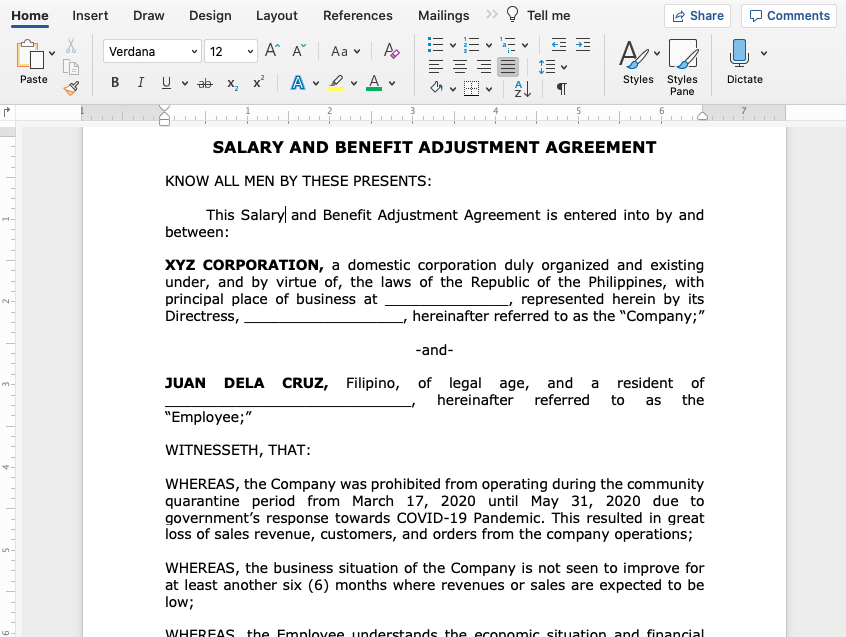

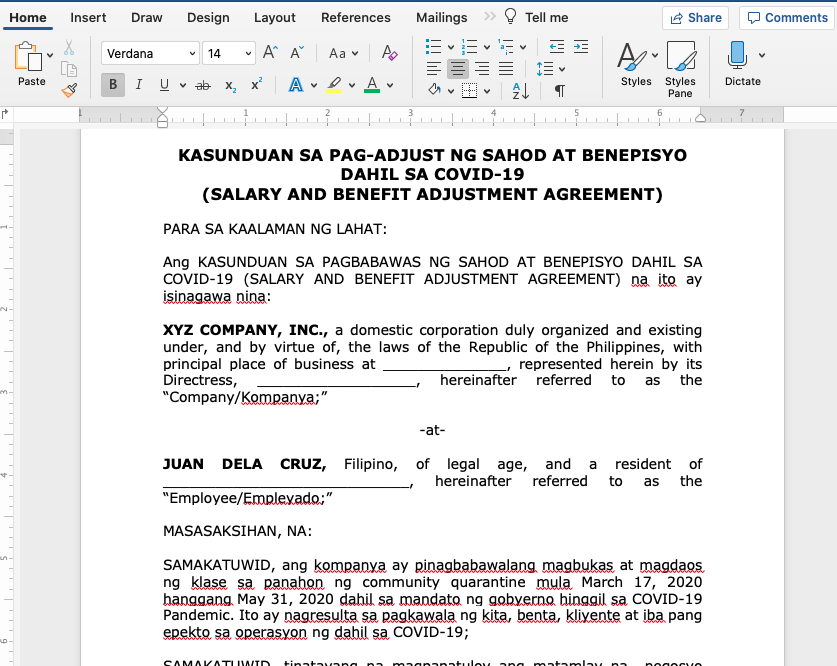

Salary & Benefit Adjustment Agreement (in Filipino / English) – Soft Copy Editable Template

₱750.000 out of 5 -

Health Checklist & Workplace COVID-19 Protocol – Soft Copy Editable Template

0 out of 5₱500.00On April 30, 2020 the Department Trade and Industry (DTI) and the Department of Labor and Employment (DOLE) issued Interim Guidelines on Workplace Prevention and Control of COVID-19.

The guidelines require employers to implement Health checklists containing declarations of various information and the Workplace Screening Protocol.

Below are sample templates of the health checklist and Screening Protocol which are Editable in Word. Templates are available at only P500.00 to be sent via your email.

-

Employment Contracts Templates Soft Copy (English and Filipino/Tagalog)

0 out of 5EMPLOYMENT CONTRACTS TEMPLATES DESCRIPTION

Employment contracts in the Philippines should be crafted in accordance with rules to ensure compliance with legal requirements.

This is saved in a single file in Word (Arial Font using sizes 12, 14, and 20). Buyers will receive the file through email from LVS’ gmail account. There will be price increase for this product soon.

Alert!: If you were able to purchase any of our soft copy products in the past please double-check that they are not part of these templates. This product is indivisible and individual soft copy templates previously purchased cannot be deducted from the price.

This product, Employment Contracts Templates (English and Filipino), contains 40+ samples or templates of various employment contracts used in the Philippines such as:

- Probationary

- Regular

- Casual

- Project

- Seasonal

- Fixed-Term or Fixed-Period, and

- Part-Time

Read more..

Some sample templates contain show formats that incorporate provisions on:

- Data Privacy Consent Clause

- Discipline

- Reference to Job Description

- Benefits

- Place of Work

- Shift

- Performance Metrics

- Decorum/Uniform

- Shift, etc.

close

Scroll down for more information

₱3,995.00₱3,900.00 -

Employee Leave Benefits

2.57 out of 5₱99.75Title: Employee Leave Benefits

Relatively new laws have been passed such as the ten (10)-day VAW-C leave for victims of violence and the recently enacted two (2)-month gynecological leave.

The author explain these benefits in interesting fashion and easy-to- read format. Likewise, he discusses important issues on Paternity. Solo Parent’s and Service Incentive Leave Benefits, among others.

Scroll down for more information

-

Tax Solutions on Employee Compensation and Benefits, 2nd Edition 2019

0 out of 5₱998.00Tax Solutions on Employee Compensation and Benefits, 2nd Edition, presents the changes on compensation income tax under R.A. 10963 or the TRAIN Law. The rates and withholding rules have changed after the passage of the law with the new withholding tax tables. The book however, addresses the main challenge for employers which is saving on tax while maximizing the take home of employees.

This work tackles this matter with the presentation of options to minimize tax implications. The revenue regulation, RR 8-2018 implements the TRAIN Law and is discussed in this work in a manner designed for understanding.

RR 11-2018 was also issued by the BIR which primarily deals with the changes on withholding rules. The author provides several sample computations and illustrations

of important concepts like exemption of compensation income of minimum wage earners. Tax on income beyond the non-taxable limit of P20,833 per month. Exclusions from substituted filing rules, among others. The preferential tax treatment of alien employees has been removed.Read more..

The TRAIN Law likewise increases the ceiling for the 13 th month pay and other benefits from the previous P82,000.00 to P90,000.00. This is another useful item to maximize the grant of benefits with minimal tax impact.

De Minimis Benefits are discussed in a comprehensive manner focusing on its availability for tax savings. The list has been updated and some amounts have been increased like that of rice subsidy, medical allowance for dependents, and uniform and clothing allowance.

Fringe benefits are also discussed in combination with all the other benefits granted by the new law and regulations. It is now at 35% which is an increase from the former 32%. The rules on computation of grossed-up monetary value, value of the benefits, and tax accounting rules of the benefits are detailed with examples.

HR and compensation and benefits practitioner as well as managers and business owners will appreciate the exposition of the rules, doctrines and principles under the new tax system.

close

Scroll down for more information

-

Guide To Valid Dismissal Of Employees (The HR Practitioner’s Handbook)

2.86 out of 5Title: Guide To Valid Dismissal Of Employees (The HR Practitioner’s Handbook)

The book by Atty. Elvin B. Villanueva provides a refreshing and analytical insight on the matter with a twist of Human Resource outlook. His works, the HR Guide Series, which includes the “Guide to Valid Dismissal of Employees” and the “Guide on Employee Compensation and Benefits,” provide a compelling lineup of various topics on labor and human resources.

Scroll down for more information

₱400.00₱320.00